Category: Economics

-

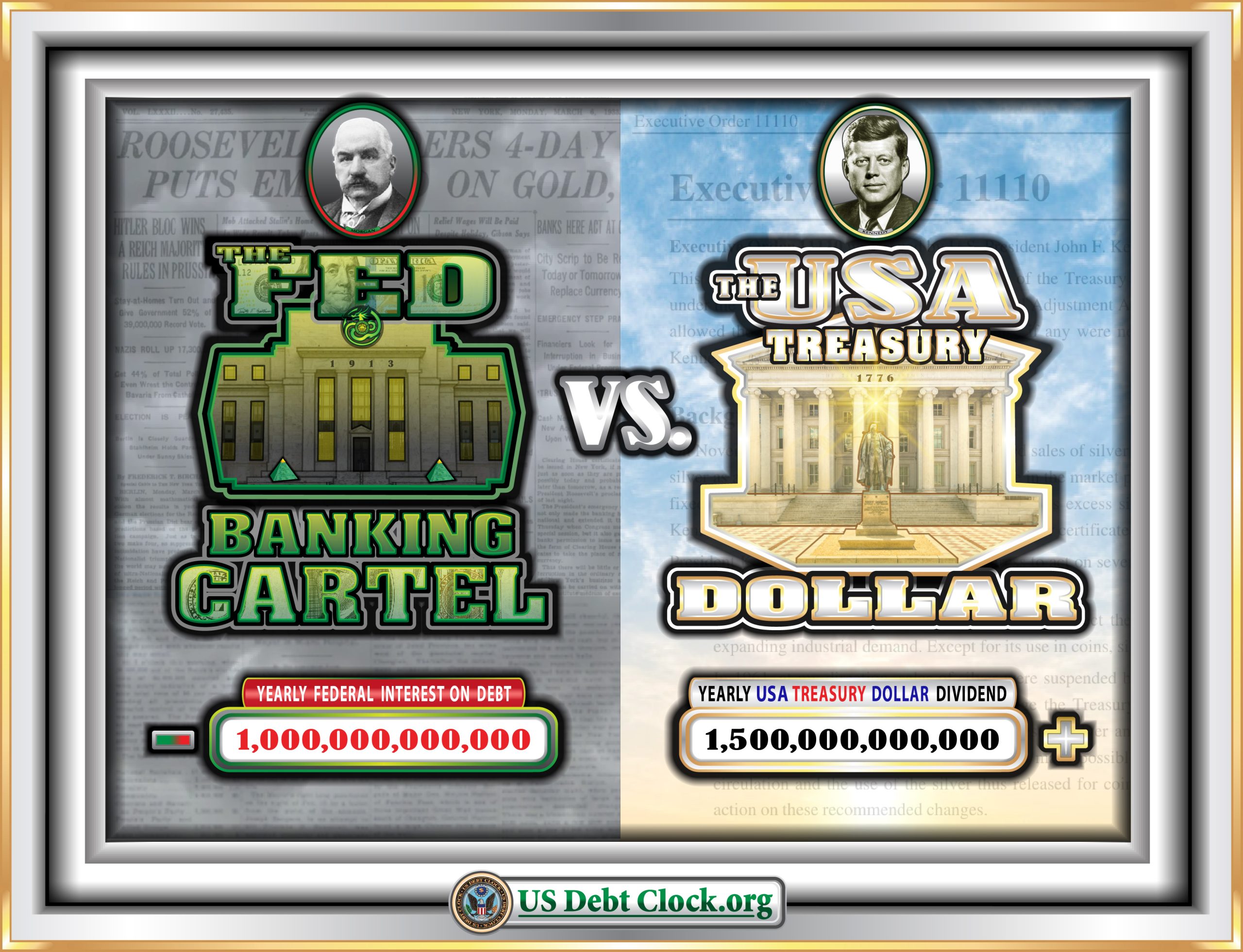

The Fiscal Tightrope: U.S. Interest Payments Outpace Defense Spending

The latest figures from the U.S. Treasury for fiscal 2024 have sparked serious discussions about the sustainability of the country’s financial health. Jim Rickards, a prominent financial commentator, encapsulated the issue perfectly: “Interest on debt: $882 billion. National defense: $874 billion. That’s all, folks. You can’t borrow your way out of a debt crisis. You…

-

Ripple Announces Ripple USD Exchange Partners for Global Distribution

Former FDIC Chair Sheila Bair, Vice Chairman of Partners Capital and former CENTRE Consortium CEO David Puth, and Ripple Executive Chairman Chris Larsen Join the RLUSD Advisory Board Ripple, the leading provider of digital asset infrastructure for financial institutions, announced its exchange partners and customers for Ripple USD (RLUSD), an enterprise-grade, USD-denominated stablecoin created with…

