Marking a pivotal shift in America’s approach to economic policy and energy independence, the end of the Green New Deal, the United States’ exit from the Paris Agreement, and the introduction of H.R.25 herald a bold new era for innovation and growth. These seismic shifts signal a renewed focus on liberty, economic opportunity, and the empowerment of individual states, offering fresh opportunities for investors, businesses, and citizens alike.

A Bold Shift Away from the Green New Deal

The Green New Deal, a sweeping proposal that aimed to achieve net-zero greenhouse gas emissions and overhaul America’s energy infrastructure, has been a divisive policy since its inception. Critics argued that the plan imposed excessive regulations and costs on businesses and taxpayers, stifling innovation and economic growth. With its formal conclusion, the U.S. is embracing a more market-driven approach to energy production, focused on efficiency, innovation, and consumer choice.

This policy shift is expected to invigorate the energy sector by lifting regulatory constraints, enabling companies to expand their operations and explore new technologies such as advanced drilling techniques, carbon capture and storage systems, and next-generation renewable energy solutions like modular nuclear reactors and hydrogen fuel cells. The natural gas and oil industries, long hampered by strict emissions caps and drilling restrictions, are now well-positioned to experience a resurgence. Renewable energy companies, too, may benefit as the focus shifts from government mandates to market-based incentives, spurring competition and innovation across the board.

Investors can now look forward to a landscape where energy independence and resource development take center stage. This pivot not only reduces America’s reliance on foreign energy but also creates lucrative opportunities for those seeking to capitalize on a freer, more dynamic energy market.

The Exit from the Paris Agreement: A Commitment to Sovereignty

13 million views. Even @ElonMusk commented.

— Steve Milloy (@JunkScience) January 16, 2023

Twitter tried to censor it but just wound up exposing (again) the lying nature of climate alarmism.

Added bonus: My explanation and warming prediction.https://t.co/8GK2PXbPLv pic.twitter.com/54PUntGurM

America’s withdrawal from the Paris Agreement is another bold move that underscores a commitment to national sovereignty. The Paris Agreement, while noble in its intent to combat climate change, imposed financial and policy obligations on participating nations, often disproportionately impacting developed economies like the United States.

By stepping away, the U.S. has reclaimed its ability to design climate policies that align with its economic and geopolitical interests. This departure frees American businesses from the burdens of meeting externally imposed carbon reduction targets and opens the door for more efficient and innovative domestic solutions. It also levels the playing field for American industries that were at a competitive disadvantage due to stringent international commitments.

The exit from the Paris Agreement reflects a pragmatic approach that balances environmental stewardship with economic growth. For investors, this shift creates a clearer, more predictable regulatory environment, reducing uncertainty and fostering confidence in sectors ranging from manufacturing to transportation.

