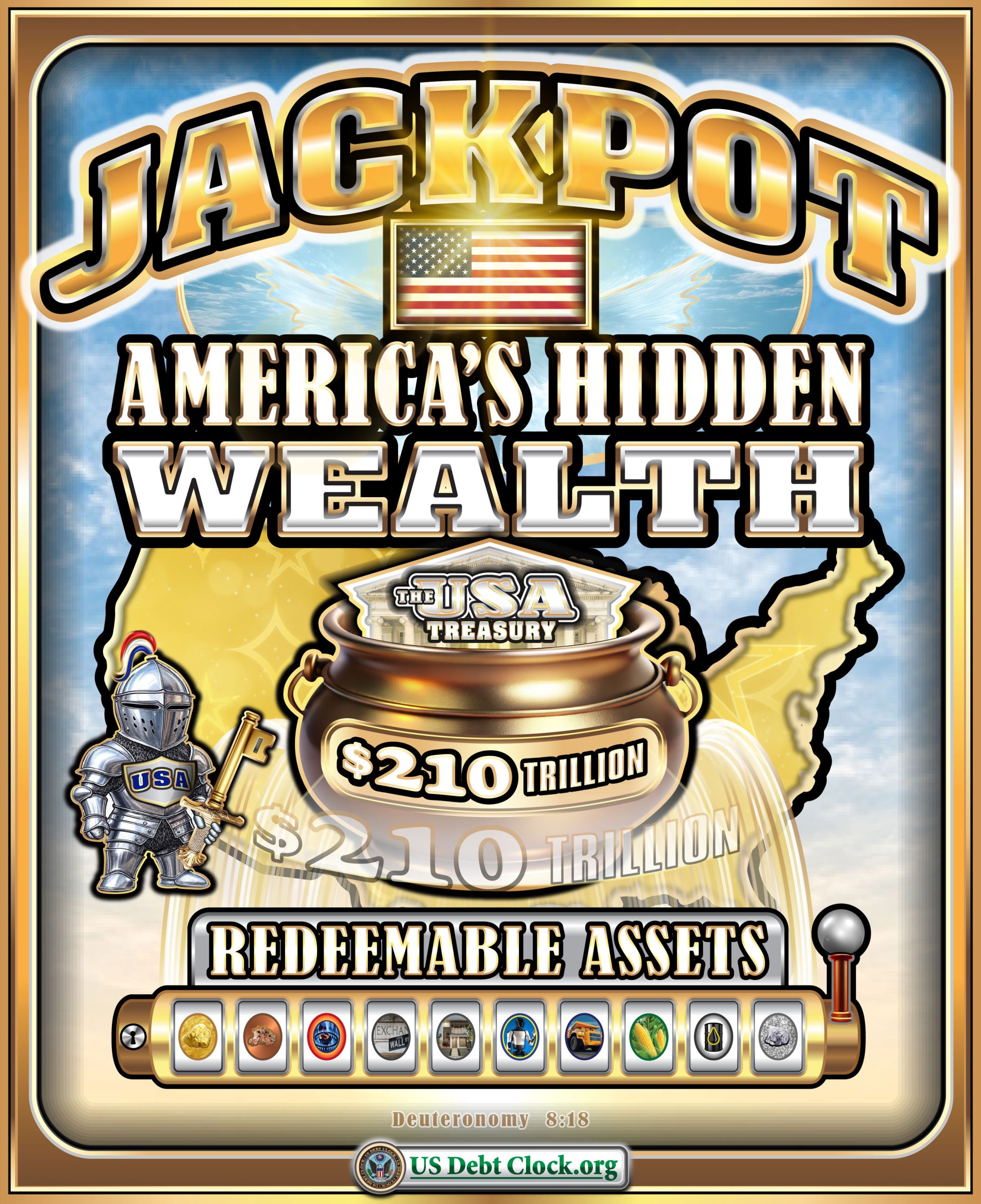

A striking graphic branded US Debt Clock has been circulating from February 5, featuring a slot-machine theme and the headline “JACKPOT — AMERICA’S HIDDEN WEALTH” with a central pot labeled “The USA Treasury” and a bold figure: $210 TRILLION. Along the bottom, the words “REDEEMABLE ASSETS” sit above a row of commodity-style icons (think hard assets: metals, energy, land/industry, and essentials). The message is clear: there’s more behind the curtain than “debt” — there are assets, too.

Before we interpret what it means, we should clarify what it is.

