And how to verify legitimate copper cathode supply from Africa—without getting played.

If you’ve spent any time around cross-border metals trading, you’ve heard the same refrain from buyers in United States and Canada:

“We’ll do it on an irrevocable, confirmed LC at sight—or we’re not doing it.”

To sellers across Africa, that can feel rigid. To North American procurement teams, bank credit committees, and compliance officers, it’s simply the cleanest way to reduce risk while keeping large tonnage moving.

Here’s why LC at sight has become the default for African-origin metals—and a practical, field-tested checklist for verifying real copper cathode supply (and filtering out the “paper metal” crowd).

What “LC at sight” really means (and what it doesn’t)

A documentary letter of credit is a bank’s written undertaking to pay the beneficiary conditional on a complying presentation of documents (not on “trust me, bro”). (academy.iccwbo.org)

When it’s “at sight,” payment is due when compliant documents are presented and accepted—as opposed to deferred payment terms (30/60/90+ days). (academy.iccwbo.org)

Two important realities:

- An LC pays against documents, not against the actual metal. If documents are forged or “technically compliant but commercially wrong,” buyers can still get burned.

- A confirmed LC shifts bank risk. If the LC is confirmed by a strong bank, the seller is less exposed to the issuing bank/country risk—often crucial in frontier corridors.

Why North American buyers insist on “at sight” for African metals

1) Counterparty risk is treated as “systemic,” not personal

Even when a supplier is honest, buyers worry about:

- sudden export restrictions

- political disruption

- port bottlenecks and “facilitation” pressure

- banking and repatriation friction

Credit committees don’t underwrite vibes. They underwrite structures.

2) Fraud patterns cluster around prepayment and loose terms

The fastest way to lose money in metals is “partial prepay to secure allocation,” followed by endless delays, document excuses, and fee requests.

An LC at sight reduces the temptation (and the opportunity) for:

- upfront “performance guarantees” that aren’t real

- “inspection fees” routed to random third parties

- switching bank coordinates mid-deal

- double-selling the same stock

3) It fits internal governance

North American corporates and trading houses often have policies like:

- no prepayment

- bank-controlled settlement

- auditable shipping/title chain

- sanctions/AML clearance before funds move

LCs plug neatly into those controls.

4) It aligns shipment, title, and payment

When structured properly, the buyer is paying only when the cargo is provably shipped under the agreed terms (e.g., a clean on-board bill of lading, inspection certificates, and insurance depending on Incoterms). Incoterms themselves are standardized trade rules published by the International Chamber of Commerce. (ICC – International Chamber of Commerce)

5) It reduces working-capital surprises

“At sight” means the seller doesn’t become the buyer’s lender. That matters in high interest-rate environments, and it matters when supply chains already carry enough risk.

The problem: “Real LC” doesn’t automatically mean “real copper”

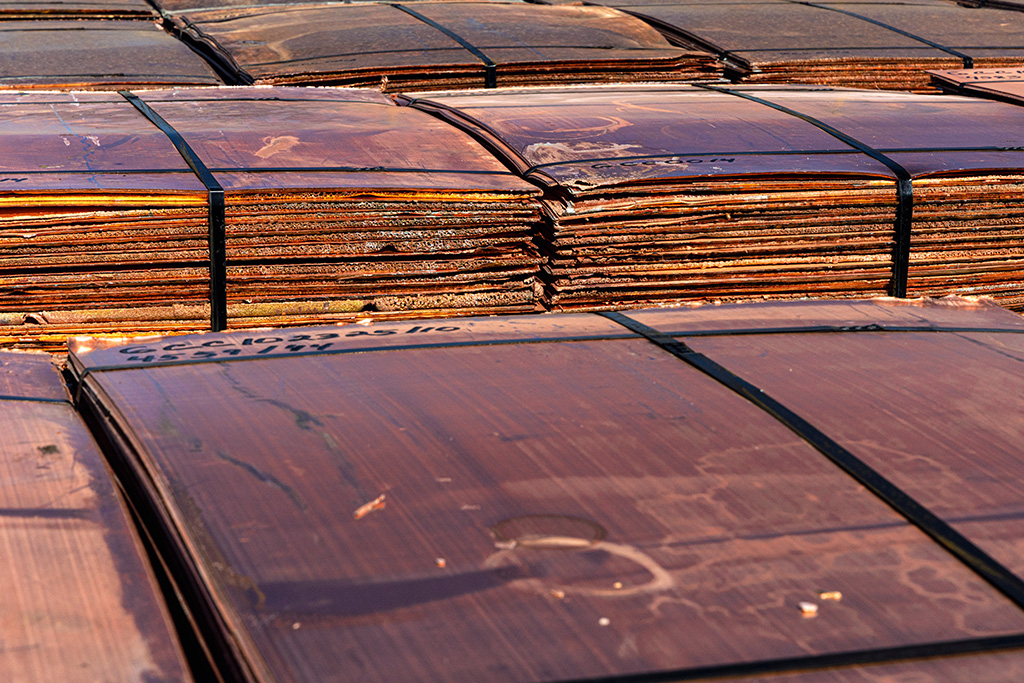

Copper cathodes are one of the most commonly “offered” commodities on the internet—and one of the most commonly faked on paper.

