Warren Buffett’s long-time business partner Charlie Munger is “making a fool of himself” for his “archaic, short-sighted and hypocritical” views on cryptocurrencies such as Bitcoin, says the CEO of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The comments from Nigel Green of deVere Group follow an opinion piece in the Wall Street Journal, where the legendary 99-year-old investor, Berkshire Hathaway Vice Chairman and vocal Bitcoin critic called for the United States to follow in the footsteps of China and ban cryptocurrencies.

Discussing the piece on Wednesday, in an interview with CNBC’s Becky Quick, Munger said: “It isn’t even slightly stupid, it’s [crypto] massively stupid, and of course it’s very dangerous, and of course the governments were totally wrong to permit it.

“And of course, I am not proud of my country for allowing this crap — well, I call it crypto sh*t. It’s worthless, it’s crazy, it’s not good, it’ll do nothing but harm.”

“I think the people that oppose my position are idiots.”

Unsurprisingly, there’s been a fervent kickback from the crypto community, amongst others.

The deVere Group CEO says: “Charlie Munger’s opinions on the subject of crypto are archaic and incredibly short-sighted.

“Whether he likes it or not, it’s inevitable that we will have a multi-faceted system of currencies moving forwards. The mix will include fiat, central bank digital currencies (CBDCs), and crypto.

“Those who demonstrably ‘get’ this: most governments, central banks, regulators, institutional investors, private investors, and financial institutions including Wall Street giants.

“Amongst those who demonstrably don’t ‘get’ this: Charlie Munger.”

He continues: “Cryptocurrencies, such as Bitcoin, are becoming almost universally regarded as part of the future of money.

“Why? Because of the staggering pace of the digitalisation of our lives and cryptocurrencies are digital by their very nature.

“They’re also borderless and global making them perfectly suited to the world of commerce, trade, and the movement of people.”

He argues that the loss of trust in governments, central banks and legacy financial institutions, has accelerated the rush to embrace the immutable blockchain technology that powers cryptocurrencies.

“In addition, it comes down to demographics. Younger generations, such as Millennials and Gen Z, are digital natives and more likely to hold crypto assets. If demographics are on your side, the future probably is, too.”

Nigel Green also slams Munger’s assertion that the U.S. should follow China’s banning of crypto.

In September 2021, China’s central bank announced that all transactions of cryptocurrencies were to be illegal, in effect banning digital currencies such as Bitcoin. It was Beijing’s seventh attempt to crack down on the internationally booming sector.

“However, less than a year later, China re-entered the Top 10 of countries adopting Bitcoin. This unequivocally suggests that the ban has either been ineffective and/or poorly enforced. If authoritarian Beijing has failed to stop Bitcoin, it will be almost impossible elsewhere,” he notes.

He adds: “Munger’s ridiculous rant is also hypocritical. His company, Berkshire Hathaway, last year made its crypto investment public with an SEC filing.

“It revealed that the firm had purchased $1 billion in shares of Nubank, a digital bank based in Brazil, and the largest of its kind in Latin America. The digital bank’s investment division, allows users to put money in a Bitcoin exchange-traded fund (ETF).”

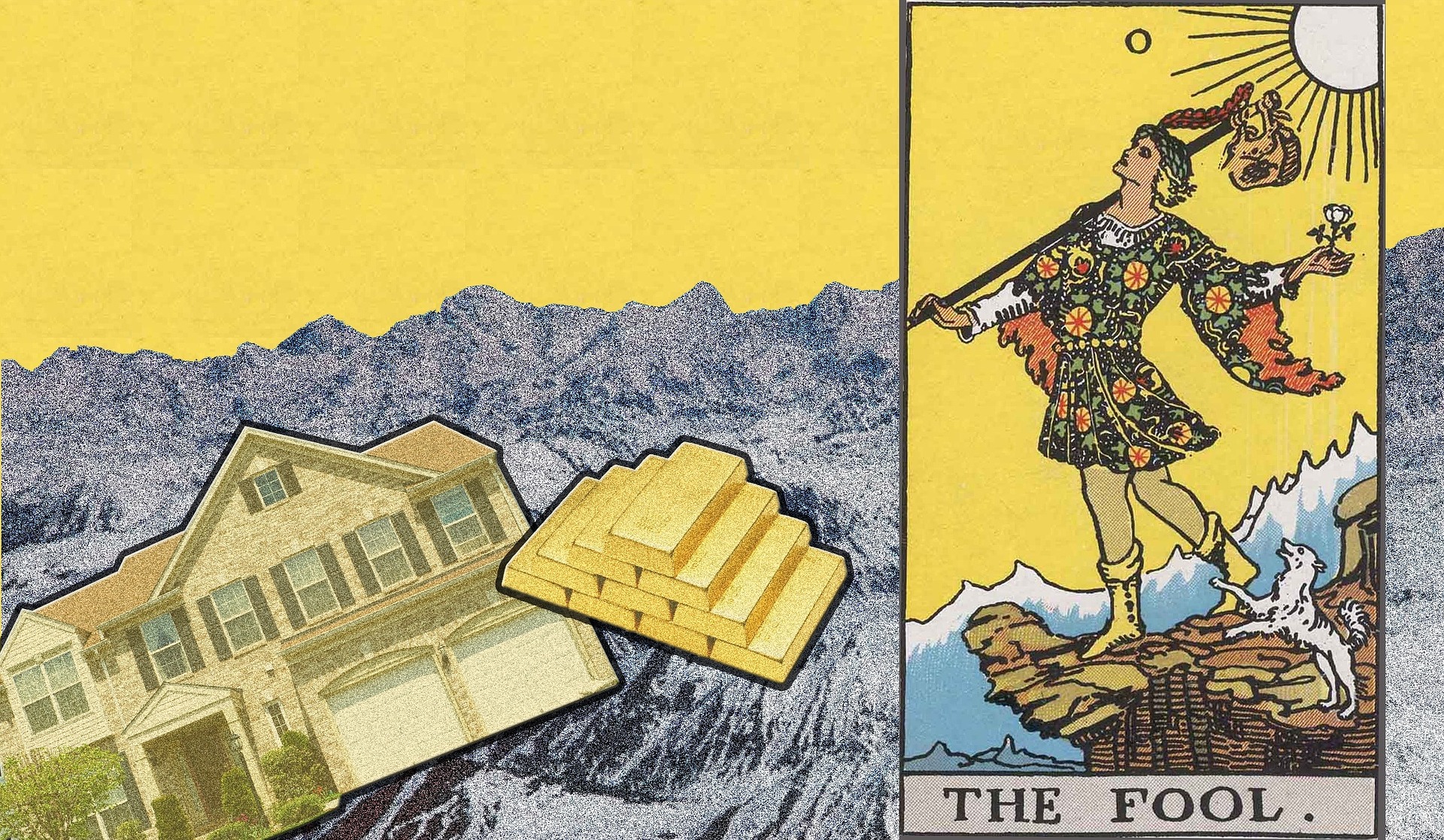

Nigel Green concludes: “Unfortunately, Mr Munger is making a fool out of himself with his crypto comments.”

Charlie Munger Fool Image by Cari Dobbins from Pixabay

Leave a Reply