A recent incident in the UK has gone viral, igniting fierce debate over financial privacy and personal freedom. An English bank customer was denied access to his own funds—£2,500—until he provided proof of what the money would be used for. He simply wanted to buy a second-hand motorbike, yet the bank’s demand for documentation before releasing his cash reveals a disturbing trend: tightening control over personal finances by both banks and governments.

This isn’t an isolated case. It’s a glimpse into a future where Central Bank Digital Currencies (CBDCs) and the removal of physical cash could hand governments unprecedented control over every transaction we make. In a world increasingly dominated by digital finance, people are waking up to the reality that they may no longer be the final authority over their own money.

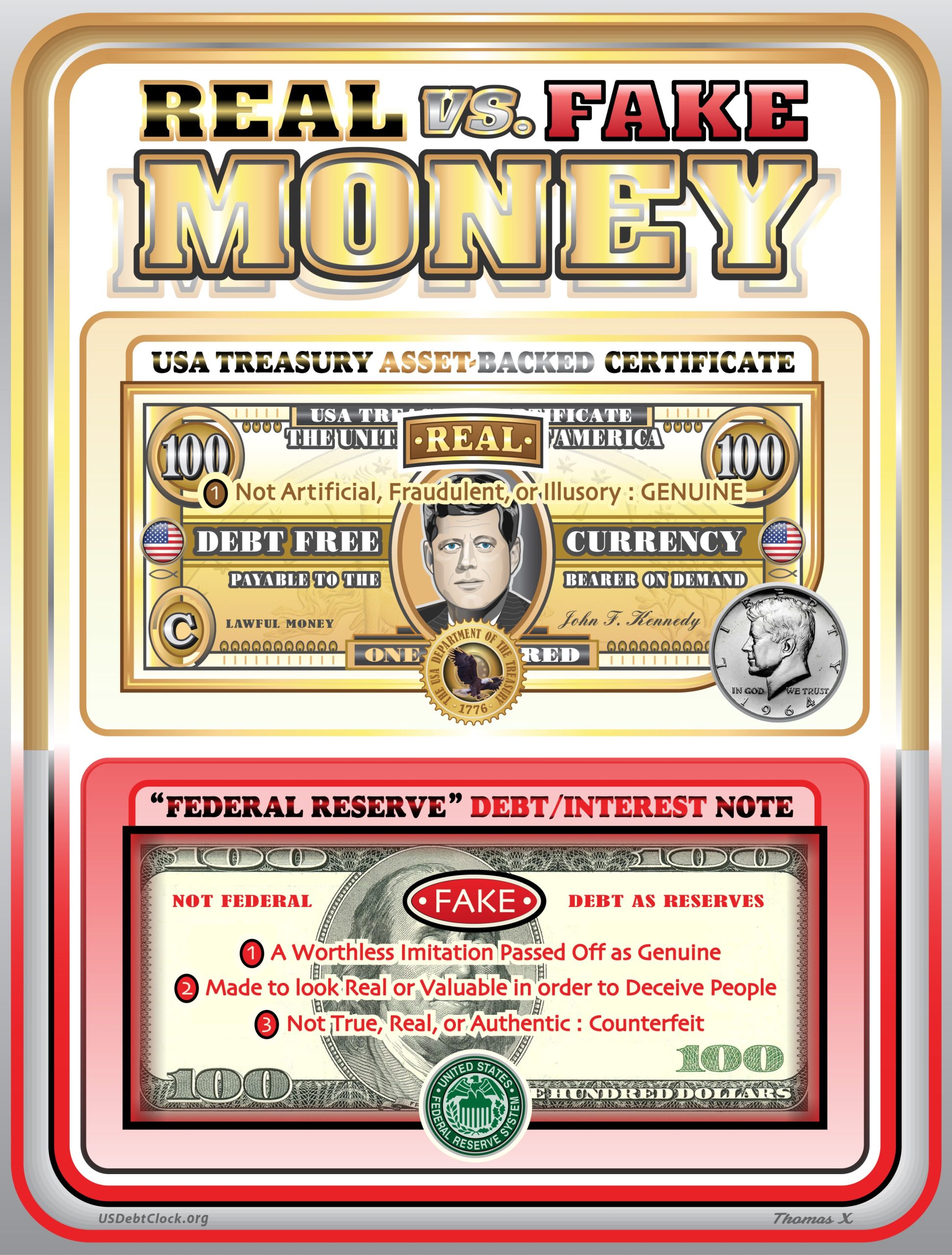

That’s why the need for real asset-backed dollars—money backed by gold, silver, or other tangible commodities—has never been more urgent.

The Threat of Programmable Money

CBDCs, while pitched as efficient and inclusive, can be programmable, meaning governments can dictate how, when, and where you spend your money. Want to buy a plane ticket during a carbon quota? Want to donate to a politically controversial cause? With a programmable CBDC, your spending could be blocked, limited, or tracked in real time.

This goes far beyond convenience and enters the territory of social control. Even today, traditional banks are beginning to ask invasive questions, delay transactions, and restrict cash withdrawals. Imagine what will happen when physical cash is phased out entirely.

Cryptocurrencies Aren’t the Only Answer

While cryptocurrencies have emerged as a response to centralization, their volatility and lack of intrinsic value make them a speculative store of value at best. They are also under increasing regulatory scrutiny and may eventually be folded into centralized systems through compliant exchanges and CBDC integration.

This is why a return to real, asset-backed money—especially gold-backed dollars—is critical. It’s not about nostalgia for the gold standard; it’s about regaining monetary sovereignty and anchoring currency in real-world value.

The Case for Gold-Backed Currency

Gold has been a store of value for thousands of years. It cannot be printed, inflated, or manipulated with the click of a mouse. A gold-backed dollar would limit the ability of central banks to debase the currency through excessive money printing, and it would offer a trustworthy hedge against inflation and economic instability.

Moreover, it would create accountability and discipline in monetary policy—something sorely lacking in today’s world of quantitative easing, negative interest rates, and bailouts.

A Hedge Against Overreach

Governments claim CBDCs will fight crime, improve transparency, and offer greater convenience. But those features come at a cost: surveillance, control, and reduced personal freedom. Asset-backed money—held outside the traditional banking system—can provide an off-ramp from tyranny, empowering individuals to transact freely without third-party interference.

The recent bank incident in England is a warning signal. If people can’t withdraw their own money without justification today, what happens when that money exists only in a centralized digital ledger tomorrow?

At Invest Offshore, we believe in the power of real assets to secure your future. Whether it’s precious metals, offshore banking, or alternative investments, diversifying away from fiat and CBDC systems is not only smart—it may soon be essential.

Opportunities are emerging in West Africa’s Copperbelt Region, where real resources back real value. Now is the time to shift from control-based currency to freedom-backed finance.

Leave a Reply