So the winning approach is:

Use an LC for payment discipline, and use independent verification for supply reality.

Below is a verification stack that separates legitimate producers and aggregators from brokers with a PDF and a prayer.

How to verify legitimate African copper cathode supply

A practical 3-layer due diligence stack

Layer 1: Prove the seller is real (and authorized)

Ask for (and validate independently):

- Company registration (and directors/shareholders/beneficial owners)

- Physical address + operating site (warehouse, yard, or plant)

- Export ability: export license and the right to export copper cathodes from the jurisdiction

- Bank account in the seller’s legal name (no third-party beneficiary, no “agent account”)

- Past shipment evidence: bills of lading references, consignee references (where possible), photos of prior lots with dates

If the origin is Democratic Republic of the Congo, Zambia, or South Africa, pay extra attention to chain-of-custody—because the risk isn’t just “fraud,” it’s also misdeclared origin, tax issues, or sanctions exposure depending on counterparties.

Red flag: Seller can’t clearly explain who owns the cathodes today, where they sit, and what documents exist right now.

Layer 2: Prove the copper is real (spec + physical control)

If someone says “Grade A cathode,” you want it anchored to recognized specifications and inspection.

The London Metal Exchange publishes rules/specs for Grade A copper cathodes (often aligned with standards such as ASTM and EN cathode grades). (Lme)

What to do in practice:

- Independent inspection at the yard/warehouse (before stuffing)

- Use a top-tier inspector like SGS or Bureau Veritas.

- Require: count, weight, packaging condition, markings, and a photo pack tied to lot IDs.

- Sampling and assay strategy (yes, even for cathodes)

- Cathodes are refined, so you’re not “assaying ore,” but you still want verification that the material matches declared purity/spec and isn’t substituted scrap.

- Have the inspector define a defensible sampling method and document it.

- Seals, stuffing supervision, and traceable container numbers

- Inspector witnesses container stuffing, records seal numbers, and issues a stuffing certificate.

- Buyer verifies container tracking and carrier booking.

Red flag: Seller refuses third-party inspection or insists on “our internal inspection only.”

Layer 3: Prove the shipment is real (logistics + documents that reconcile)

Legit deals reconcile across: documents ↔ weights ↔ containerization ↔ vessel movements.

Minimum document set to require under the LC (typical—your bank may refine):

- Commercial invoice

- Packing list

- Certificate of weight (often inspector-issued)

- Certificate of quality/spec (inspector-issued)

- Certificate of origin

- Export/customs documents (as applicable)

- Full set clean on-board bill of lading (with consistent shipper/consignee and matching commodity description)

- Insurance certificate if required under your Incoterms (e.g., CIF/CIP)

Then do the reconciliation:

- Do invoice quantities match packing list bundles?

- Do weights match inspector report and port weighbridge tickets?

- Do container numbers + seals match stuffing report and bill of lading?

- Does the vessel exist, sail, and arrive consistent with the BL date?

Red flag: Documents appear “perfect” but don’t reconcile (or the seller won’t let your team verify them with issuers/inspectors).

Deal-killers and scam signals (quick filter)

If you see these, pause:

- “TT upfront for allocation / insurance / taxes / release”

- “Send MT103 / proof of funds before we show documents”

- Massive discounts to market with no commercial explanation

- Seller avoids naming the actual warehouse location until after payment

- Constant introduction of intermediaries and “mandates” who must be paid

Real supply chains don’t behave like that. They behave like operations.

The LC structure that works best for copper cathodes (buyer-friendly)

If you’re the buyer, the most defensible setup is usually:

- Irrevocable documentary LC

- Confirmed (especially if issuing bank/country risk is a concern)

- At sight

- Subject to standard rules (commonly UCP framework)

- Includes inspection + stuffing certificates from an agreed independent inspector

- Tight beneficiary/shipper consistency (no last-minute party swaps)

This doesn’t guarantee perfection—but it dramatically increases the chance you’re dealing with real metal and real operators.

Bottom line

North American buyers prefer LC at sight for African metals because it’s a bank-controlled settlement mechanism that fits governance, reduces prepayment fraud exposure, and forces a document trail. (academy.iccwbo.org)

But the real win comes from pairing the LC with independent, physical verification and document reconciliation across the supply chain.

That’s how you move copper cathodes from “offer” to “cargo.”

Invest Offshore continues to track real-asset opportunities globally (Gold) including investment opportunities in West Africa seeking investors for the Copperbelt Region.

Leave a Reply