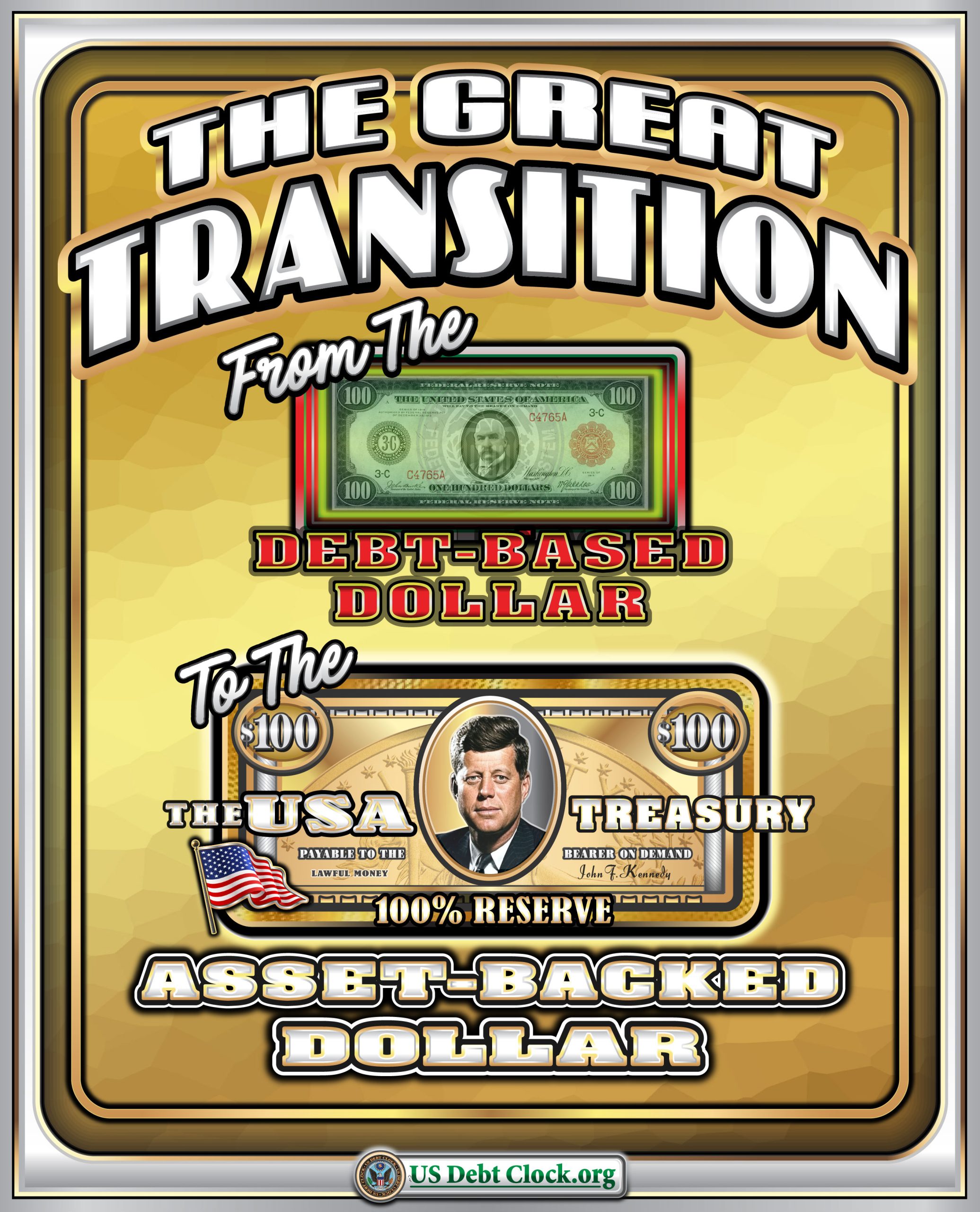

The February 20 graphic from the US Debt Clock is the most obvious depiction yet of what many readers call the New Money Revolution: a stylized “before and after” showing a DEBT-BASED DOLLAR transforming into a U.S. Department of the Treasury 100% RESERVE, ASSET-BACKED DOLLAR.

It’s designed like a poster you can’t ignore—big headline (“THE GREAT TRANSITION”), a green “old” bill at the top, and a gold-toned “Treasury” note at the bottom marked “PAYABLE TO THE BEARER ON DEMAND” and “100% RESERVE.” In other words: from IOUs and leverage… to receipts and redemption.

