Rockstars may protect their assets in the Netherlands for several reasons, including favorable tax laws, a stable political and economic environment, and a robust legal system that offers strong protection of intellectual property rights.

The Netherlands has a favorable tax regime for businesses and individuals, including a competitive corporate tax rate, no withholding tax on royalties, and a tax treaty network that provides for favorable treatment of income derived from international transactions. This makes it an attractive location for musicians and other artists who earn income from their intellectual property.

Additionally, the Netherlands has a stable political and economic environment, with a highly skilled workforce, modern infrastructure, and a pro-business government. This provides a secure and reliable base for artists to manage their assets.

Finally, the Netherlands has a strong legal system that offers robust protection of intellectual property rights, including trademarks, copyrights, and patents. This can be important for artists who want to protect their creative works and prevent others from profiting from their ideas without their permission.

All of these factors make the Netherlands an attractive location for rockstars to protect their assets and manage their financial affairs.

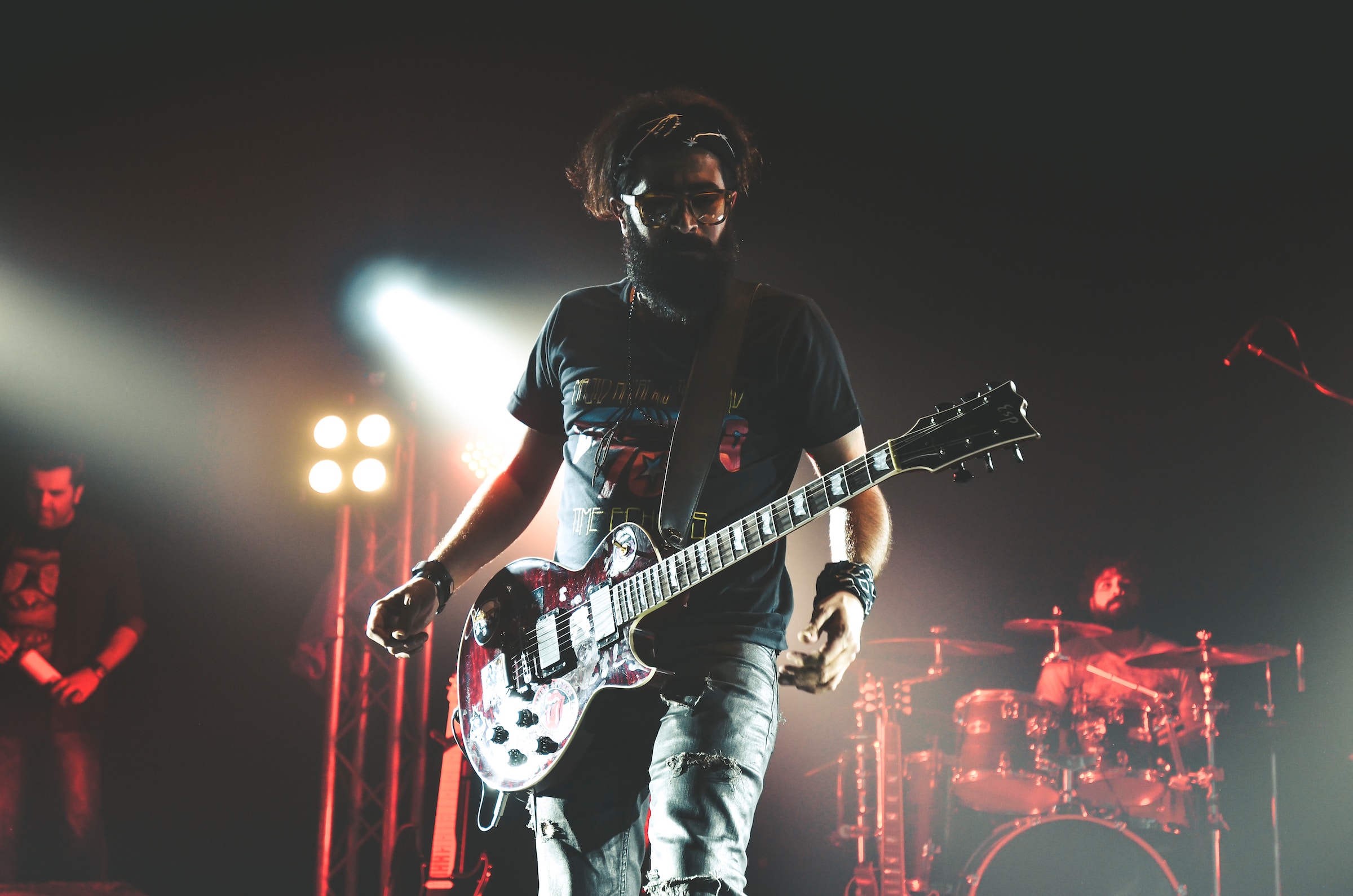

Rockstars Protect Assets in the Netherlands

It is difficult to provide an exhaustive list of all the rockstars who protect their assets in the Netherlands, as this information is often kept private. However, there are several well-known musicians who have established companies or other entities in the Netherlands to manage their financial affairs and protect their assets.

