Today’s U.S. Debt Clock graphic is doing what it does best: compressing a decade-plus of disruption into one punchy visual.

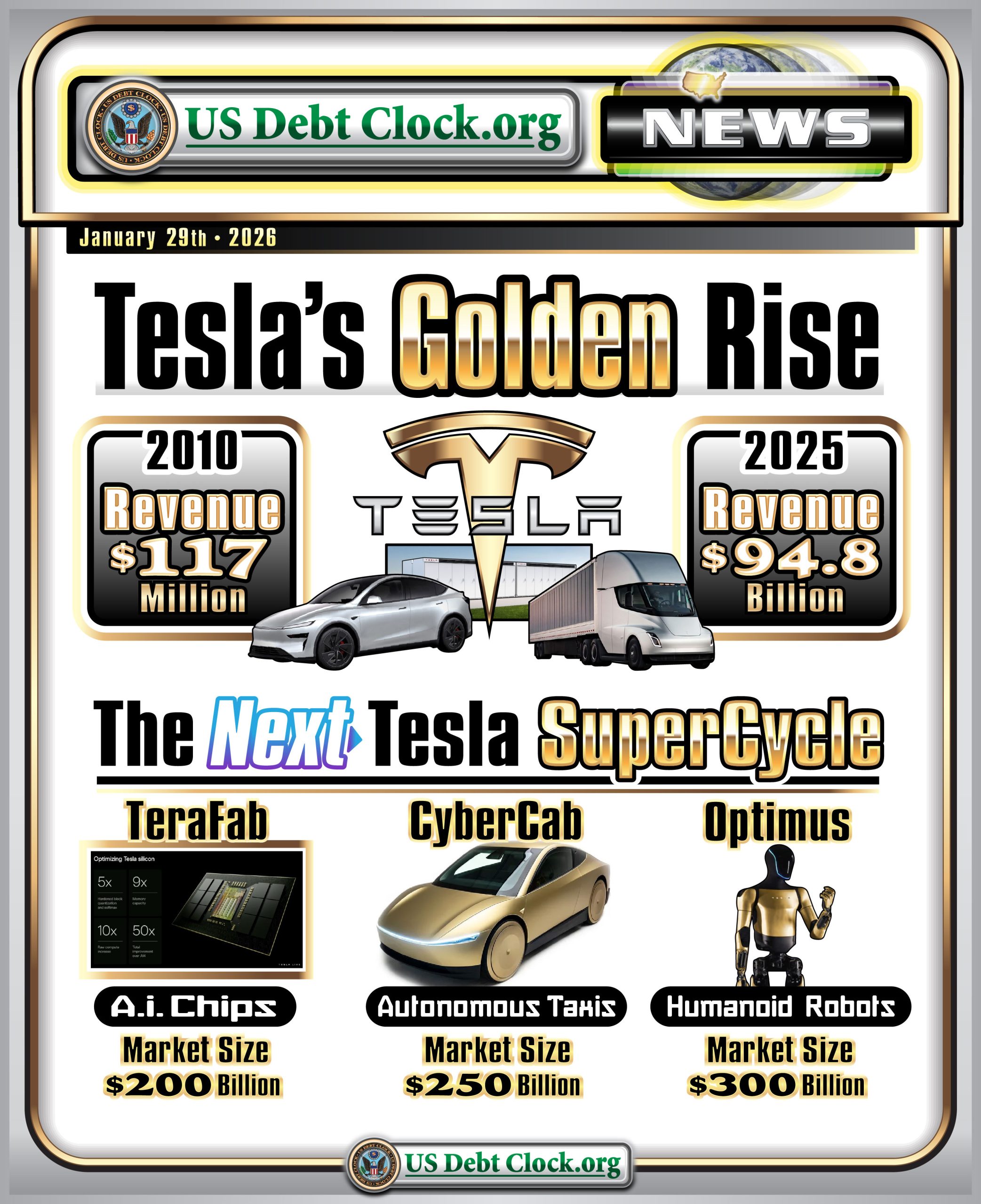

At the center is Tesla’s revenue arc — from roughly $116.7M in 2010 to $94.8B in 2025 — a reminder that “impossible” often just means “early.” Tesla’s own 2010 results pegged full-year revenue at $116.7M. And Tesla’s 2025 revenue near $94.8B was widely reported following its latest results.

But the graphic isn’t celebrating the past. It’s selling the next act.

The three pillars: chips, autonomy, robots

The Debt Clock image frames Tesla’s next cycle as three new “companies inside the company,” each tied to a massive addressable market:

- “TeraFab” (AI chips): Tesla leaning deeper into the AI hardware stack, potentially including its own chip manufacturing capabilities to secure long-term supply and performance advantages.

- CyberCab / Robotaxi: Tesla continues to position autonomous transport as a core growth engine, with large-scale deployment of self-driving vehicles aimed at transforming urban mobility.

- Optimus (humanoid robotics): the “robot workforce” thesis — where Tesla evolves from being seen as a car company into a vertically integrated automation and robotics enterprise.

The numbers circulating on the graphic (AI chips $200B, autonomous taxi $250B, humanoid robots $300B) should be viewed as narrative-sized opportunity estimates, not precise forecasts. Still, the strategic direction is unmistakable: AI + autonomy + robotics define Tesla’s next decade.

A practical “Tesla Super Cycle” stock watchlist (by exposure)

Not investment advice. For thematic exposure only.

1) The core bet

- Tesla (TSLA) — the purest expression of the thesis, spanning vehicles, energy storage, autonomy, AI compute, and robotics.

2) AI compute & semiconductor leverage (the “TeraFab” orbit)

Companies that benefit if AI hardware spending accelerates:

- NVIDIA (NVDA) — AI accelerators and software ecosystem

- AMD (AMD) — datacenter GPUs and CPUs

- TSMC (TSM) — leading-edge semiconductor manufacturing

- ASML (ASML) — critical lithography equipment supplier

3) Autonomy stack and robotaxi adjacency

Firms tied to sensing, compute, and autonomous driving infrastructure:

- Mobileye (MBLY) — ADAS and autonomy systems

- Uber (UBER) — potential beneficiary as a global mobility marketplace if autonomous fleets scale

4) Industrial robotics & automation (the “Optimus halo” trade)

If humanoid robotics becomes commercially viable, the entire automation sector re-rates:

- ABB (ABB) — robotics and industrial automation

- Fanuc (FANUY) — factory robotics leader

- Rockwell Automation (ROK) — industrial control systems

5) Materials & electrification “picks and shovels”

Massive buildouts require raw materials:

- Albemarle (ALB) — lithium supply chain exposure

- Freeport-McMoRan (FCX) — copper exposure tied to electrification and datacenter expansion

The Invest Offshore angle: the real super cycle is physical

Behind every futuristic chart are very real requirements: power generation, copper, batteries, factories, logistics, and industrial capacity.

That is why Invest Offshore continues to focus on real-asset opportunities alongside technology trends. We currently have investment opportunities in West Africa seeking investors for the Copperbelt Region.

Leave a Reply