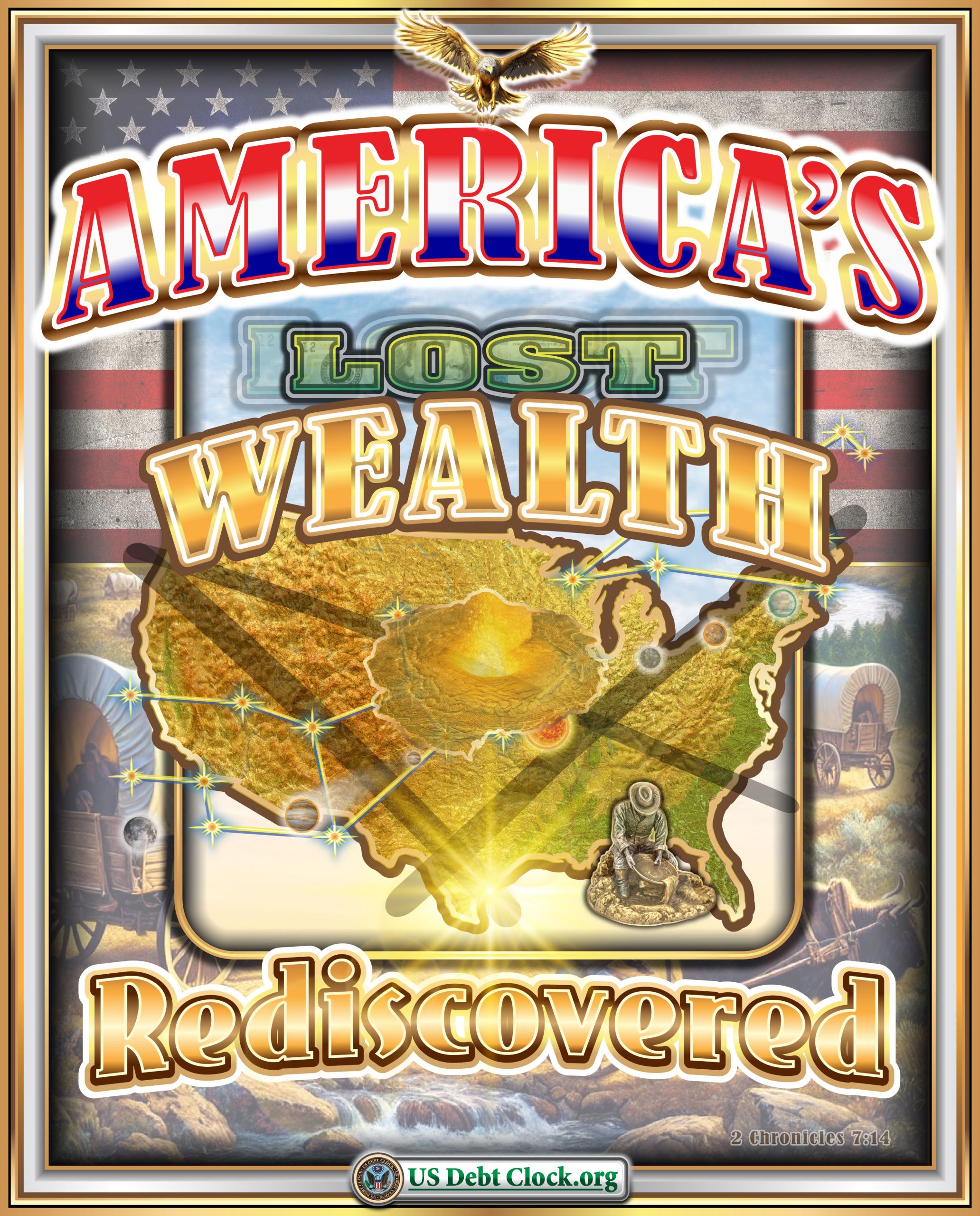

On February 12, the US Debt Clock graphic (shared on usdebtclock.org) dropped a bold visual: “AMERICA’S LOST WEALTH — Rediscovered.” It’s framed like a vintage treasure poster—an eagle overhead, an American flag backdrop, and a golden map of the United States lit up with “nodes” like a mineral grid. In the lower corner, a prospector kneels beside ore, hinting at the core message: the next chapter of American wealth won’t be printed—it will be mined, refined, and produced.

