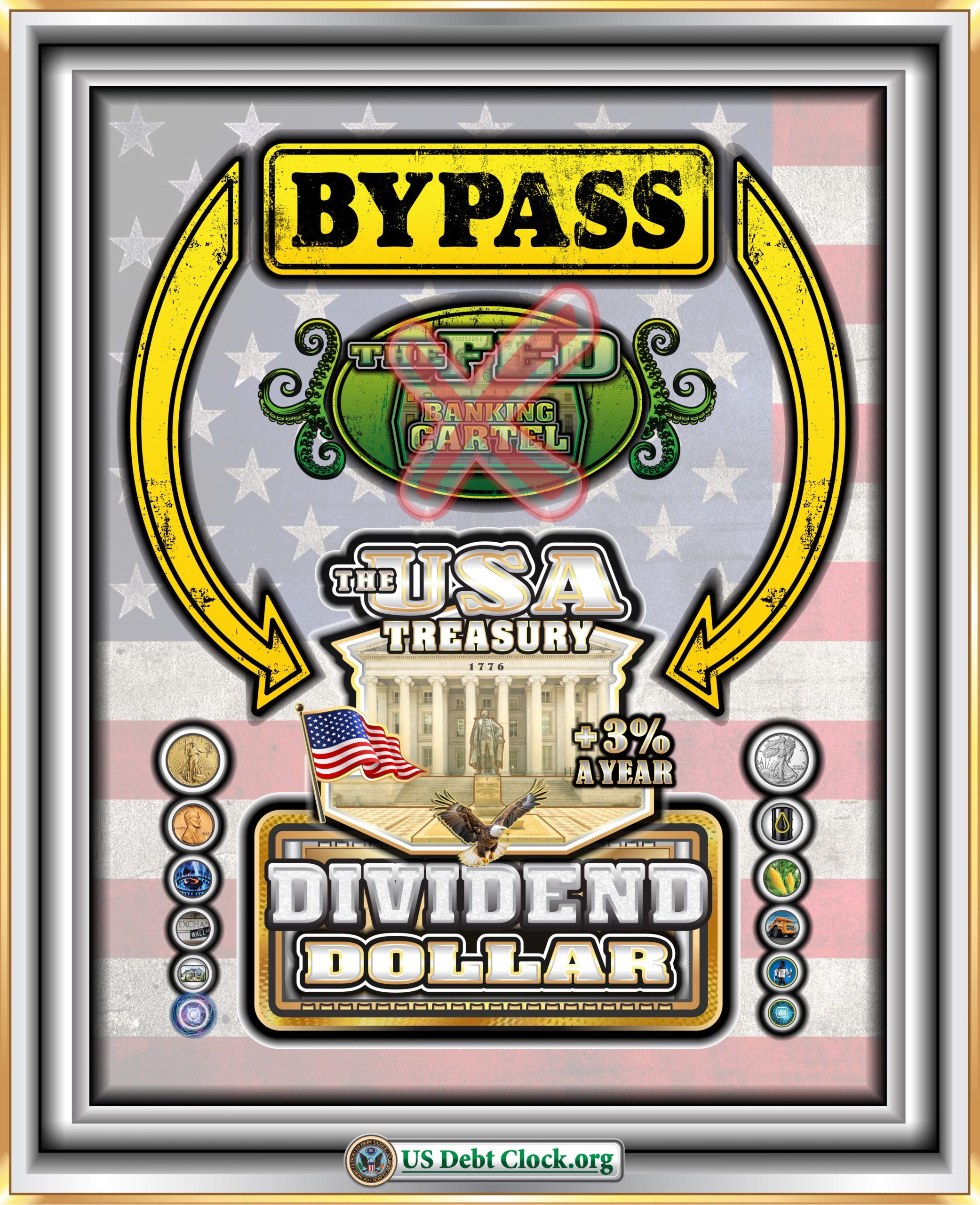

In our previous discussion about the transition from Federal Reserve Notes (FERN) to Treasury Certificates, we highlighted the quiet monetary transformation taking place in the United States, illustrated by the images from @USDebtClock_org. Now, let’s dig deeper into how these changes could reshape the financial system, bypass the Federal Reserve, and introduce a new economic model centered on the concept of “Dividend Dollars.”

Treasury Certificates: The End of Central Bank Dominance?

