The tide has turned. The Age of the Bankers is closing its last ledger, and the Age of the Treasury—the people’s money—is roaring in like a storm with Donald J. Trump at the helm.

On January 30, 2026, Trump made the kind of move that sends shivers down K Street’s spine and rattles the foundations of Wall Street’s ivory towers. He nominated Kevin Warsh as the next Chair of the Federal Reserve—a man who’s been sounding the alarm on monetary distortion and fake growth since Bernanke first fired up the printing presses.

This isn’t just a nomination. It’s a regime change.

Warsh Means War on Wall Street’s Easy Money

Warsh is no stranger to the system. He was the system. He’s a former Fed governor who left the board disillusioned by the central bank’s addiction to money printing. His critique? The Fed wasn’t stimulating the real economy—it was pumping air into asset bubbles and widening the gap between Main Street and Wall Street.

Trump is now setting the record straight.

With Warsh, it’s Main Street first. We’re talking about real capital investment, domestic manufacturing, and monetary policy with a backbone—not a pacifier.

When Kevin Warsh walks into the Eccles Building, he’s not bringing a dove or a hawk. He’s bringing a damn wrecking ball.

Hamilton Returns to Davos

Ten days before Warsh’s nomination, U.S. Trade Representative Jamieson Greer took the stage at Davos and invoked none other than Alexander Hamilton—America’s first Treasury Secretary and the godfather of U.S. industrial policy.

Greer quoted Hamilton’s 1791 Report on Manufactures, a document that championed tariffs, subsidies, and national investment in domestic industry. Back then, it threatened the grip of foreign dependency and British imperialism. Hamilton paid the ultimate price for that vision in 1804—shot in a duel as powerful interests sought to snuff out American independence.

Now, the Trump team is resurrecting that plan—with a vengeance.

$18 Trillion? A Psy-Op or a Signal?

At Davos on January 21, Trump dropped a bomb: $18 trillion in secured commitments to rebuild American industry.

Is that number real? Well, fact-checkers say the verified pledges—mostly from allies like the EU and Japan—tally closer to $5 trillion over a decade.

But this isn’t about arithmetic. It’s about messaging. Trump’s message was clear: “We’re bringing the capital home.” The big reset isn’t just happening. It’s being funded, structured, and executed right now. And the Fed? It’s being sidelined.

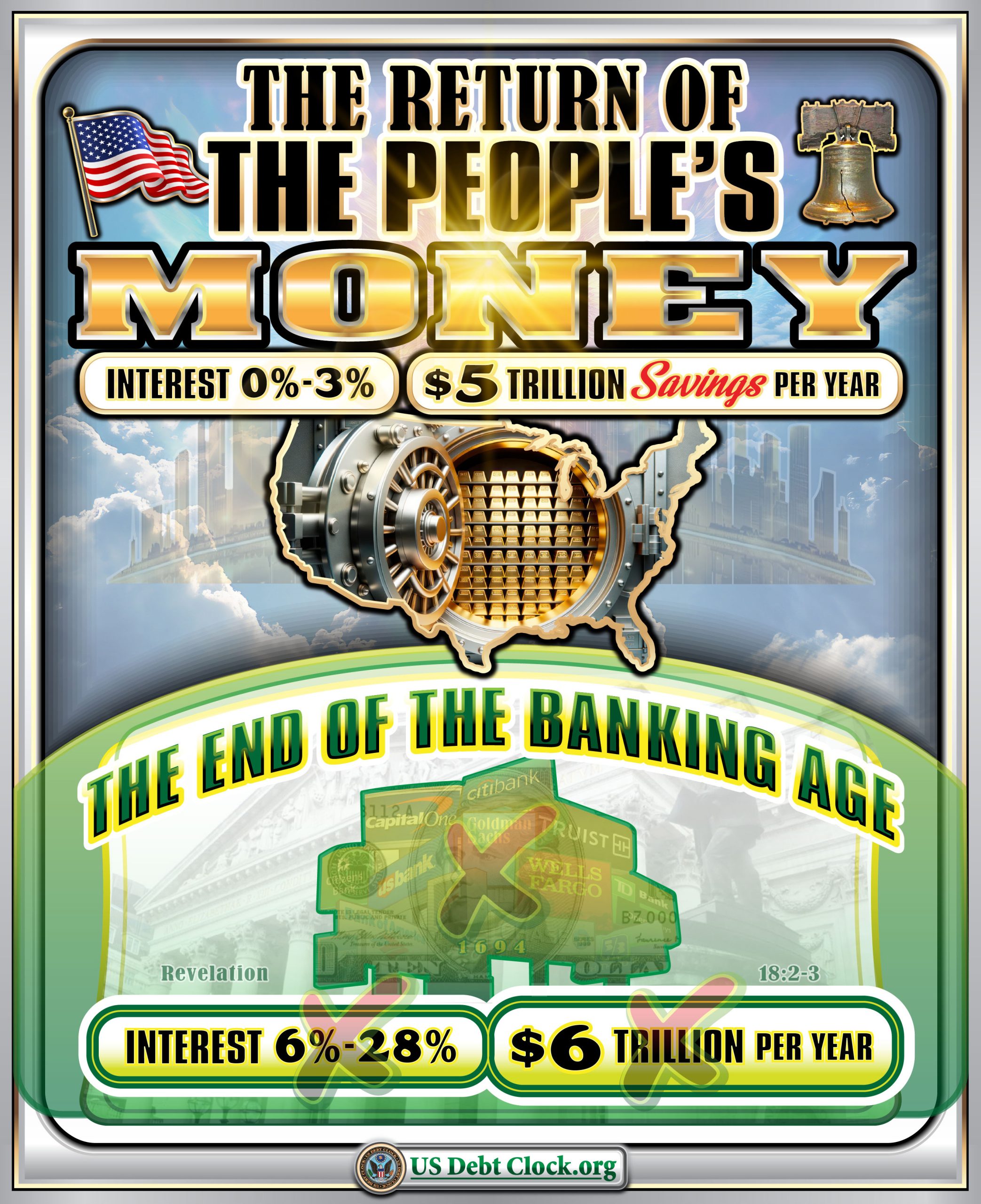

From Bank Notes to Treasury Notes

The Fed was never federal. It had no reserve. It was always a cartel—a shadow system built on promises backed by debt.

Now, the U.S. is flipping the script:

- Treasury-minted coins.

- Treasury-issued certificates.

- M0-backed monetary sovereignty.

The dollar isn’t dying. It’s being reclaimed. And the middlemen—private banks, offshore lenders, and parasitic funds—are being cut out like dead wood.

We’re talking about a complete restructuring of global liquidity, from dark pools to light rails. And guess what?

The orchestra’s still playing, but the chairs are being rearranged.

When the Fed music stops, you better be in the right chair.

Prepare for the Great Wealth Transfer

This isn’t the Great Reset they wanted. It’s the People’s Reset—and it’s happening on American terms.

So here’s what Gekko says:

✅ Ditch Fed-backed assets.

✅ Move into metals and M0.

✅ Access Treasury-aligned programs through the right offshore pathways.

✅ Position for the era where money is backed by value, not vapors.

Because when the dust settles, the wealth will not be destroyed—it will be transferred.

The only question is: Will you be on the receiving end?

Invest Offshore connects accredited investors with Treasury-linked instruments, offshore metal allocations, and private placement infrastructure aligned with the emerging post-Fed monetary order. Be early. Be positioned. Be unshakeable.

Leave a Reply