How many raw diamonds and Congo cubes export from DRC

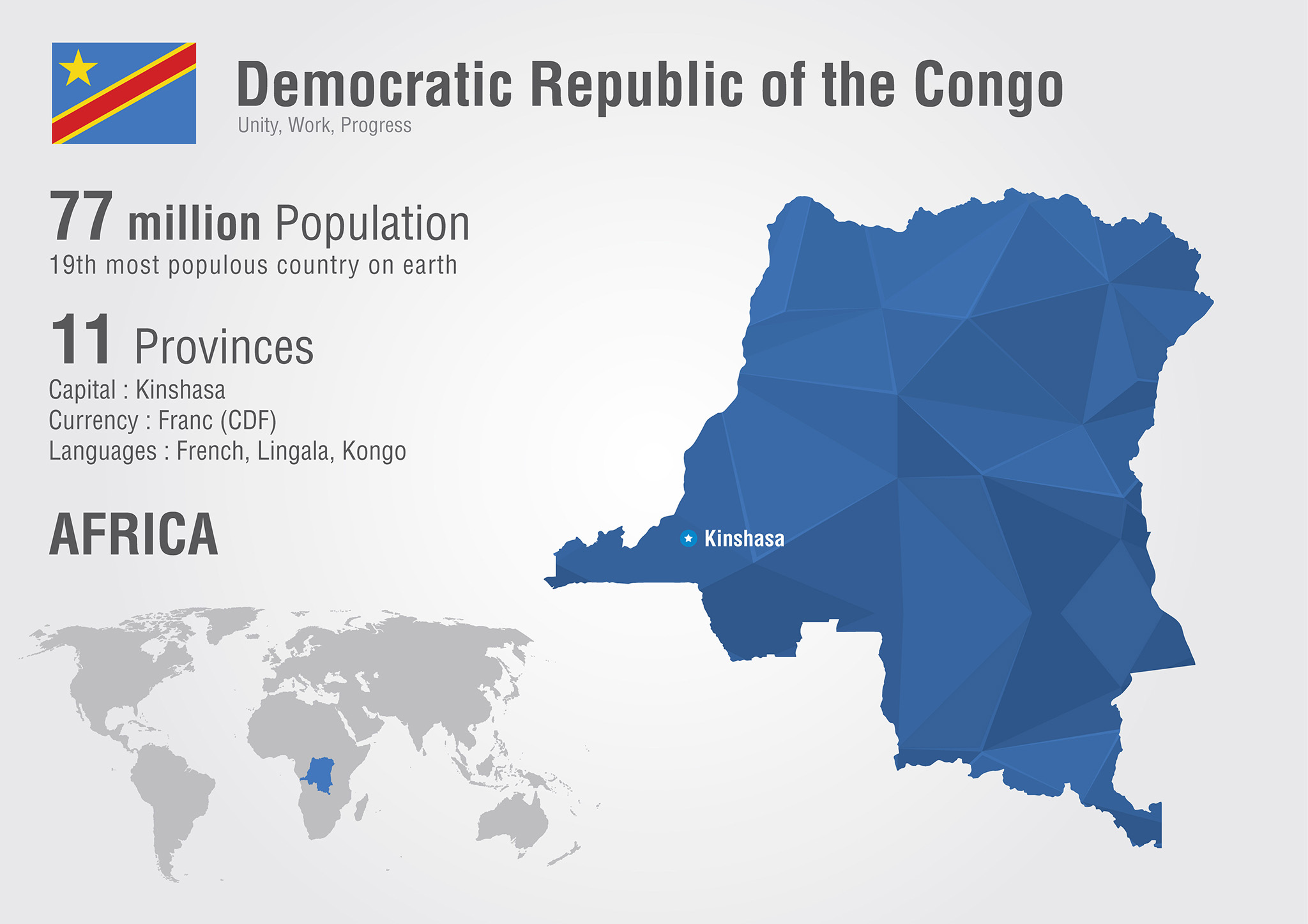

According to the Kimberley Process Certification Scheme (KPCS), which tracks the export and import of raw diamonds globally, the Democratic Republic of Congo (DRC) was the third-largest producer of rough diamonds in 2019, with a reported export value of $0.66 billion.

Regarding the “Congo cube” term, it is not clear what exactly it refers to. If you could provide more information or context, I may be able to assist you further.

Congo Cubes are Raw Diamonds and uncut

The Democratic Republic of Congo (DRC) is a significant producer of rough diamonds, and the country’s artisanal mining sector is known to produce a significant portion of these diamonds. However, due to the informal nature of this sector, it can be challenging to track the exact number of raw diamonds or Congo cubes exported from the DRC.

Diamonds for Investing Offshore

Investing in diamonds can be an option for diversifying a portfolio, but it’s important to be aware that it comes with its own set of risks and challenges. Diamonds are not traded on public exchanges, making them less liquid than traditional investments like stocks or bonds.

