📊 Invest Offshore News Brief — January 2026

US Debt Clock Sparks Talk of Radical Economic Reform

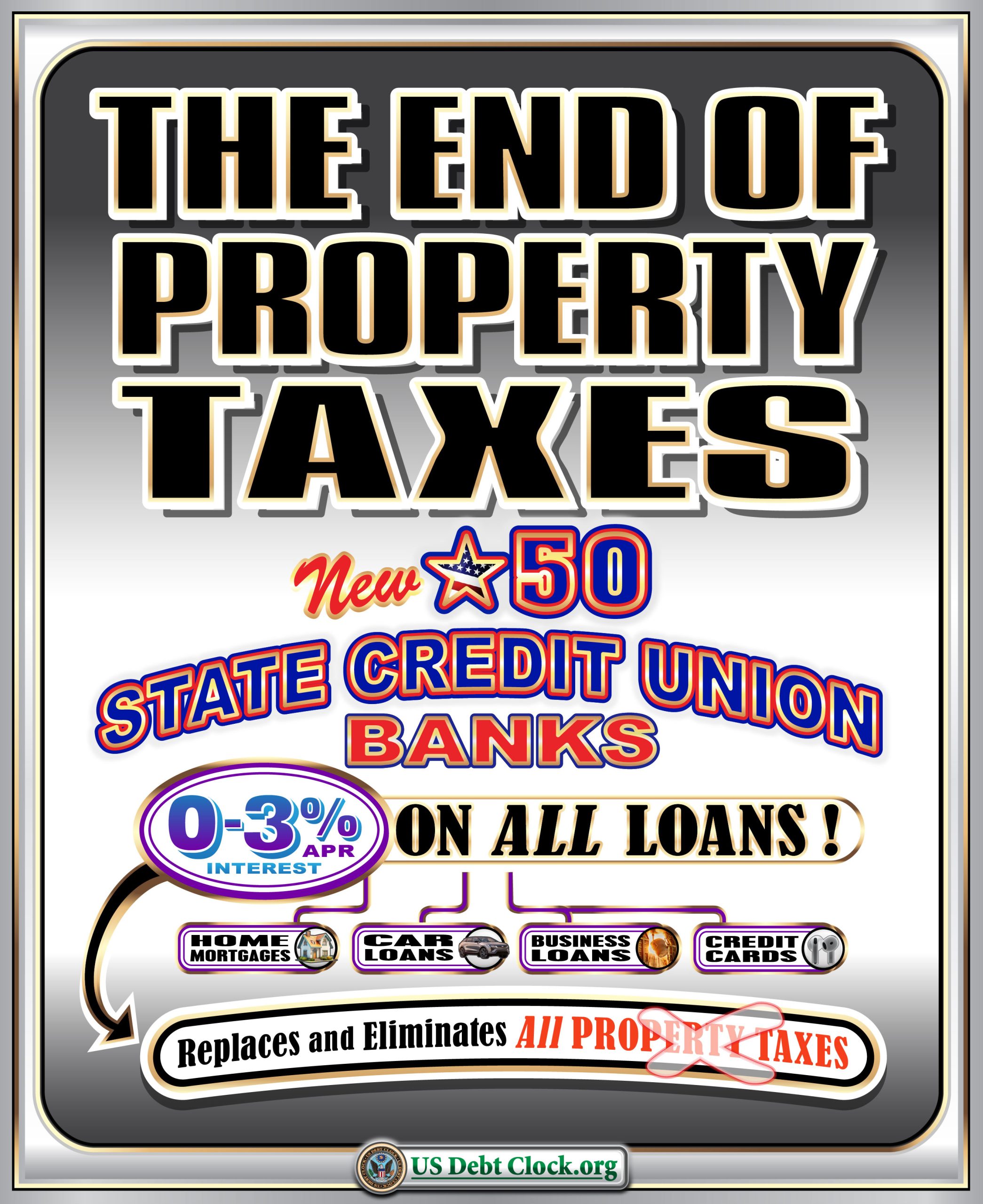

A controversial posting circulating on USDebtClock.org and shared widely on social platforms has ignited heated debate about what some are calling “The End of Property Tax” in the United States and a proposed overhaul of the financial system. The graphic and accompanying narrative envision:

- The creation of 50 new state credit union banks, one for each U.S. state, operating independently of the Federal Reserve.

- A financial structure where these banks extend 0–3% interest on all loans — including mortgages, auto loans, and business credit — suggesting a dramatic reduction in borrowing costs. (amg-news.com – American Media Group)

- The elimination of all traditional property taxes forever, coupled with a shift toward what proponents describe as a people-owned banking and credit system. (amg-news.com – American Media Group)

It’s important to note this concept is emerging primarily from online financial commentary and grassroots campaigns rather than official policy announcements. Even so, its spread reflects rising public interest in alternative monetary models amid ongoing concerns about national debt levels — the U.S. national debt recently surpassed $38 trillion, according to official data. (WBFF)

For offshore investors and global capital allocators, such ideas — whether they come to fruition or remain speculative — highlight a growing appetite for structural reform in major developed economies. If any version of this vision gained political traction, the implications for credit markets, real estate investment, and fiscal policy could be profound.

Historic Western Hemisphere Defense Chiefs Summit

In February, top defense officials from 34 Western Hemisphere nations are set to convene in Washington, D.C., for the inaugural Western Hemisphere Chiefs of Defense Conference. Hosted by U.S. Chairman of the Joint Chiefs of Staff Gen. Dan Caine, this gathering represents a renewed push for regional security coordination. (Reuters)

According to Reuters and other sources:

- Leaders from 34 nations — including general staffs from countries with territories in the region (e.g., Denmark, Britain, France) — will discuss common security priorities across the Americas. (Reuters)

- The U.S. military characterizes the meeting as an effort to strengthen “historical ties, common values, and regional stability,” emphasizing how security cooperation supports long-term prosperity for citizens throughout the hemisphere. (The Business Times)

- The summit follows recent U.S. action in Venezuela — including the ouster of that country’s leader — making this the most significant defense gathering of its kind in decades. (Reuters)

Beyond tactical discussions on narcotics interdiction and transnational criminal networks, the conference signals a strategic pivot toward collective stability in an interconnected global environment.

📌 Why This Matters for Offshore Investors

These two developments — one economic, one geopolitical — may seem distinct, but they share a common theme: transformation and stability.

- Economic speculation about radical fiscal reform speaks to deep public interest in restructuring how credit, taxation, and banking operate in the world’s largest economy.

- A major defense cooperation initiative underscores that long-term peace and security are foundational to prosperity, particularly in regions integrated through trade, investment, and people-to-people ties.

As we look forward into 2026, this could be interpreted as part of a broader shift toward a “Golden Era” of collaboration — where economic innovation and security cooperation converge to enhance global prosperity. Whether these narratives evolve into policy reality remains to be seen, but for forward-looking investors, the message is clear: stability and reform, wherever they emerge, shape markets.

Leave a Reply