Tag: Treasury Department

-

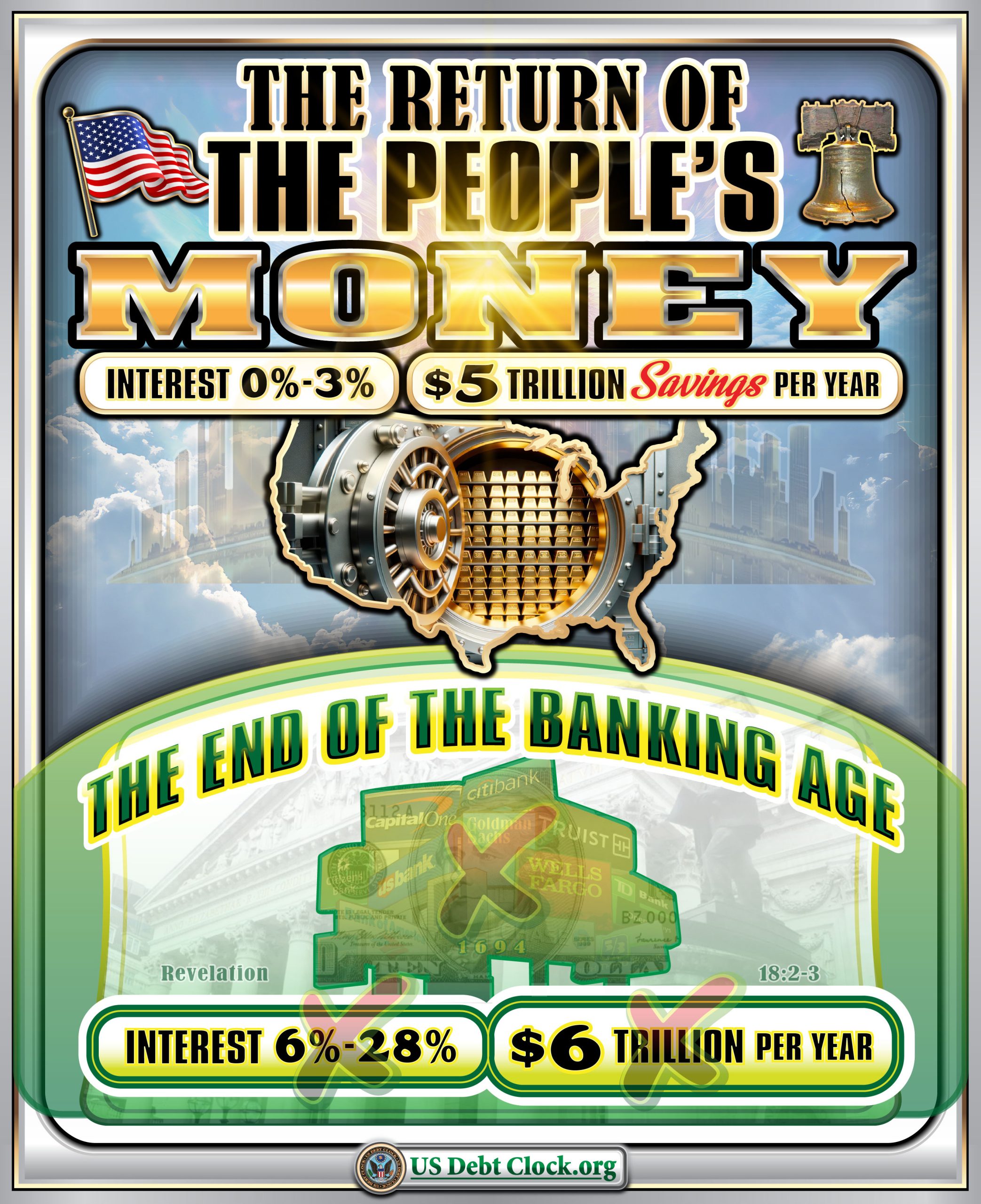

The Return of the People’s Money and End of the Banking Age

The tide has turned. The Age of the Bankers is closing its last ledger, and the Age of the Treasury—the people’s money—is roaring in like a storm with Donald J. Trump at the helm. On January 30, 2026, Trump made the kind of move that sends shivers down K Street’s spine and rattles the foundations…