For example, according to reports, musicians such as The Rolling Stones, U2, Guns N’ Roses, Metallica, and the Red Hot Chili Peppers have all established companies in the Netherlands to manage their finances and protect their assets. Additionally, many other artists, including DJs and electronic music producers, have established companies in the Netherlands to take advantage of its favorable tax regime and other benefits.

It is worth noting that protecting assets in the Netherlands does not necessarily imply any wrongdoing or tax evasion. Many artists and companies establish entities in the Netherlands for legitimate business reasons, such as to take advantage of its favorable tax laws, stable political environment, and strong legal system.

Netherlands is more expensive for Asset Protection structures

Establishing asset protection structures in the Netherlands may be more expensive than in some other jurisdictions, but it can also offer certain advantages that make it a worthwhile investment for some individuals and businesses.

For example, setting up a Dutch BV (Besloten Vennootschap), which is a type of limited liability company, can require a relatively high initial investment in terms of time and money. However, once the company is established, it can provide a range of benefits, including limited liability for shareholders, a flexible corporate structure, and access to favorable tax laws and treaties.

Additionally, the Netherlands is known for its strong legal system and robust protection of intellectual property rights, which can help to safeguard assets and prevent unauthorized use or exploitation of intellectual property.

While establishing asset protection structures in the Netherlands may involve higher initial costs, it is important to consider the potential long-term benefits and protections that these structures can provide. Ultimately, the decision to establish an asset protection structure in the Netherlands or elsewhere should be based on individual circumstances, including the nature and size of the assets involved, as well as the specific needs and goals of the individual or business in question.

Rockstars protect assets offshore

Music can be considered as an asset and can potentially be protected offshore using various asset protection structures, depending on individual circumstances and goals.

One common approach to protecting music assets offshore is to establish a company or trust in a jurisdiction with favorable tax laws and strong legal protections for intellectual property. This can provide a range of benefits, including tax advantages, asset protection, and enhanced privacy.

For example, a musician or music label could establish an offshore company in a jurisdiction such as the Cayman Islands, Bermuda, or the British Virgin Islands, which are known for their favorable tax laws and strong legal systems. The company could then own the rights to the music and license it to others for use, while the profits are earned offshore and subject to the tax laws of the chosen jurisdiction.

Another approach to protecting music assets offshore is to establish a trust, which can be used to hold and manage the rights to the music. A trust can offer a high level of asset protection, as the assets held within the trust are legally separate from the individual or business that established it. This means that the assets are protected from creditors, legal judgments, and other risks that could impact the individual or business.

It is important to note that establishing offshore asset protection structures can be complex and require the advice of legal and financial professionals with expertise in this area. Additionally, it is crucial to ensure that all applicable laws and regulations are followed to avoid any potential legal or tax issues.

Approximate Asset Value of music protected in the Netherlands

It is difficult to provide an approximate asset value of music protected in the Netherlands, as this information is often kept private and not publicly disclosed. The value of music assets can vary widely depending on factors such as the popularity of the music, the number of albums sold or streamed, and the number of licensing agreements in place.

That being said, the Netherlands is known to be an attractive location for musicians and other artists to protect their assets, particularly due to its favorable tax laws and strong legal protections for intellectual property. Many well-known musicians and music companies have established entities in the Netherlands to manage their finances and protect their assets.

It is important to note that the value of music assets and the amount of protection needed can vary widely depending on individual circumstances, and the decision to protect assets in the Netherlands or elsewhere should be based on a careful analysis of these factors. Ultimately, the value of music assets and the level of protection needed will depend on a range of factors, including the popularity of the music, the number of licensing agreements in place, and the individual or company’s goals and objectives.

How much are Rock songs worth

The value of rock songs can vary widely depending on a range of factors, including the popularity of the artist, the success of the song, and the number of licensing agreements in place. It is also important to note that the value of a song is often not publicly disclosed and can be difficult to estimate accurately.

That being said, there have been some notable examples of rock songs and their estimated values. For example:

- In 2021, Bob Dylan sold the rights to his entire catalog of songs to Universal Music Publishing Group for an estimated $300 million.

- In 2019, Hipgnosis Songs Fund, a company that invests in music copyrights, acquired the rights to a catalog of songs by Lindsey Buckingham, including several hit songs from Fleetwood Mac, for an estimated $100 million.

- In 2018, Sony/ATV Music Publishing acquired the rights to a catalog of songs by Fleetwood Mac co-founder Lindsey Buckingham, including hits such as “Go Your Own Way” and “Tusk,” for an estimated $30 million.

- In 2016, Michael Jackson’s estate sold the rights to his share of the Beatles’ catalog to Sony/ATV Music Publishing for an estimated $750 million.

It is worth noting that the value of a song can fluctuate over time and can be influenced by a range of factors, including changes in the music industry, shifts in consumer preferences, and legal disputes. Additionally, the value of a song can be difficult to estimate accurately, as it often depends on subjective factors such as artistic merit and cultural relevance.

Photos by Sam Moghadam Khamseh on Unsplash and Николай Начев from Pixabay and by Jose Antonio Gallego Vázquez on Unsplash and Mike B from Pexels

Leave a Reply