Understanding the Implications of a Maxed Out Debt Clock

The U.S. National Debt has reached an alarming milestone: $33 trillion. This astronomical figure, unparalleled in U.S. history, comes at a time when concerns about the nation’s fiscal health are more pronounced than ever. Alongside this, the U.S. Debt Clock, a symbolic representation of the country’s financial standing, indicates that the money supply is running out. Here’s what this means and why it’s crucial.

Historical Context of the Debt

The U.S. National Debt has been growing steadily since the nation’s inception, primarily due to wars, economic recessions, and major policy decisions. However, the recent acceleration in debt accumulation can be attributed to several factors:

The 2008 Financial Crisis: Stimulus packages and bailouts increased government expenditures.

Entitlement Programs: The growth of Social Security, Medicare, and other welfare programs.

Recent Pandemics: Emergency spending and relief packages, such as the CARES Act, further ballooned the debt.

Tax Cuts: Reduced government revenue has limited the ability to pay down the debt.

Other Factors: Trade imbalances, defense spending, and structural budget deficits.

The U.S. Debt Clock and the Money Supply

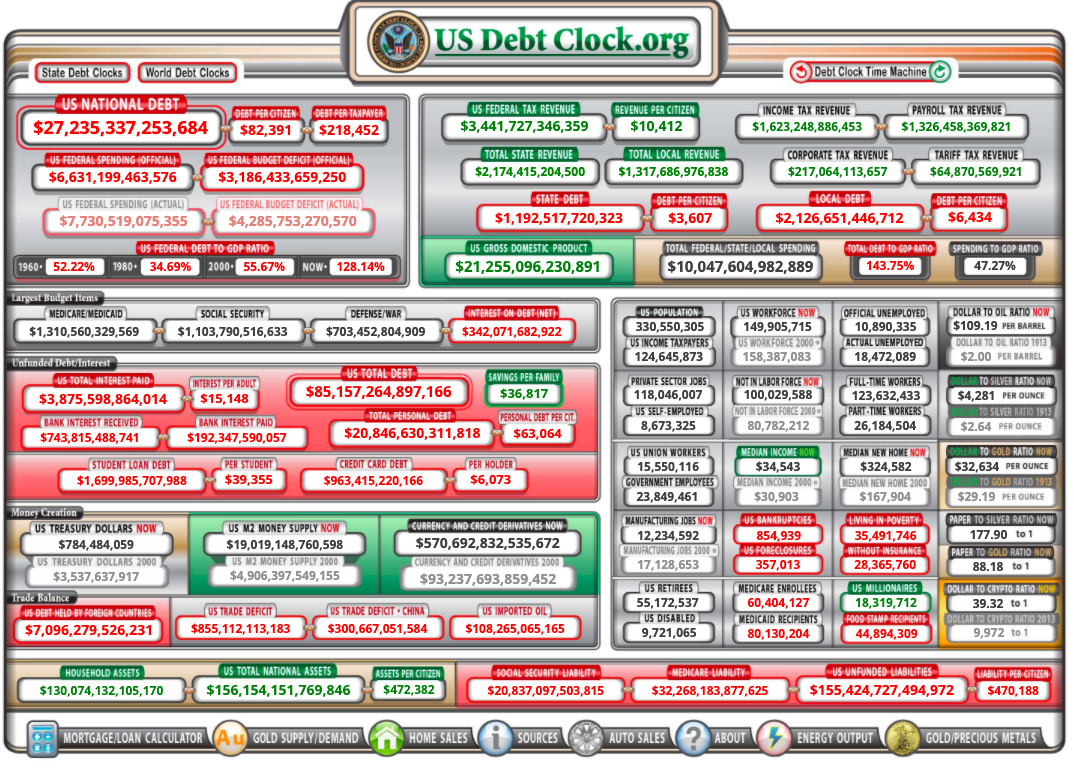

The U.S. Debt Clock, situated in Manhattan, New York, showcases real-time data on various economic metrics, including the national debt. Another vital metric it displays is the money supply, which refers to the total amount of monetary assets available in an economy at any specific time.

The Debt Clock indicating that the money supply is “running out” is symbolic. In reality, central banks can print money, meaning the supply won’t technically “run out.” However, the indication suggests two intertwined concerns:

Excessive Money Printing: Central banks, like the Federal Reserve, have increased the money supply to stimulate the economy, particularly during recessions. But too much money printing can devalue a currency and lead to inflation.

Lack of Fiscal Space: If the debt continues to grow at its current rate, the U.S. might find itself with less flexibility to manage future economic crises. High levels of debt can crowd out other types of essential government spending and can eventually lead to higher interest rates.

Implications for the Future

Economic Vulnerability: High national debt levels can make a country more susceptible to external economic shocks. If investors begin to question the U.S.’s ability to service its debt, it could lead to higher borrowing costs.

Generational Impact: Future generations might be burdened with higher taxes or reduced government services as the nation grapples with its debt.

Inflation Concerns: As mentioned, excessive money printing can devalue a currency and lead to inflation, which erodes purchasing power for everyday citizens.

Moving Forward

Addressing the U.S. national debt requires a multi-pronged approach. Potential solutions include:

- Reassessing Fiscal Policy: This involves making hard choices about government spending and revenue. Potential options include reforming entitlement programs, revisiting tax policies, and cutting unnecessary expenses.

- Promoting Economic Growth: A thriving economy can increase government revenue without raising taxes. This involves creating an environment conducive to business growth and innovation.

- Bipartisan Cooperation: Addressing the debt crisis will require both major political parties to find common ground and prioritize the nation’s long-term fiscal health over short-term political gains.

In conclusion, while the U.S. National Debt reaching $33 trillion is a concerning milestone, understanding its implications and working towards sustainable solutions is the way forward. It’s a call for collective action, both from policymakers and the public, to ensure the nation’s fiscal sustainability.

U.S. National Debt Clock

Leave a Reply