H.R.25: A New Era of Economic Freedom

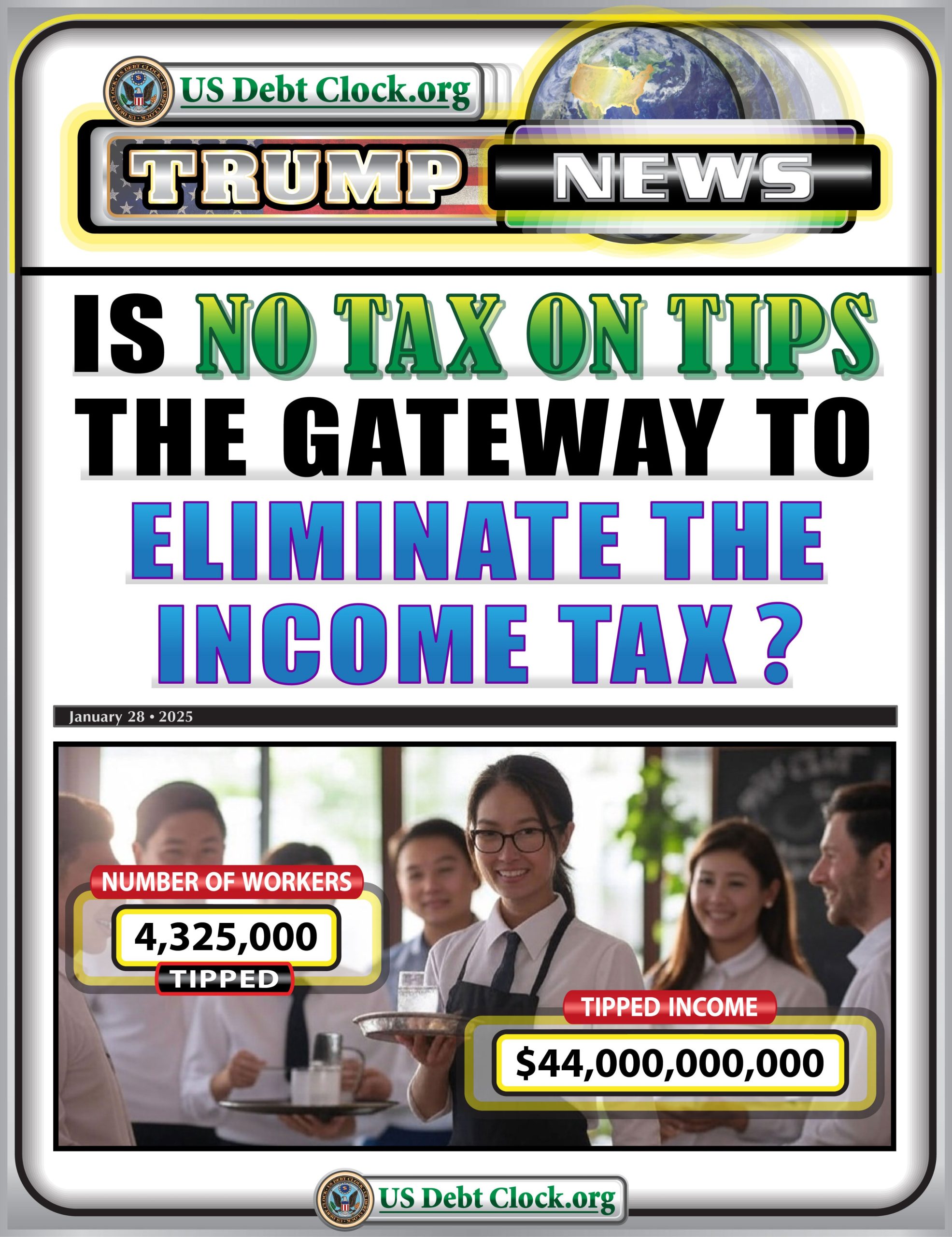

Perhaps the most transformative development in this trifecta of policy changes is the introduction of H.R.25, a bill designed to repeal federal income taxes, abolish the Internal Revenue Service (IRS), and replace the current tax structure with a national sales tax administered primarily by the states. This groundbreaking legislation aims to simplify the tax code, enhance transparency, and empower individuals and businesses.

The current income tax system has long been criticized for its complexity, inefficiency, and potential for abuse. By replacing it with a national sales tax, H.R.25 shifts the tax burden to consumption rather than income. This encourages savings and investments, key drivers of economic growth. Moreover, a sales tax ensures that everyone contributes to government revenue, including tourists and non-residents who make purchases in the U.S.

The abolition of the IRS is another monumental aspect of this bill. Without a centralized tax authority, the risks of overreach and bureaucratic inefficiency are significantly reduced. States will have greater control over tax collection, fostering competition and innovation in tax administration. This decentralized approach aligns with America’s federalist principles, empowering states to tailor tax policies to their unique economic landscapes.

For investors, H.R.25 represents a golden opportunity. The shift to a consumption-based tax system reduces the tax burden on income, dividends, and capital gains, making the U.S. an even more attractive destination for investment. Businesses, too, will benefit from lower compliance costs and a more predictable tax environment, enabling them to allocate resources more effectively.

The Global Implications

These policy changes are not just significant for the U.S.; they send ripples across the global economy. America’s exit from the Paris Agreement and the repeal of income taxes position the country as a magnet for businesses and investors seeking a competitive, innovation-friendly environment. These moves are likely to draw capital from regions with higher regulatory and tax burdens, further solidifying the U.S.’s status as a global economic leader.

Additionally, the end of the Green New Deal signals to the world that economic growth and environmental sustainability are not mutually exclusive. By embracing market-driven solutions, the U.S. is setting an example of how innovation and private enterprise can address environmental challenges without sacrificing prosperity.

Opportunities for Offshore Investors

For those investing offshore, these shifts in U.S. policy present intriguing possibilities. The transition to a national sales tax and the reduction of regulatory burdens create a more predictable and investor-friendly environment. International investors can take advantage of America’s renewed focus on economic freedom and capitalize on opportunities in energy, infrastructure, and manufacturing.

Moreover, the exit from the Paris Agreement and the end of the Green New Deal provide clarity for multinational corporations and investors navigating the complex interplay of global climate policies. By fostering a stable and competitive business climate, the U.S. is reaffirming its role as a top destination for foreign direct investment.

Conclusion

The end of the Green New Deal, America’s withdrawal from the Paris Agreement, and the introduction of H.R.25 mark a transformative moment in U.S. policy. These changes reflect a renewed commitment to freedom, fairness, and economic opportunity, creating a more dynamic and investor-friendly environment.

For investors, both domestic and offshore, the future is bright. The U.S. is poised to lead the world in innovation, energy independence, and economic growth, offering unparalleled opportunities for those ready to seize them. As these policies take root, the stage is set for a new era of prosperity and progress.

Leave a Reply