The financial markets are a complex web of transactions, investments, and speculation, where the interplay of various factors determines asset prices. Within this intricate landscape, the silver market holds a unique position due to its dual role as both an industrial commodity and a financial investment. However, it has been the subject of intense scrutiny and speculation over the years, particularly regarding allegations of price manipulation.

This blog post delves into the evidence surrounding claims that large financial institutions, notably JPMorgan Chase, have engaged in practices to suppress the price of silver, and explores the potential consequences of such actions on investors and the market as a whole.

The Theory of Manipulation

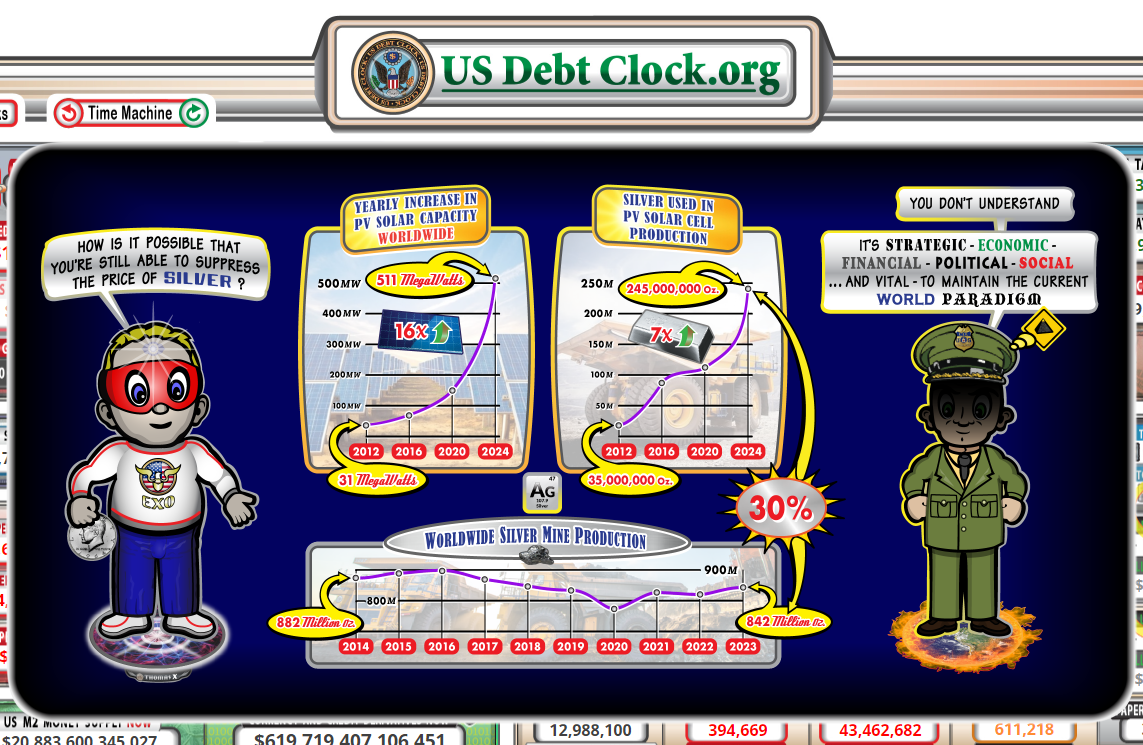

At the heart of the manipulation debate is the assertion that certain major banks maintain significant short positions in the silver market, effectively suppressing its price. Proponents of this theory argue that through various trading strategies, including the aggressive use of derivatives and futures contracts, these institutions can exert undue influence on silver prices, keeping them artificially low. This claim has sparked considerable discussion, with some pointing to specific trading patterns and regulatory settlements as indirect evidence of such practices.

Consequences for Investors

The implications of potential price manipulation in the silver market are far-reaching, affecting not just the metal’s price but also the broader financial landscape. Here are some key impacts:

- Erosion of Investor Confidence: Persistent allegations of manipulation can undermine trust in the fairness and transparency of financial markets. This erosion of confidence can lead to decreased market participation, higher volatility, and diminished capital formation, as investors may be hesitant to engage in a market perceived as unfair.

- Impact on Investment Portfolios: For investors holding silver or related financial products, manipulation can lead to direct financial losses. The artificial suppression of silver prices can distort the true market value of these investments, potentially resulting in significant underperformance compared to other assets.

- Regulatory Oversight and Transparency: Allegations of silver market manipulation often lead to regulatory investigations and legal actions against implicated entities. These proceedings can shed light on market practices, leading to reforms and increased transparency. However, they also contribute to market uncertainty and can have a chilling effect on investment until resolved.

Navigating the Turbulent Waters

For investors and market observers, the key to navigating the complexities of the silver market lies in vigilance and a commitment to understanding the underlying dynamics at play. While direct evidence of manipulation can be challenging to uncover, being aware of the market’s susceptibility to such practices is crucial.

Investors should diversify their portfolios to mitigate the risks associated with any single commodity or asset class. Additionally, staying informed about regulatory developments and market analyses can provide valuable insights into potential market distortions.

The Road Ahead

The debate over silver market manipulation underscores the need for robust regulatory frameworks and transparent market practices. While allegations of manipulation remain a contentious issue, the focus should ultimately be on ensuring that the markets operate in a fair and efficient manner, protecting the interests of all participants.

As the silver market continues to evolve, it will be essential for regulators, investors, and market participants to work together to foster a transparent, equitable trading environment. Only through collective efforts to address concerns and implement reforms can the integrity of the silver market—and, by extension, the broader financial system—be maintained.

Leave a Reply