Why Treasury Certificates Change Everything

For more than a century, the global financial system has operated on a fundamental flaw that few people ever stop to question:

Almost all money enters circulation as debt.

Not earned.

Not saved.

Not invested productively first.

But lent — into existence — through fractional reserve banking, carrying interest that mathematically can never be fully repaid.

This is the quiet engine behind chronic inflation, sovereign debt spirals, asset bubbles, and the permanent transfer of wealth from producers to financiers.

There is, however, an alternative model.

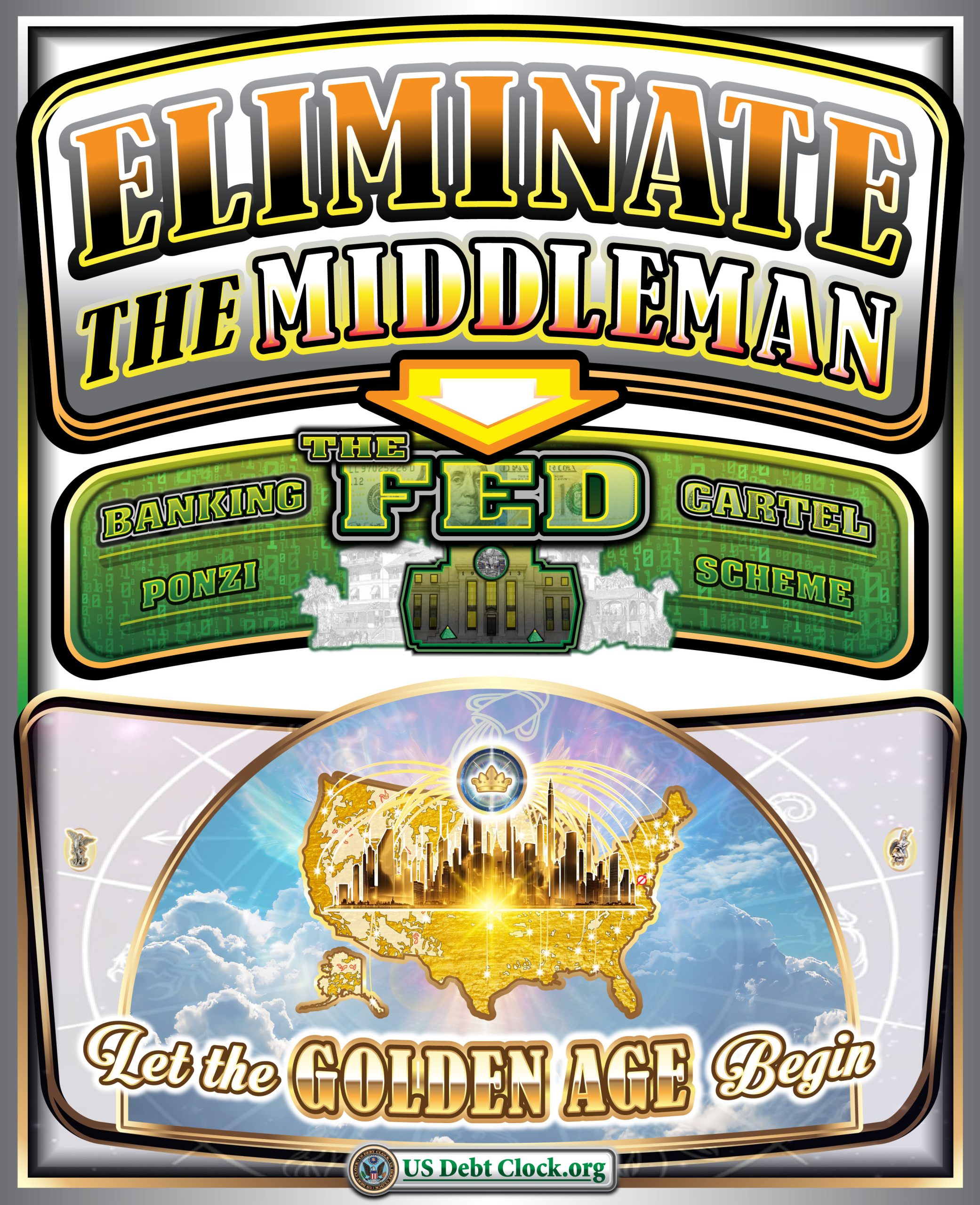

One that spends money into circulation, rewards saving with a dividend, and removes the banking middleman entirely.