What the US Debt Clock is (and isn’t)

The US Debt Clock site is not a U.S. government website and it isn’t an official Treasury publication. A fact-check referencing the site’s own “about”/disclaimer language notes it is not associated with any U.S. government agency and not affiliated with or funded by any political party or lobbying group. (PolitiFact)

So treat the February 5 “Jackpot” graphic as commentary and symbolism, not as an official Treasury balance sheet.

Breaking down the image: what it’s trying to communicate

Here’s what the design elements are signaling:

- Slot machine + lever: a “system reset” metaphor — pull the lever, the outcome changes.

- A treasure pot labeled “The USA Treasury”: implies the source of the “hidden wealth” is national-level.

- “$210 TRILLION”: a headline number meant to reframe the conversation from debt only to debt vs. assets.

- “Redeemable Assets” + icons: the “reel” shows a basket of real-world things (metals/commodities/energy/industry/essentials) — i.e., tangible value, not paper promises.

- Silver “USA” knight holding a key/sword: a protector/guardian motif — “Silver controls ignition”.

In other words: the image is making an argument for an asset-backed narrative—that America’s underlying resource base, productive capacity, and strategic assets matter when evaluating the future of money.

What could “$210 trillion” be referring to?

In mainstream economics, the U.S. does have massive national wealth when you count:

- private sector net worth (households + businesses),

- public sector assets (land, infrastructure, resources, receivables),

- and productive capacity.

But a single, precise “$210T redeemable” figure is not something you can treat as settled fact just because it appears in a graphic. The image is best read as a provocative estimate or rhetorical device—an attempt to say: “Stop staring only at liabilities; there’s a balance sheet story here.”

Where “Treasury Certificates” enter the story

Within “reset” communities online, the phrase Treasury Certificates is often used as shorthand for a future system where money is re-anchored to hard assets (directly or indirectly): gold, commodities, productive assets, resource streams, etc.

That’s the conceptual bridge the image is trying to build:

- There are “redeemable assets.”

- Therefore a new Treasury-issued instrument could be “redeemable” (asset-linked).

- Therefore a monetary “reset” could happen via Treasury rather than via private banking.

Important reality check on “NESARA/GESARA,” “White Hats,” and “Cabal” claims

A lot of posts frame this as NESARA/GESARA finally arriving, with control shifting from a shadowy “cabal” to “white hats.” Those are political-myth narratives, not verified policy. There is no official, evidenced basis to claim that a specific “global currency reset” is scheduled, or that a hidden group is orchestrating it from behind the scenes.

What is fair to say:

- People use images like this to express a desire for a more transparent, asset-grounded system.

- If major monetary reform ever occurs, it will come through public mechanisms: legislation, regulation, Treasury/Fed operations, and internationally through institutions and treaties—in the open, with documents you can read.

So: treat the “Treasury Certificates = NESARA/GESARA” idea as a thesis or metaphor, not as confirmed fact.

The bigger takeaway: why “redeemable assets” resonates now

Whether or not you buy the $210T headline number, the image taps into something real:

- Trust in purely “confidence-based” money has been strained.

- Investors are gravitating toward things with floors: metals, energy, productive land, and strategic commodities.

- Even in conventional finance, you can see renewed emphasis on resilience, supply chains, and real assets—because they behave differently than leverage and paper claims when systems wobble.

That’s what “Jackpot” theme is really selling: the idea that value is still there — but it’s not evenly accessible, and the rules may change.

The verse the graphic quotes: Deuteronomy 8:18

The image anchors its message with scripture:

“But thou shalt remember the Lord thy God: for it is he that giveth thee power to get wealth, that he may establish his covenant which he sware unto thy fathers, as it is this day.” — Deuteronomy 8:18 KJV (BibleGateway)

In context, it’s a warning against pride and amnesia: don’t confuse the tool (wealth) with the source (God, discipline, stewardship, and purpose).

What to do with this as an investor

If you strip away the hype and keep the signal, the image is pointing to a durable principle:

Position around assets that remain valuable across regimes.

That can mean:

- diversified exposure to precious metals and strategic commodities,

- productive real assets (energy, agriculture, infrastructure-adjacent plays),

- and jurisdictional diversification where appropriate.

And yes—if something branded “Treasury Certificates” ever emerges as a meaningful new instrument, you’ll want to evaluate it the same way you’d evaluate anything in markets: issuer, legal structure, redemption terms, liquidity, and auditability—not memes.

Invest Offshore continues to track real-asset opportunities globally, including investment opportunities in West Africa seeking investors for the Copperbelt Region, plus verified gold for sale through our network and partners, and select mining concessions with documented title, geology, and clear pathways to production.

Leave a Reply