The introduction of Treasury Certificates represents a seismic shift in how money could be issued and circulated in the U.S. economy. Traditionally, the Federal Reserve has been the gatekeeper of the nation’s money supply. It issues Federal Reserve Notes and controls money circulation through mechanisms such as interest rates, quantitative easing, and lending policies. However, Treasury Certificates are different. They are issued directly by the U.S. Treasury and are not tied to the Federal Reserve’s monetary policies.

Bypassing the Federal Reserve: How It Works

If the U.S. government decides to transition to Treasury Certificates, it effectively sidesteps the Federal Reserve. Instead of money being created through loans and interest-bearing mechanisms, Treasury Certificates would allow the government to “spend” money into existence. This new money wouldn’t be lent into circulation but spent directly on public projects, infrastructure, social programs, or other government initiatives.

The implications of this bypass are profound:

- Interest-Free Currency Issuance: One of the biggest criticisms of the current financial system is that it creates money as debt. Every dollar in circulation is backed by a loan, which accrues interest, contributing to the exponential growth of national debt. By issuing Treasury Certificates, the government could eliminate the need for interest-bearing currency, freeing up resources that are currently spent on debt servicing.

- Direct Government Spending: Money created under this system would flow into the economy through direct spending rather than being channeled through financial institutions. This could lead to more targeted and efficient economic stimulation, as the government could allocate resources to areas that need them most, such as infrastructure, healthcare, or renewable energy.

- Reduced Power of Central Banks: By bypassing the Federal Reserve, the U.S. Treasury would reclaim a significant portion of monetary control. This could fundamentally alter the power dynamics of global finance and shift economic influence from central banks to governments.

Introducing the Dividend Dollar

A key component of this new system would be the introduction of the “Dividend Dollar.” Unlike traditional currency, the Dividend Dollar is designed to appreciate in value, increasing by 3% per year. This appreciation mechanism addresses one of the primary concerns of savers and investors: inflation. In today’s economy, money loses value over time as inflation erodes purchasing power. The Dividend Dollar flips this concept on its head.

How the Dividend Dollar Works

- Built-In Appreciation: The Dividend Dollar would be programmed to increase in value at a fixed rate of +3% per year. This would make it an attractive store of value for both individuals and institutions, incentivizing saving and long-term investment. With a guaranteed appreciation rate, it would offer a more stable and predictable financial future for Americans and international investors alike.

- Incentives for Wealth Preservation: As the Dividend Dollar grows in value, it encourages financial prudence and long-term planning. People would be less inclined to spend recklessly, as holding onto Dividend Dollars would yield a consistent return. This could foster a culture of savings and help build generational wealth.

- Government Spending, Not Lending: In the current system, money enters the economy primarily through loans from commercial banks. This creates a cycle of debt that often fuels economic bubbles. Under the Dividend Dollar system, money would be spent into circulation directly by the government. This could reduce economic volatility and make fiscal policy more impactful in stimulating sustainable economic growth.

The Economic Implications of the Dividend Dollar

- Controlled Inflation: With a fixed annual appreciation of 3%, the Dividend Dollar could help stabilize inflation rates. Since the money supply would be managed more directly by the Treasury, the government could exert greater control over economic conditions. This could lead to a more predictable and stable financial environment, benefiting both domestic and international markets.

- Wealth Redistribution and Infrastructure Investment: By spending money into circulation, the government could allocate resources to crucial projects. This would not only boost economic productivity but also create jobs and stimulate growth. Offshore investors would have opportunities to capitalize on these developments, especially in sectors like real estate, renewable energy, and technology.

- Impact on Global Markets: A strong and appreciating U.S. currency could lead to shifts in global trade and investment patterns. Emerging markets that rely heavily on U.S. dollars may need to adapt, while countries that have significant dollar reserves could see changes in their economic strategies. Offshore investors would need to stay vigilant and diversified to navigate these potential shifts.

Preparing for the New Money Revolution

The transition from Federal Reserve Notes to Treasury Certificates, coupled with the introduction of Dividend Dollars, could redefine the global financial landscape. While it’s too early to say how quickly or smoothly this transition will occur, the signs are becoming increasingly clear. The U.S. government appears to be laying the groundwork for a new monetary era, one that prioritizes sustainability, economic stability, and long-term wealth preservation.

For offshore investors, understanding these changes and adapting investment strategies accordingly is crucial. Diversifying assets, investing in hard currencies, and exploring new opportunities—such as those available in West Africa’s Copperbelt Region—could prove invaluable in navigating this evolving financial landscape.

Stay tuned to Invest Offshore as we continue to track these developments and provide insights into how the new money revolution will impact global markets and investment opportunities.

Leave a Reply