The United States is poised for a significant shift in its financial system with the transition to U.S. Treasury Certificates, a move that signals a deeper commitment to asset-backed monetary structures. This transition is underpinned not just by the famed gold reserves held at Fort Knox but also by an expansive amount of identified in-ground gold reserves across the nation.

Fort Knox and Beyond: A Solid Gold Foundation

Fort Knox, Kentucky, is synonymous with U.S. gold reserves. As a symbol of wealth and security, the gold stored in this vault has long been the backbone of fiscal stability in the country. However, the story of U.S. gold reserves extends far beyond the walls of Fort Knox. Recent assessments reveal that the U.S. has approximately 3,000 tonnes of identified gold reserves still in the ground. This constitutes about 6% of the world’s total identified reserves, estimated at 53,000 tonnes. This substantial in-ground asset highlights the U.S.’s rich mineral wealth and adds another layer of economic resilience.

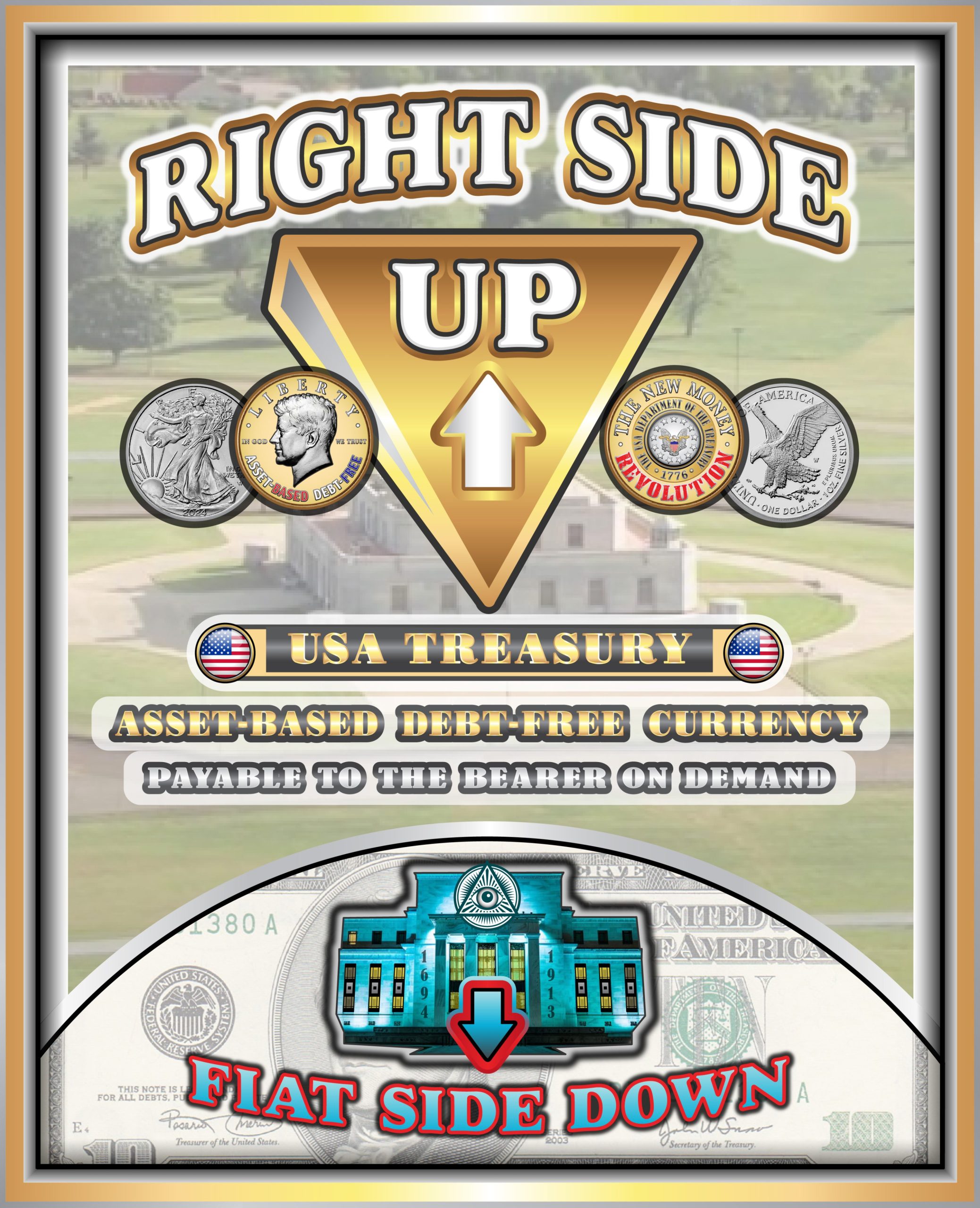

Transition to Treasury Certificates

The move towards Treasury Certificates involves converting these physical and potential gold assets into a currency backing unlike any seen in recent times. This transition reflects a growing trend among nations to stabilize their currencies through tangible assets. Treasury Certificates, supported by both the tangible gold in Fort Knox and the potential gold still to be mined, are expected to offer a more stable and secure form of currency. This asset-backed approach aims to instill greater confidence in the U.S. dollar, potentially curbing inflation and stabilizing the economy in times of financial uncertainty.

Economic Implications

The economic implications of this transition are profound. By backing the currency with substantial gold reserves, the U.S. is setting a standard for value that is less susceptible to the fluctuations of the international financial markets. This stability is likely to attract investors looking for a safe haven in times of economic turbulence. Moreover, the emphasis on real assets could lead to a reevaluation of gold mining practices, possibly spurring advancements in mining technology and sustainability practices as the demand for thorough and efficient extraction increases.

Impact on Global Financial Systems

The introduction of U.S. Treasury Certificates will likely resonate beyond American borders, affecting global financial systems. As the dollar gains a new level of security and trust, other nations might consider similar moves, especially those with significant natural reserves that can back their currencies. This shift could usher in a new era of asset-backed currencies worldwide, encouraging a more intrinsic approach to value rather than the predominantly speculative methods seen today.

Conclusion

The transition to U.S. Treasury Certificates marks a pivotal moment in financial history, where tangible assets like gold are once again becoming central to economic strategy and currency value. This move not only reinforces the U.S.’s financial system but also sets a precedent for how countries might leverage natural resources to bolster economic stability. As we observe this transition, the role of gold, both stored and untapped, will undoubtedly become a focal point in discussions about the future of national and global economies.

Leave a Reply