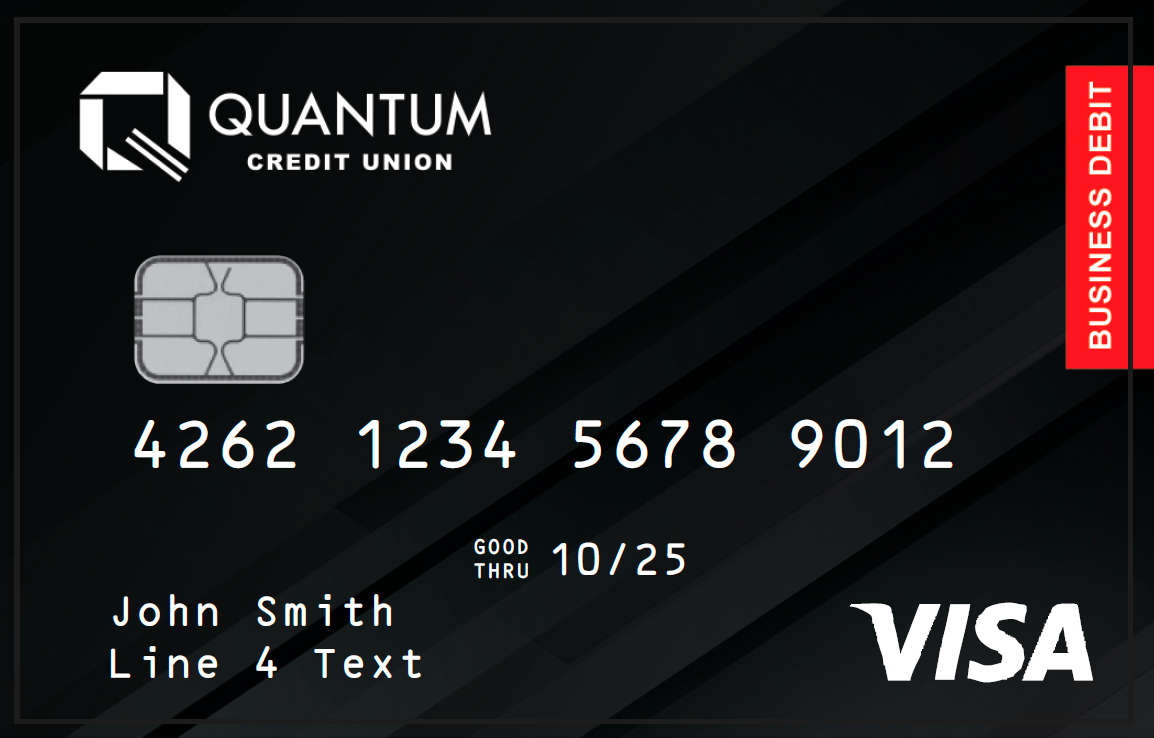

When it comes to choosing a credit card, finding the right balance between rewards, fees, and flexibility is key. The Quantum Visa credit card distinguishes itself in this competitive market with a range of features designed to offer both value and convenience, making it a strong contender for those who prioritize everyday spending without the burden of annual fees.

Key Features

No Annual Fee

One of the most attractive aspects of the Quantum Visa is its no annual fee policy. This applies to both the primary and supplementary cardholders, providing significant savings compared to premium cards that often come with hefty annual fees. For budget-conscious consumers, this is a substantial benefit that allows them to enjoy the card’s features without worrying about extra costs.

Cashback Rewards

The Quantum Visa offers a 2% cashback on contactless transactions of at least RM100, capped at RM20 per month. While the cap may seem modest, the cashback rate is competitive, especially for a card with no annual fee. This feature is ideal for users who frequently make contactless payments and want to earn rewards on everyday purchases.

Complementary Card

Adding to its appeal, the Quantum Visa typically comes with a complementary Quantum Mastercard upon approval. This dual-card offering allows users to maximize rewards across different spending categories, providing more flexibility and opportunities to earn cashback and points.

Additional Benefits

VIP Points Program

In addition to cashback, the Quantum Visa also offers a VIP Points program. Cardholders earn 1 VIP Point for every RM1 spent on local retail transactions and 2 VIP Points for every RM1 spent overseas. These points can be redeemed for various gifts and have a 3-year expiry period, adding another layer of value for cardholders.

Flexible Payment Plans

For larger purchases, the Quantum Visa provides a 12-month flexi payment plan with a 1% one-time upfront interest on transactions of RM1,200 or more. This feature offers a practical way to manage significant expenses, allowing cardholders to spread payments over time without incurring high-interest charges.

Contactless Functionality

The card also includes contactless payment technology, enabling convenient tap-to-pay transactions. This feature aligns with the growing trend toward contactless payments, making the Quantum Visa a modern and user-friendly option.

Comparison to Other Cards

While many Visa cards offer rewards programs, the Quantum Visa’s unique combination of no annual fee, cashback rewards, and a complementary Mastercard sets it apart. Although some premium Visa cards may offer higher cashback rates or more extensive travel benefits, they often come with annual fees. In contrast, the Quantum Visa is positioned as an everyday spending card with broad appeal. Its straightforward cashback structure, paired with the no-fee policy, makes it an attractive option for those seeking simplicity and value in their credit card choice.

Conclusion

For consumers who want a credit card that offers rewards without the burden of an annual fee, the Quantum Visa credit card is a standout choice. With its no-cost structure, competitive cashback, and additional perks like the VIP Points program and flexible payment plans, it provides excellent value for everyday spending. While it may not compete with premium cards on travel benefits, the Quantum Visa shines as a practical and cost-effective option for the savvy spender.

Invest Offshore is always on the lookout for innovative financial products and services that align with our commitment to value-driven investments. We also have investment opportunities in West Africa seeking investors for the Copperbelt Region. Contact us to learn more about how you can diversify your portfolio and tap into these emerging markets.

Leave a Reply