Silver doesn’t reset like a speculative asset.

It resets the way a pressure valve releases: slowly at first, then all at once.

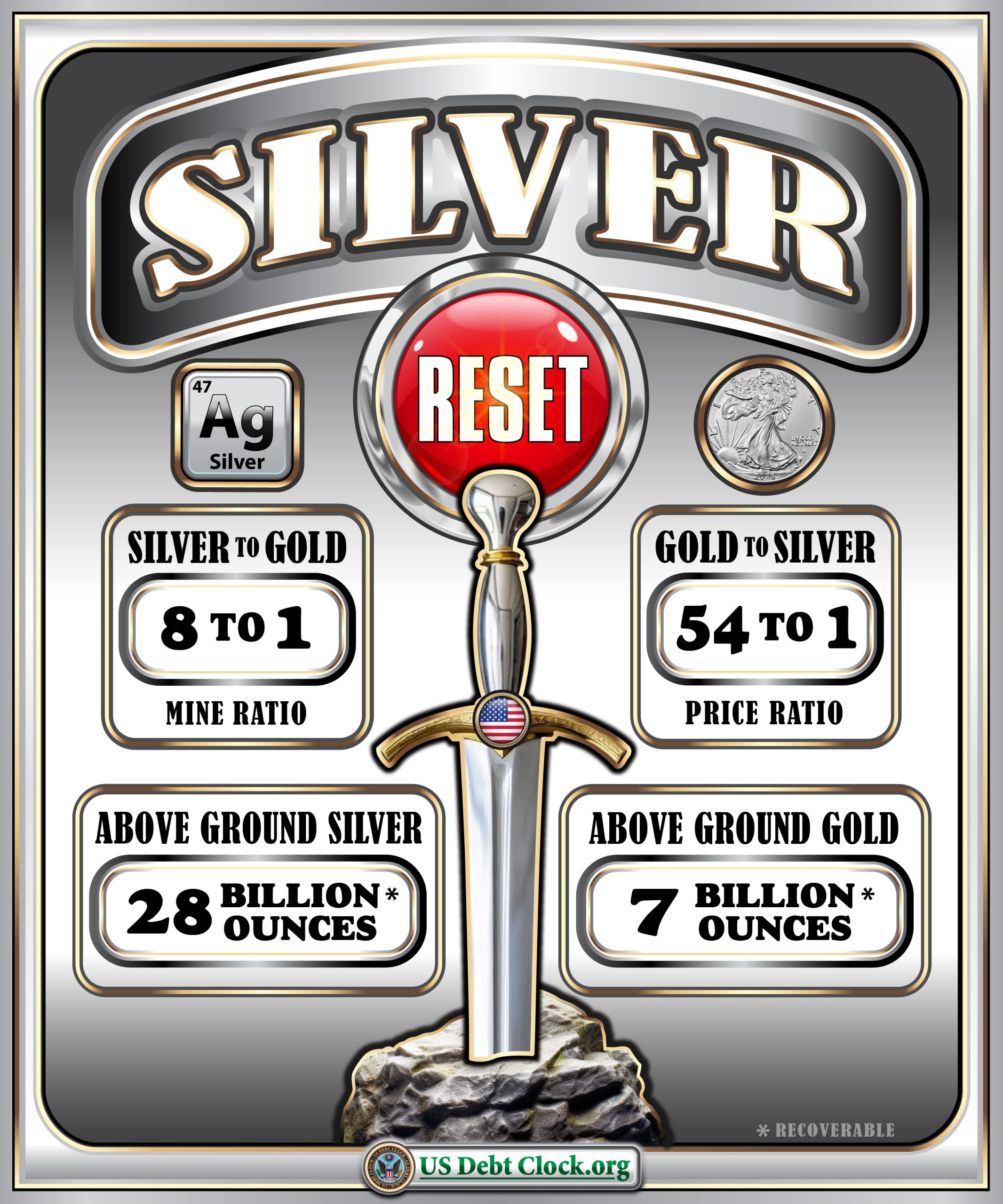

Industrial demand is no longer optional. Solar, electrification, defense systems, AI hardware, and advanced electronics all depend on silver’s unmatched conductivity. At the same time, mine supply growth has lagged demand for years. This imbalance is setting the stage for what many in the industry now recognize as the silver reset — a structural repricing driven by physical scarcity, not financial engineering.

But here’s the critical point most investors miss:

When silver resets, capital doesn’t flow to stories — it flows to proof.