-

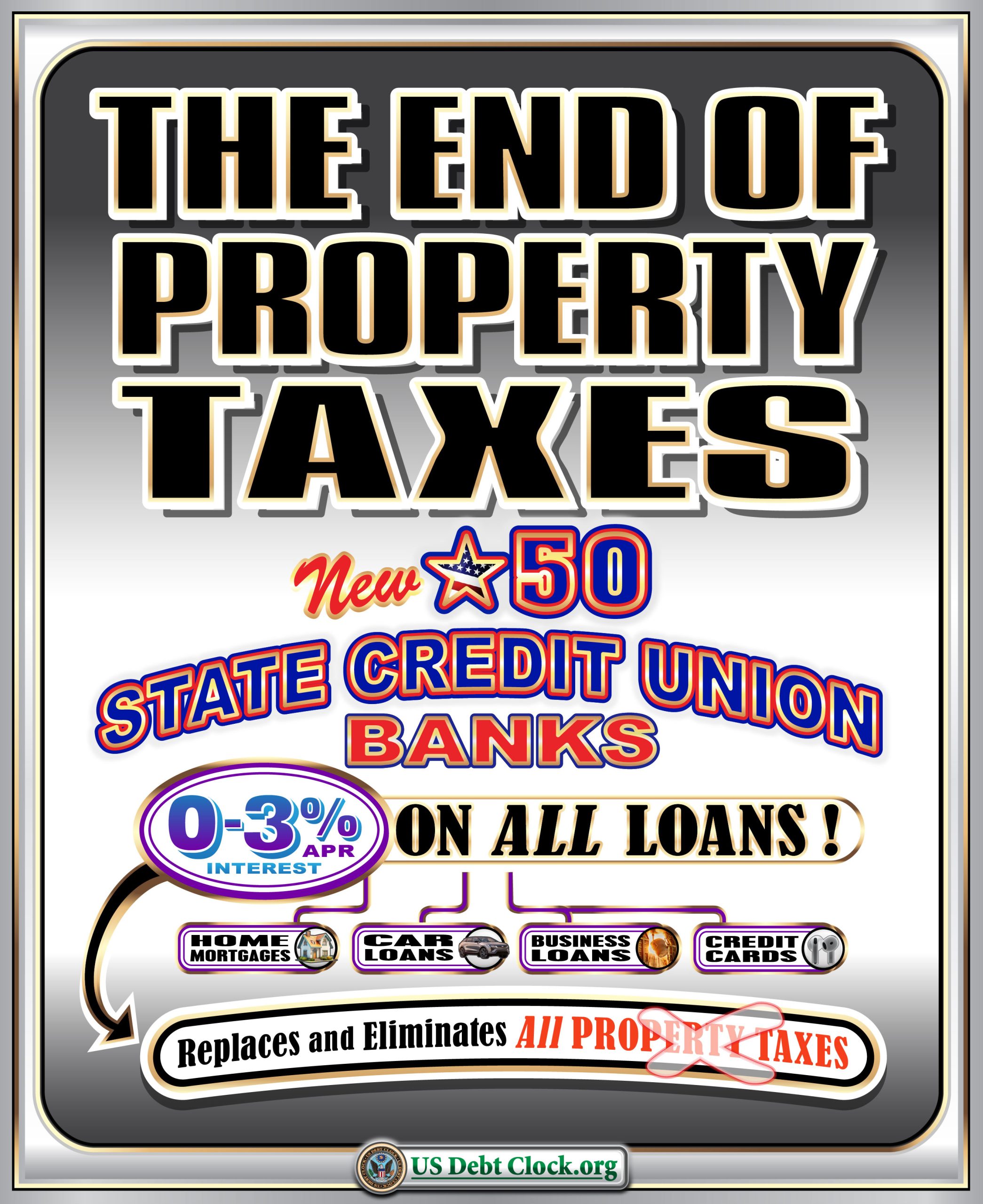

Peace, Prosperity, and Radical Reform: Signals of a Potential Golden Era

📊 Invest Offshore News Brief — January 2026 US Debt Clock Sparks Talk of Radical Economic Reform A controversial posting circulating on USDebtClock.org and shared widely on social platforms has ignited heated debate about what some are calling “The End of Property Tax” in the United States and a proposed overhaul of the financial system.…

-

The Global Cash Pallet Redemption Permit Holder: A Little-Known Gatekeeper to Institutional Liquidity

In the shadows of global finance exists a role so specialized that most market participants have never heard of it—yet sovereigns, central banks, and Tier-1 institutions know it well. This role is known as the Global Cash Pallet Redemption Permit Holder, acting as an Authorized Representative to Institutional Buyers. It is not retail finance. It…

-

The Great Silver Breakout

For more than a century, silver has been quietly telling a story that few have bothered to calculate properly. Not the paper price quoted on COMEX screens, not the derivative-laden futures market, but the real ratio between money creation and physical metal. When you run the math honestly, the result is startling—and it explains why…

-

The Old Money System Just Hit Its Breaking Point — And a New One Is Rising

On December 1, 2025, the financial world quietly crossed a line it can never uncross. No press conference. No presidential address. No Wall Street victory lap. But in one silent moment, the old global monetary regime reached its terminal stage. The Federal Reserve froze its balance sheet at $6.57 trillion—ending Quantitative Tightening forever—and exposed the…

-

USD Pallet Services: The Gekko Playbook for High-Volume Cash Logistics in a Post-Euro World

You think you’ve seen liquidity? Kid, you haven’t even scratched the surface. We’re entering the most explosive monetary realignment in history—and it’s not happening in a boardroom. It’s happening in bunkers, vaults, and coded storage units filled with USD Pallets. Quiet. Off-ledger. Waiting. And now… they’re coming online. Let me walk you through the real…

-

A Great Awakening: The Treasury, The Fed, and the Ghosts of Satoshi

It is summer in America, but the winds are cold in Washington. The smell of fear is sharp in the corridors of money, and the echoes of old gunpowder hang over the Potomac like a veteran’s breath. The battle is joined now—not with sabers but statutes, not with musket balls but Bitcoin wallets long silent,…

-

Stablecoins and U.S. T-Bills: The Treasury Eyes a New Era of Digital Demand

In a quietly momentous shift, the U.S. Treasury Borrowing Advisory Committee (TBAC) has formally acknowledged the disruptive and potentially beneficial role of stablecoins in the broader financial ecosystem. Once viewed with skepticism, dollar-backed stablecoins are now being discussed as a “new payment mechanism” — and more importantly, as a significant and growing source of demand…