Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

The World’s Most Reluctant Tourists: A Venezuelan Expat’s Guide to Everywhere (Except Home)

The Venezuelan expat didn’t leave home because they wanted to. They left because the universe gently—but persistently—pushed them out the door with a suitcase, a WhatsApp group, and a recipe for arepas memorized like scripture. Make no mistake: Venezuela is still home. The kind of home you dream about at 3 a.m., where the coffee…

-

Trending Crypto: Institutions Accumulate as Retail Chases the Next Move

Crypto markets are entering 2026 with a familiar but important split personality: institutions are accumulating quietly, while retail attention is drifting toward fast-moving altcoins and social tokens. Prices are firm, sentiment is constructive, but the tone is notably measured rather than euphoric. That combination often marks the middle phase of a cycle — not the…

-

Shorting the Wind: Why Inverse Plays on Wind ETFs Are Back on the Table

At the World Economic Forum 2026 in Davos, Donald Trump delivered a blunt message that sent a chill through the renewables narrative. Calling green energy policies the “greatest hoax in history” and deriding the Green New Deal as a “Green New Scam,” Trump singled out wind energy as emblematic of policy-driven misallocation of capital. Whether…

-

Delaware: America’s Oldest Corporate Safe Harbor

When Larry Page, co-founder of Google and a principal force behind Alphabet, quietly shifts his corporate base to Delaware, it sends a clear signal. For founders, boards, and global investors alike, Delaware remains the safest jurisdiction in America to run a large enterprise with peace of mind. Delaware’s appeal has nothing to do with size.…

-

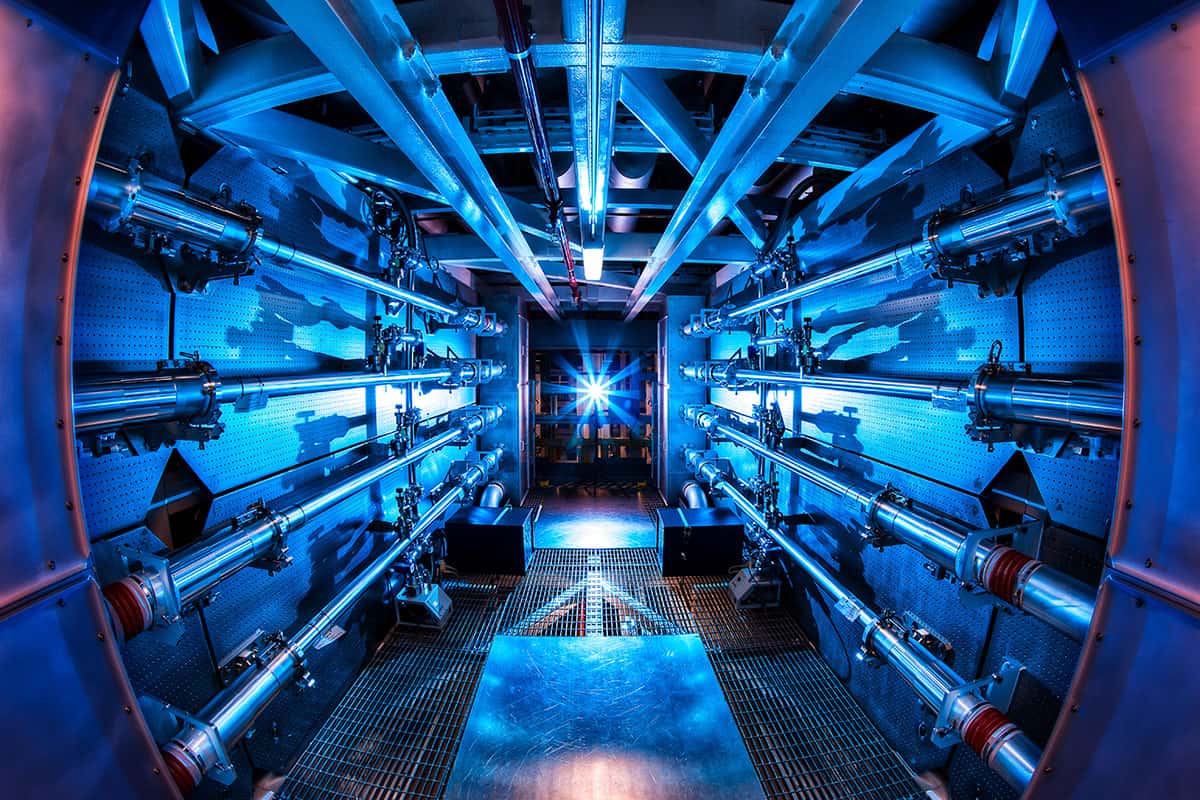

Invest Offshore Recommends Zero Hedge’s “Where The Department of Energy Is Investing”

Invest Offshore is recommending a timely and insightful analysis published by Zero Hedge, submitted by Tight Spreads, titled “Where The Department of Energy Is Investing.” The article cuts through the noise to explain why fusion energy is accelerating a quiet but massive U.S. push to securitize domestic rare earth and advanced-materials supply chains—and which companies…

-

From a Family Garage to Global Blockchain Banking: The Story of Bank Frick

In an era when most European private banks trace their roots to centuries-old aristocratic lineages, Bank Frick stands out for a very different reason: its modern origin story and its early embrace of financial innovation. A Garage Start-Up in the Alps (1998) The bank was founded in 1998 by Liechtenstein fiduciary Kuno Frick Sr. (1938–2017)…

-

The New Sultan of Persia? Imagining an Iranian Re-Boot Under the Qajar Heir

For decades, Iran has been frozen between an ancient civilizational memory and a modern political reality that has delivered neither peace nor prosperity to its people. Yet history has a way of resurfacing—sometimes quietly, sometimes symbolically—before it becomes catalytic. A growing body of discussion among historians, royal-house enthusiasts, and diaspora commentators is now revisiting a…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.