Invest Offshore is recommending a timely and insightful analysis published by Zero Hedge, submitted by Tight Spreads, titled “Where The Department of Energy Is Investing.” The article cuts through the noise to explain why fusion energy is accelerating a quiet but massive U.S. push to securitize domestic rare earth and advanced-materials supply chains—and which companies sit at the center of that effort.

At the core of this race is fusion, and at the core of fusion is materials science.

Fusion’s Bottleneck: High-Temperature Superconducting Magnets

One of the most critical constraints in making compact, commercially viable fusion reactors is the production of high-temperature superconducting (HTS) magnets. These magnets rely on Rare-Earth Barium Copper Oxide (REBCO)—a material that delivers extraordinary magnetic field strength while operating at higher temperatures than traditional superconductors.

The U.S. Department of Energy’s fusion roadmap depends on reliable domestic access to REBCO tapes, HTS conductors, and the rare earth inputs behind them. This is why fusion has become a central driver of America’s broader rare-earth securitization strategy.

Key DOE-Aligned Companies Enabling Compact Fusion

Bruker Corporation (NASDAQ: BRKR)

While best known for scientific instrumentation, Bruker plays a far deeper role in U.S. energy strategy through its subsidiary Bruker Energy & Supercon Technologies (BEST).

BEST is widely recognized for its stewardship of HTS magnet engineering, supplying both Niobium-Tin and HTS conductors to multiple high-priority DOE initiatives, including:

- Fusion energy systems

- Particle accelerator upgrades

- Advanced NMR platforms (critical for isotope purity verification)

Without these magnets, compact fusion designs simply do not scale.

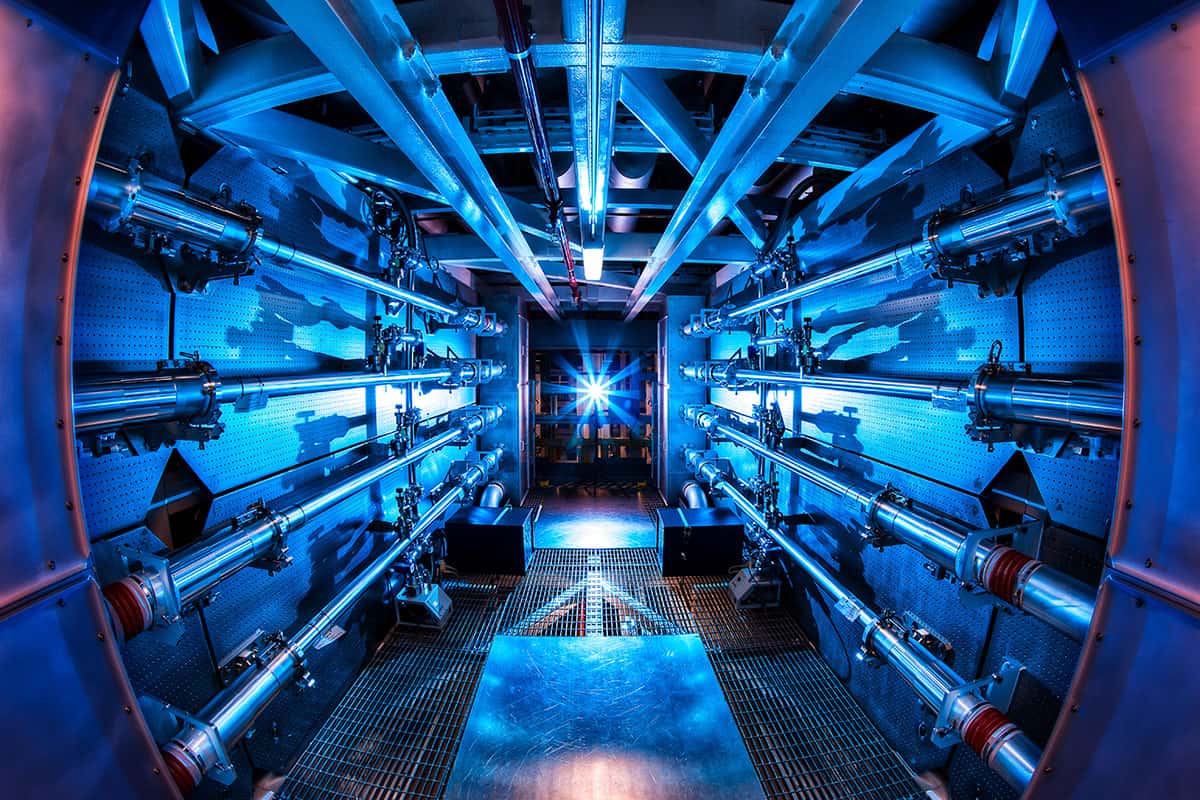

Inertial Confinement Fusion: The Pulsed Path

The Zero Hedge article also highlights Inertial Confinement Fusion (ICF)—a fundamentally different approach from magnetic confinement.

Rather than sustaining plasma continuously, ICF uses ultra-powerful pulsed lasers to compress microscopic fuel pellets. Each pulse triggers a micro-explosion, producing energy in rapid bursts—more akin to an internal combustion engine than a steady turbine.

This approach places enormous importance on laser optics, coatings, and high-power diode systems.

Optical & Laser Enablers of Fusion

Coherent Corp. (NYSE: COHR)

Coherent is a critical, often underappreciated player in the fusion ecosystem:

- Its LEAP excimer laser platform is used by REBCO manufacturers to deposit superconducting layers onto HTS tape

- It supplies high-power diode lasers that pump the massive laser systems used in inertial fusion experiments

In short, no lasers, no fusion—and no HTS manufacturing at scale.

Syntec Optics (NASDAQ: OPTX)

Syntec Optics provides the specialized lenses, mirrors, and precision optical components required for high-energy laser systems. These are not commodity parts; they must withstand extreme thermal, photonic, and mechanical stress.

As fusion experiments scale, optics become a strategic chokepoint, placing companies like Syntec directly inside the DOE’s long-term investment arc.

Why This Matters for Offshore & Advanced-Materials Investors

The Zero Hedge piece makes a larger point that aligns closely with Invest Offshore’s long-standing thesis:

- Energy dominance is now materials dominance

- Rare earths, superconductors, optics, and advanced ceramics are replacing oil as strategic assets

- Governments are quietly reshoring and securitizing supply chains before markets fully price the shift

Fusion is not just an energy story—it is a rare-earth, advanced manufacturing, and strategic materials story.

Final Takeaway

We recommend reading “Where The Department of Energy Is Investing” in full because it connects the dots between fusion, rare earths, superconductors, and U.S. industrial policy with clarity rarely seen in mainstream coverage.

For investors looking beyond headlines and into the physical building blocks of the next energy era, this article is required reading.

Source: Zero Hedge – Where The Department of Energy Is Investing

Leave a Reply