If you are interested in investing in diamonds offshore, you may consider seeking the services of a reputable diamond investment firm or financial advisor who specializes in this area. They can help you navigate the process of purchasing and holding diamonds as an investment, as well as provide guidance on factors such as quality, rarity, and market trends.

It’s also important to consider the potential risks associated with investing in diamonds, including fluctuations in the market, the possibility of fraud or counterfeit diamonds, and the challenge of valuing diamonds accurately. Therefore, before investing, you should conduct thorough research and consult with a financial expert to determine if this type of investment is suitable for your overall investment strategy and risk tolerance.

Raw Diamonds and Rough Gems as an Investment

Investing in raw diamonds and rough gems is an option for diversifying a portfolio, but it’s important to be aware that it comes with its own set of risks and challenges. Similar to investing in polished diamonds, raw diamonds and rough gems are not traded on public exchanges, making them less liquid than traditional investments like stocks or bonds.

If you are interested in investing in raw diamonds and rough gems, you may consider seeking the services of a reputable diamond investment firm or financial advisor who specializes in this area. They can help you navigate the process of purchasing and holding these types of assets as an investment, as well as provide guidance on factors such as quality, rarity, and market trends.

It’s also important to consider the potential risks associated with investing in raw diamonds and rough gems, including fluctuations in the market, the possibility of fraud or counterfeit stones, and the challenge of valuing these assets accurately. Therefore, before investing, you should conduct thorough research and consult with a financial expert to determine if this type of investment is suitable for your overall investment strategy and risk tolerance.

Furthermore, investing in raw diamonds and rough gems may require additional knowledge and expertise in gemology to identify and value them correctly. This may entail additional costs, such as hiring a professional gemologist for an appraisal or certification. Therefore, it’s crucial to do your due diligence and ensure that you have the necessary knowledge and resources before investing in raw diamonds and rough gems.

Crossing Borders with Diamonds and Gems

It’s important to be aware that crossing borders with diamonds and gems may be subject to various rules and regulations, depending on the country of origin and the destination. In some cases, you may need to obtain specific permits, licenses, or certifications to legally transport diamonds and gems across borders.

It’s recommended to check the customs and import/export regulations of both the country of origin and the destination country to ensure that you comply with all the necessary requirements. Some countries may have restrictions or prohibitions on certain types of diamonds and gems, and failure to comply with these regulations could result in penalties or legal consequences.

Additionally, it’s essential to ensure that the diamonds and gems you are transporting are authentic and legally obtained. If you are traveling with valuable gems or diamonds, it’s advisable to keep them in a secure location and carry any relevant documentation or certification with you to verify their authenticity.

To avoid any potential issues or complications, it may be beneficial to consult with a professional gemologist, customs broker, or legal expert before attempting to transport diamonds or gems across borders. They can provide guidance on the regulations and requirements involved in the process and help ensure that you comply with all applicable laws and regulations.

Best places in the world to buy and sell diamonds and gems

There are several locations worldwide where you can buy and sell diamonds and gems, including:

Antwerp, Belgium – Antwerp is known as the diamond capital of the world and has a robust diamond trading industry. It is home to the Antwerp Diamond Bourse, which is the oldest and largest diamond exchange in the world.

New York City, United States – New York City is one of the largest diamond trading centers in the world, with a significant number of diamond dealers and wholesalers located in the city.

Mumbai, India – Mumbai is a major hub for diamond cutting and polishing, and it is estimated that up to 90% of the world’s diamonds are cut and polished in India.

Dubai, United Arab Emirates – Dubai has emerged as a significant player in the diamond trade in recent years, with several large diamond exchanges and a growing number of diamond dealers and traders.

Hong Kong – Hong Kong is a major center for the global gemstone trade, and it hosts several large gem and jewelry shows throughout the year.

It’s worth noting that buying and selling diamonds and gems involves a significant amount of risk, and it’s crucial to work with reputable dealers and have the necessary knowledge and expertise to ensure that you are making informed decisions. It’s recommended to conduct thorough research and seek the advice of a professional gemologist or financial advisor before making any purchases or investments in diamonds or gems.

Is an Uncut Diamond Worth Anything?

Although an uncut diamond doesn’t have any sparkle, that doesn’t mean it’s not worth anything. The fact is that the quality of the uncut diamond has a huge impact on the value and quality of the final product that you see on your jewelry. The worth of a diamond is determined majorly by the cut. For an uncut diamond, the price is mainly determined by its carat, color, and clarity. Carat refers to the weight, which means the higher the carat, the higher the price. This is based on the assumption that its quality is also high.

Conclusion on Raw Diamonds from Bixlers Complete Jewellery Guide

Uncut diamonds generally have many flaws, also known as inclusions. Uncut diamonds with fewer flaws/inclusions generally have a higher clarity grade, which ultimately increases their worth. A flawless uncut diamond may actually be worth more than a cut and polished diamond with a much lower clarity grade. The color of the uncut diamond also determines its worth. Colorless or near-colorless uncut diamonds are rare, and the more colorless they are, the more expensive they are.

Leave a Reply