Before we go further, one key point: the US Debt Clock is not an official government outlet, and its own “about” language has been cited as stating it is not associated with any U.S. government agency. (PolitiFact)

So treat this as symbolic commentary—but symbolism can still be useful, especially when it captures a direction markets already feel.

What “debt-based dollar” means in plain English

“Debt-based” is shorthand for a system where most money exists as credit:

- Banks create deposits when they make loans.

- Government finances deficits via Treasury issuance.

- The financial system expands and contracts based on confidence, collateral, and credit conditions.

That doesn’t mean “money is fake.” It means money is, largely, a liability somewhere else—a promise, not a thing.

What the image claims is coming next: “100% reserve” and “asset-backed”

The poster’s lower half is doing two things at once:

- Calling for full backing (the “100% reserve” language)

- Hinting at redemption (“payable… on demand”)

In the most charitable interpretation, the message is:

A dollar should represent claimable value anchored to assets, not perpetual expansion of debt.

Now, in the real world, “asset-backed” can mean different structures (from hard convertibility, to partial backing, to a rules-based reserve regime). The graphic doesn’t specify a mechanism—it’s making a directional claim: less leverage, more backing; less debt narrative, more balance-sheet narrative.

Why this is the clearest “New Money Revolution” poster yet

If prior images were winks and breadcrumbs, this one is a billboard:

- From: debt-based dollar

- To: Treasury / 100% reserve / asset-backed dollar

It compresses years of internet debate into one frame. That clarity is exactly why it’s spreading: people are hungry for a simple, legible story about what comes after the current system’s stress cycles.

The greatest feat isn’t the message—it’s the timing

Here’s the part the graphic does not show (but every serious operator understands):

If markets ever believed they knew the exact date and time that “Treasury flips the switch,” the global financial system would get chaotic—fast.

Why? Because traders don’t wait for the event. They front-run it.

What chaos would look like if an exact switch date were known

- FX shock and speculative attacks

If the world expected a repricing of the dollar regime, currency markets would try to price the “new” system immediately—creating violent swings and broken correlations. - Bank runs and liquidity hoarding

Depositors (retail and institutional) move before they are moved. Banks respond by tightening credit. That creates reflexive stress. - Derivatives repricing and collateral spirals

Rates, swaps, futures, options—everything that references the dollar’s “rules” has to be re-valued. Repricing triggers margin calls, which forces liquidations, which triggers more volatility. - Treasury market turbulence

The bond market is the system’s spine. If traders thought settlement rules, redemption terms, or reserve structure were changing on a known date, positioning would become crowded and unstable. - Trade finance disruption

Importers/exporters would accelerate or pause shipments, re-price invoices, and demand different settlement terms. That’s how you get real-economy shockwaves from a monetary narrative.

This is why surprise vs. anticipation matters so much in policy. Even in conventional monetary policy, research shows volatility jumps around announcements—especially when there is an element of surprise. (Federal Reserve)

So if a full regime change were truly coming, the operational reality is simple:

You don’t publish a countdown clock for the biggest arbitrage opportunity on earth.

How real transitions (usually) happen

When systems change without breaking, it’s typically because the transition is managed through:

- phased rollouts, pilot programs, parallel rails

- weekend cutovers (when markets are closed)

- regulatory sequencing (rules before tools)

- liquidity backstops to prevent cascades

- deliberate ambiguity about exact timing to prevent front-running

That last point is what readers often miss. Timing secrecy isn’t “mystical.” It’s a practical defense against market stampedes.

Bottom line

The February 20 image is viral because it says, plainly:

We are moving from a debt story to an asset story.

Whether that arrives as an actual “asset-backed dollar,” a Treasury-led restructuring, new settlement rails, or a broader reserve regime shift—the logic of the poster is about restoring trust through backing and discipline.

And if the switch ever truly flips, the greatest accomplishment won’t be printing a new note.

It will be doing it without the world’s traders tearing the system apart five minutes before launch.

Invest Offshore continues to track real-asset opportunities globally, including investment opportunities in West Africa seeking investors for the Copperbelt Region, plus verified gold for sale through our network and partners worldwide, and select mining concessions with documented title, geology, and clear pathways to production.

Leave a Reply