In a seismic shift that reverberates through financial markets, US Treasury bond prices are collapsing, while yields soar to multi-year highs. This development marks a significant inflection point in the trajectory of the global financial system, signaling the imminent end of the Federal Reserve system as we know it. In this blog post, we delve into the factors driving this dramatic upheaval and explore the implications for investors and the transition to Treasury Certificates.

The Unraveling of US Treasury Bonds

Persistent Inflation:

- Persistent inflationary pressures, fueled by supply chain disruptions, labor shortages, and robust consumer demand, erode the purchasing power of fixed-income investments like US Treasury bonds.

- Investors demand higher yields to compensate for the erosion of real returns caused by inflation, leading to a sell-off in bond prices and a spike in yields.

Hawkish Federal Reserve Policy:

- The Federal Reserve’s pivot towards a more hawkish monetary policy stance, characterized by aggressive interest rate hikes and balance sheet reduction, exacerbates selling pressure in the bond market.

- Expectations of tighter monetary policy to combat inflationary pressures contribute to rising yields, as investors anticipate higher borrowing costs and reduced liquidity.

Broader Economic and Fiscal Concerns:

- Broader economic and fiscal concerns, including mounting government debt, geopolitical tensions, and uncertainties surrounding fiscal stimulus measures, weigh on investor sentiment and confidence in US Treasury bonds.

- As fiscal and monetary authorities grapple with these challenges, investors seek refuge in alternative assets and safe-haven instruments, further driving down demand for US Treasury bonds.

The Rise of Treasury Certificates

Transition to Treasury Certificates:

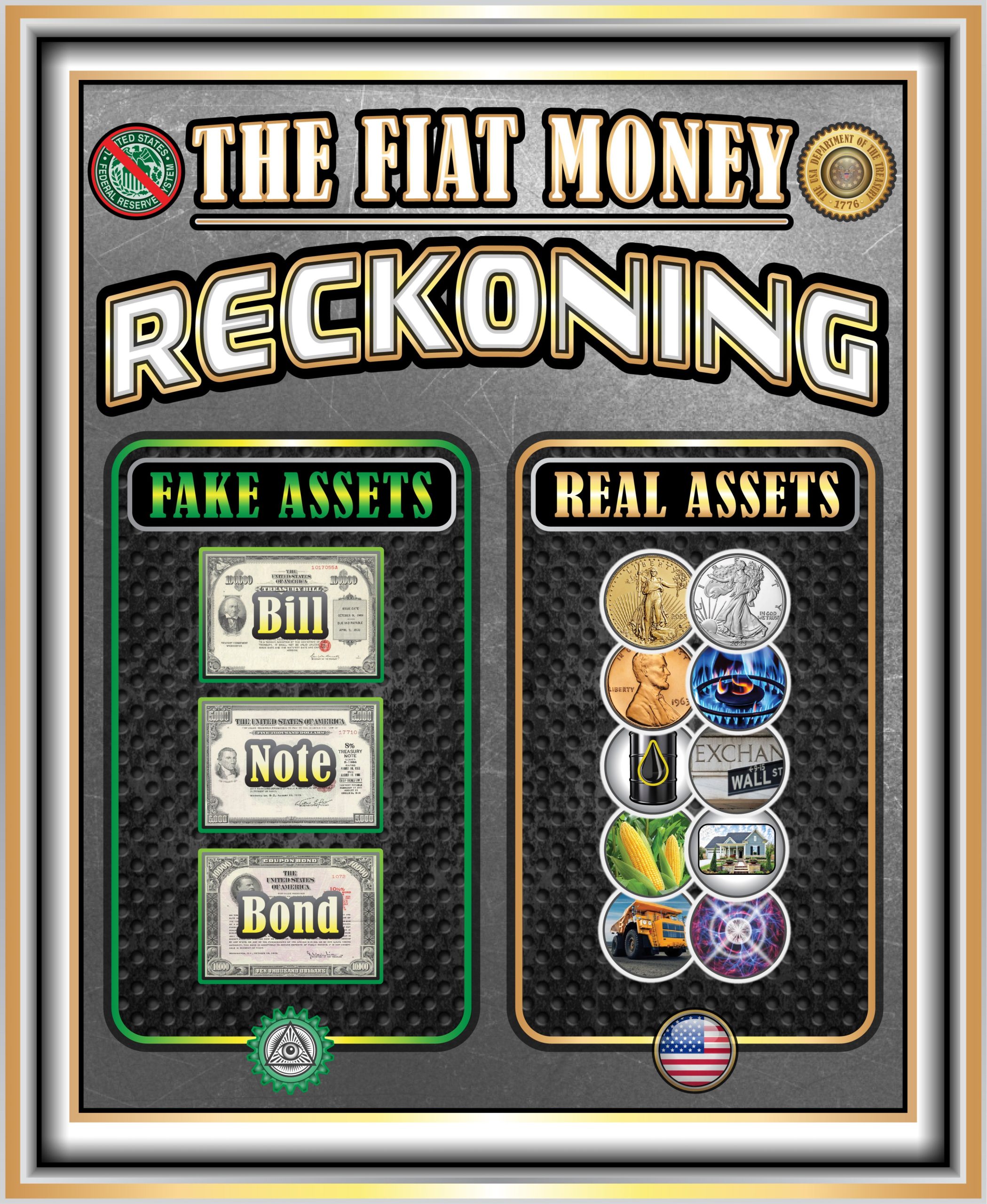

- Against the backdrop of collapsing US Treasury bond prices, the transition to Treasury Certificates gains momentum as investors seek refuge in alternative stores of value and monetary instruments.

- Treasury Certificates, backed by tangible assets and issued directly by the US Treasury, offer a compelling alternative to traditional fixed-income investments, providing investors with greater transparency, security, and inflation protection.

Reinventing the Financial System:

- The collapse of US Treasury bonds and the transition to Treasury Certificates mark a paradigm shift in the global financial system, heralding the end of the Federal Reserve system and the dawn of a new era of monetary sovereignty and stability.

- By embracing Treasury Certificates and sound money principles, policymakers and investors pave the way for a more resilient, equitable, and sustainable financial ecosystem.

Navigating the Transition

As US Treasury bond prices collapse and yields spike to multi-year highs, investors face unprecedented challenges and opportunities in navigating the transition to Treasury Certificates. By staying informed, diversifying portfolios, and embracing innovative investment strategies, investors can position themselves to thrive amidst evolving market dynamics and seize opportunities for growth and prosperity in the new financial paradigm.

Conclusion

The collapse of US Treasury bond prices and the surge in yields signal the end of the Federal Reserve system and the beginning of a new chapter in the evolution of global finance. As investors adapt to changing market conditions and embrace the transition to Treasury Certificates, they have the opportunity to reshape the financial landscape and pave the way for a more resilient and equitable future.

In the next installment of our series, we will explore strategies for investors to navigate the transition to Treasury Certificates and capitalize on emerging opportunities in the evolving financial ecosystem.

Disclaimer: This blog post is for informational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

Leave a Reply