And in Canada, proof is governed by one thing above all else:

National Instrument 43-101 (NI 43-101).

NI 43-101: The Gatekeeper of Credible Silver Supply

NI 43-101 is the Canadian Securities Administrators’ regulatory framework that governs how public companies disclose scientific and technical information about mineral projects, and it has become the de facto global benchmark for credible mineral disclosure, widely relied upon by investors, banks, exchanges, and regulators far beyond Canada when assessing mining projects worldwide.

Its purpose is simple and uncompromising:

- eliminate exaggerated claims,

- standardize mineral disclosure,

- protect capital markets,

- and ensure investors are comparing projects on equal footing.

Under NI 43-101, any material disclosure about a mineral project must be supported by a technical report prepared and signed by a Qualified Person (QP). Resource and reserve terminology is tightly defined. Economic claims must follow prescribed study levels. Marketing language is irrelevant if it isn’t supported by defensible data.

In a silver reset environment, NI 43-101 compliance becomes a form of currency.

Canada’s Silver Reality: 14th Place — For Now

Canada is currently ranked around 14th globally in silver production. That’s not a geological failure — it’s a development and activation gap.

Contrast that with:

- Mexico, the world’s largest silver producer,

- followed by China and Peru, which round out the top tier.

These countries dominate not because Canada lacks silver, but because Canada has allowed large portions of its silver endowment — particularly in British Columbia — to sit dormant.

And that is exactly where the opportunity lies.

The silver reset is not about chasing Mexico ounce-for-ounce overnight. It’s about moving Canada from a passive 14th-place supplier into a credible, expanding competitor among the top producers by reactivating, validating, and financing silver projects that already exist.

Why BC’s Dormant Silver Mines Matter Right Now

British Columbia has a deep history of silver-rich polymetallic systems, often associated with lead, zinc, and gold. Many of these mines didn’t shut down because the silver disappeared — they shut down because:

- silver prices were suppressed,

- capital markets were hostile,

- permitting timelines were long,

- and historical data was never modernized into compliant disclosure.

Today, that same historical data — when properly validated — can dramatically shorten the path back to production.

But only if it is converted into NI 43-101–compliant technical reports.

The Silver Reset Playbook for Canada

If Canada is serious about moving from 14th place toward the top tier, this is the sequence that matters.

1. Reactivate the data, not the hype

Dormant projects must:

- digitize historical drilling and underground records,

- validate assays and QA/QC procedures,

- identify what can be relied upon versus what must be re-drilled.

Old mines don’t need new stories — they need modern disclosure.

2. Engage Qualified Persons early

NI 43-101 lives and dies with the QP. The right QP:

- understands the deposit type,

- knows how regulators read reports,

- and can defend assumptions under scrutiny.

Without this, projects stall before capital ever arrives.

3. Match disclosure to development stage

Not every project needs a feasibility study on day one. But every project needs:

- a compliant technical summary,

- a defensible exploration or development plan,

- and clear disclosure of risks and next steps.

Investors are far more tolerant of early-stage risk than they are of non-compliance.

4. Build financeability into the technical story

Modern silver financing demands clarity on:

- permitting pathways,

- access and infrastructure,

- power availability,

- environmental and tailings strategy,

- Indigenous engagement planning.

These are no longer “later-stage” concerns — they are valuation drivers.

5. Structure offerings like institutions are watching

In a silver reset, capital flows to projects that show:

- disciplined use of proceeds,

- milestone-based advancement,

- governance that inspires confidence,

- disclosure that anticipates regulatory and investor scrutiny.

This is how dormant assets become bankable supply.

Competing With Mexico Starts With Credibility

Mexico, China, and Peru dominate global silver production because they consistently deliver real ounces into the market.

Canada can compete — not by promotion, but by activation.

British Columbia alone holds enough dormant and underdeveloped silver assets to materially move Canada up the production rankings — if those assets are:

- properly disclosed,

- professionally reported,

- and structured for modern capital markets.

The silver reset rewards discipline.

Projects that meet NI 43-101 standards will be financed.

Projects that don’t will be ignored — regardless of how high silver prices go.

The Bottom Line

The silver reset is not just a pricing event.

It’s a credibility event.

Canada currently sits around 14th place in global silver production — but with NI 43-101–driven reactivation of BC’s dormant silver mines, Canada has a realistic path to climb the rankings and compete with the world’s top producers.

Silver is being repriced.

Only compliant ounces will count.

Invest Offshore also has investment opportunities in West Africa seeking investors for the Copperbelt Region.

Leave a Reply