Let’s decode what the image is really saying—and why it resonates right now.

First: what this image is (and what it isn’t)

This is not an official release from the U.S. Department of the Treasury. It’s a symbolic graphic published via US Debt Clock that uses patriotic and “Treasury” branding to make a bigger point: America’s balance sheet includes resources, deposits, and dormant production capacity—especially in minerals and energy.

Read it as a message about incentives and assets—not as an audited statement.

The image’s core thesis: price wakes up geology

A mine can sit “dead” for decades for one simple reason: it wasn’t economic.

But when free-market prices rise—because demand increases, supply tightens, or currency confidence shifts—three things happen fast:

- Prospecting explodes

Higher prices justify the risk of hunting for new deposits. More boots on the ground. More claims staked. More drilling funded. - Dormant mines get re-rated

Old tailings, “uneconomic” veins, low-grade deposits, and forgotten districts suddenly become viable—especially when modern processing can pull value out of material that was once thrown away. - Capital returns to the sector

With prices and margins improving, financing reopens: equipment gets ordered, crews get hired, and shutdown projects restart.

That’s why the poster screams “rediscovered.” It’s not magic—it’s economics.

Why a modern-day gold rush is plausible

A “gold rush” doesn’t have to look like 1849. Today it looks like:

- Geochemical surveys, drones, hyperspectral imaging, and modern geophysics

- AI-assisted targeting (pattern recognition across geological datasets)

- Heap leach improvements, better flotation, reprocessing of tailings

- Revived districts where infrastructure already exists (roads, power, water, permitted footprints)

The prospector in the corner is a metaphor for something very current:

we’re entering a cycle where discovery and production are rewarded again.

It won’t just be gold

The poster’s “wealth map” implies a network of resources—because the 2026 economy is built on more than one metal.

Expect pressure (and opportunity) across:

- Gold & silver (monetary metals, store-of-value demand, industrial silver demand)

- Copper (electrification, grids, EVs, data centers)

- Critical minerals (rare earths, graphite, nickel, lithium, antimony, etc.)

- Uranium (energy security and baseload narratives)

- Industrial minerals tied to defense, manufacturing, and energy systems

In other words: the rediscovery is broad.

What “rediscovered” really means in markets

This is the part most investors miss:

A mineral deposit is not “wealth” until it becomes a producing asset.

The journey looks like:

- claim/lease/title clarity

- exploration & drilling

- resource estimate + metallurgy

- permitting & community agreements

- financing

- construction

- production + offtake

That pipeline is why the biggest upside is often found before the market agrees it’s real—yet it’s also where risk is highest.

How investors can think about positioning

If this is a real “gold rush” cycle, there are a few classic ways investors seek exposure (each with different risk profiles):

- Producers: lower risk, cash-flow driven, less upside torque

- Developers: high upside if financing/permitting lands

- Explorers/prospect generators: highest upside, highest failure rate

- Royalties/streams: often defensive exposure to production without operating risk

- Physical metal: no management risk, but no operational upside

None of this is a recommendation—just the map of how the sector typically behaves when prices move.

The takeaway

The February 12 “Lost Wealth Rediscovered” image is basically a one-page argument that says:

When prices rise, the earth gets “bigger.”

Not because new rocks appear—but because more of what already exists becomes economic to find and produce.

That’s the engine of the next modern rush: not hype—incentives.

Invest Offshore continues to track real-asset opportunities globally, including investment opportunities in West Africa seeking investors for the Copperbelt Region, plus verified gold for sale through our network and partners worldwide, and select mining concessions with documented title, geology, and clear pathways to production.

Leave a Reply