-

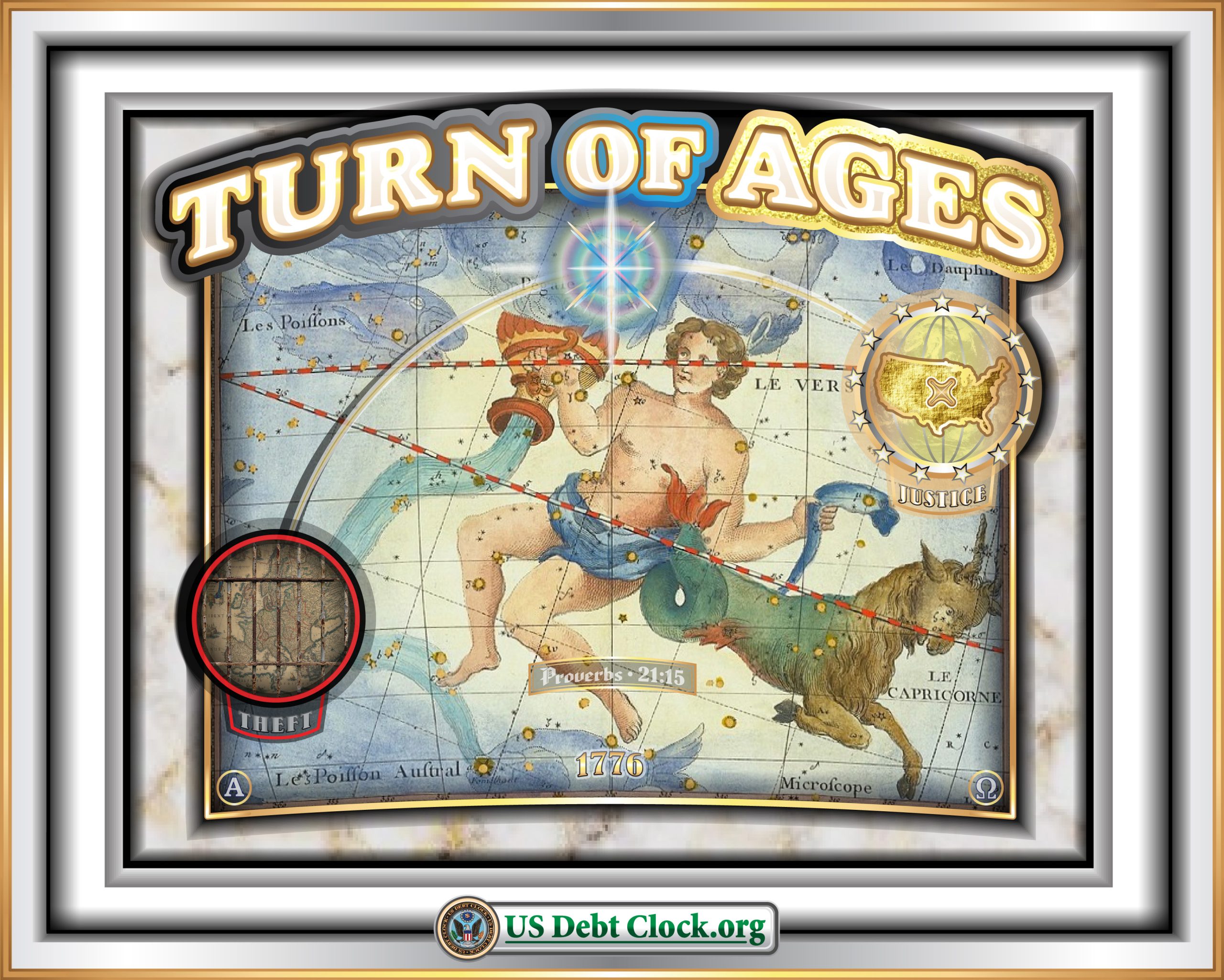

The New Money Revolution: U.S. Debt Clock and the Shift from FERN to Treasury Certificates

In recent months, a significant shift has been quietly taking place in the financial world, and it’s being illustrated in real-time on social media platform X, via @USDebtClock_org. For those closely monitoring the images and data displayed, it’s clear that these are not merely visual representations of government debt but signs of an impending monetary…

-

A Black Swan in Japan’s Financial Waters

Japan has held the line, keeping interest rates near zero. It’s a choice they’ve made for decades, but now the world’s tides are shifting. A sudden change in global interest rates could push Japan into unfamiliar, dangerous waters. And when the storm hits, it won’t just be local. The low rates have helped Japanese banks…

-

October 1st: Global Economic Shifts and Their Impact on Offshore Markets

A Day of Convergence for Global Economic Shifts October 1st, 2024, is shaping up to be a pivotal date on the global financial and economic landscape, with numerous key developments converging all at once. Investors and market participants should brace themselves for potential shifts that could significantly impact energy prices, financial markets, trade, and personal…

-

Gold Prices Surge to New Highs, Closing Above $2600/oz: Is the Rally Unstoppable?

Gold is shining brighter than ever, hitting fresh all-time highs on Friday as it closed well above the $2600/oz mark. This rally appears unstoppable, as new records are set with increasing frequency, shaking the markets and exciting investors globally. Many are left wondering: what’s behind this relentless surge? Fed’s Surprise Rate Cut Fuels the Gold…

-

The Dawn of a New Era: Treasury Certificates and the Great Reset

The sun rose slowly over the city, casting long shadows across empty streets. A quiet revolution was underway, but this wasn’t the kind of upheaval born from the clash of steel or the roar of voices. It was a revolution of the mind, of the system, of the dollar itself. They called it the Great…

-

Founding Father Edmund Randolph vs. The Federal Reserve: A Historical Reflection on Modern Monetary Policy

In today’s rapidly evolving financial landscape, where central banks wield considerable power over monetary policy, the legacy of America’s Founding Fathers continues to resonate. One such figure, Edmund Randolph, provides a thought-provoking lens through which we can examine the modern role of the Federal Reserve. Randolph, a statesman and advocate of limited government, was known…

-

Fed Set to Cut Rates and U.S. Budget Deficit Soars: What It Means for Global Investors

As the Federal Reserve prepares to cut interest rates by 25 basis points on September 18, the U.S. finds itself grappling with a staggering budget deficit. The August budget shortfall soared to $380 billion—an eye-popping 66% increase from last August and over 50% more than July’s $243 billion. Shockingly, this is nearly $100 billion higher…