That alternative is now openly being discussed under a name that hasn’t been used at scale since the 19th century:

Treasury Certificates.

How Money Enters the System Today (And Why It’s Broken)

Under the Federal Reserve system, money is created when banks lend.

- A bank issues a loan

- New money appears on its balance sheet

- Interest is attached

- The principal exists — but the interest does not

This means someone must always default, or the system must continuously expand debt just to service old debt.

The consequences are global and unavoidable:

- Governments trapped in perpetual borrowing

- Citizens punished for saving through inflation

- Asset prices inflated far beyond productive value

- Banking institutions positioned as mandatory toll collectors

This is not capitalism.

It is debt servitude disguised as finance.

Spending Money Into Circulation: The Treasury Certificate Model

Treasury Certificates flip the system on its head.

Instead of lending money into existence, the Treasury spends new money directly into the economy — for infrastructure, productivity, wages, energy, and national development.

No interest.

No private bank issuance.

No exponential debt math.

Money enters circulation debt-free.

Historically, this model funded:

- The American Civil War (Greenbacks)

- Massive industrial expansion

- Infrastructure booms without sovereign insolvency

The key difference?

Money is issued as a public utility — not a private loan product.

The Dividend to Save — Not the Penalty

Under the current system, savers lose.

Inflation quietly taxes stored value, forcing people into speculation just to preserve purchasing power.

Treasury Certificates introduce a radically different incentive:

Saving becomes productive again.

Instead of interest paid by borrowers, savers receive a Treasury Dividend — a yield derived from national productivity, resource output, and real economic growth.

This changes human behavior at a civilizational level:

- People save instead of speculate

- Capital becomes patient

- Long-term planning replaces short-term leverage

- Productivity is rewarded, not debt accumulation

Money becomes a store of value again, not a melting ice cube.

Eliminating the Middleman: What Happens Without the Fed

When Treasury Certificates replace Federal Reserve Notes, the Federal Reserve becomes unnecessary.

Not reformed.

Not regulated.

Obsolete.

The Treasury no longer borrows from private banking institutions.

It no longer pays interest to create its own currency.

It no longer mortgages future generations to fund the present.

Global implications are profound:

- National debt stops compounding

- Tax pressure eases over time

- Inflation becomes a policy choice, not a byproduct

- Currency regains credibility through discipline and transparency

This is not socialism.

It is sovereign monetary sanity.

Global Trade Under Treasury Certificates

Debt-based currencies force nations into a zero-sum game.

Treasury Certificates support a trade-settlement economy instead of a debt-settlement economy.

- Resources are exchanged for value, not IOUs

- Hard assets anchor credibility

- Trade deficits no longer require perpetual borrowing

- Nations cooperate instead of competing for dollar liquidity

This is why commodity-rich regions — particularly Africa, Latin America, and resource-producing economies — stand to benefit the most.

Why This Matters Now

The existing system is mathematically finished.

- Sovereign debt is unpayable

- Central banks are trapped

- Confidence is evaporating

- Hard assets are quietly re-monetizing

Treasury Certificates are not a theory.

They are a necessity — the only way forward without systemic collapse.

The question is no longer if the system changes.

It is who understands it early.

The Invest Offshore Perspective

At Invest Offshore, we see Treasury Certificates as the foundation of the next monetary era — one anchored in real assets, real productivity, and real sovereignty.

This is why we focus on:

- Hard-asset jurisdictions

- Commodity-backed finance

- Infrastructure-driven growth

- West African investment opportunities tied to energy, copper, and gold

When money stops being debt, capital flows toward production, not speculation.

And that is where the next generation of wealth will be built.

The old system lends money into existence and taxes the future.

The new system spends money into productivity and pays a dividend to those who save.

History always chooses the latter.

And it is choosing again.

Leave a Reply