Tag: Private Placement Trading

-

Why DBS Bank Keeps Winning “World’s Best Bank” — And Why Pros Park Capital There

From 2018 through 2025, DBS Bank has amassed a trophy case that few institutions can match. The Singapore-headquartered lender didn’t just ride Asia’s growth cycle; it set the pace in digital banking, wealth management, and risk discipline—earning repeated “World’s Best Bank” accolades from top-tier finance publications. The accolades that matter (2018–2025) Why this list is…

-

The Moment of Monetary Reckoning Has Arrived

There are times in financial history when the currents shift so violently that only the sharpest players even realize they’re moving. Welcome to Q4 of 2025—the most extraordinary moment in the history of money. We’re talking about a sea of capital in motion. Not theoretical. Not digital vaporware. Real money. Pallets of physical U.S. dollars.…

-

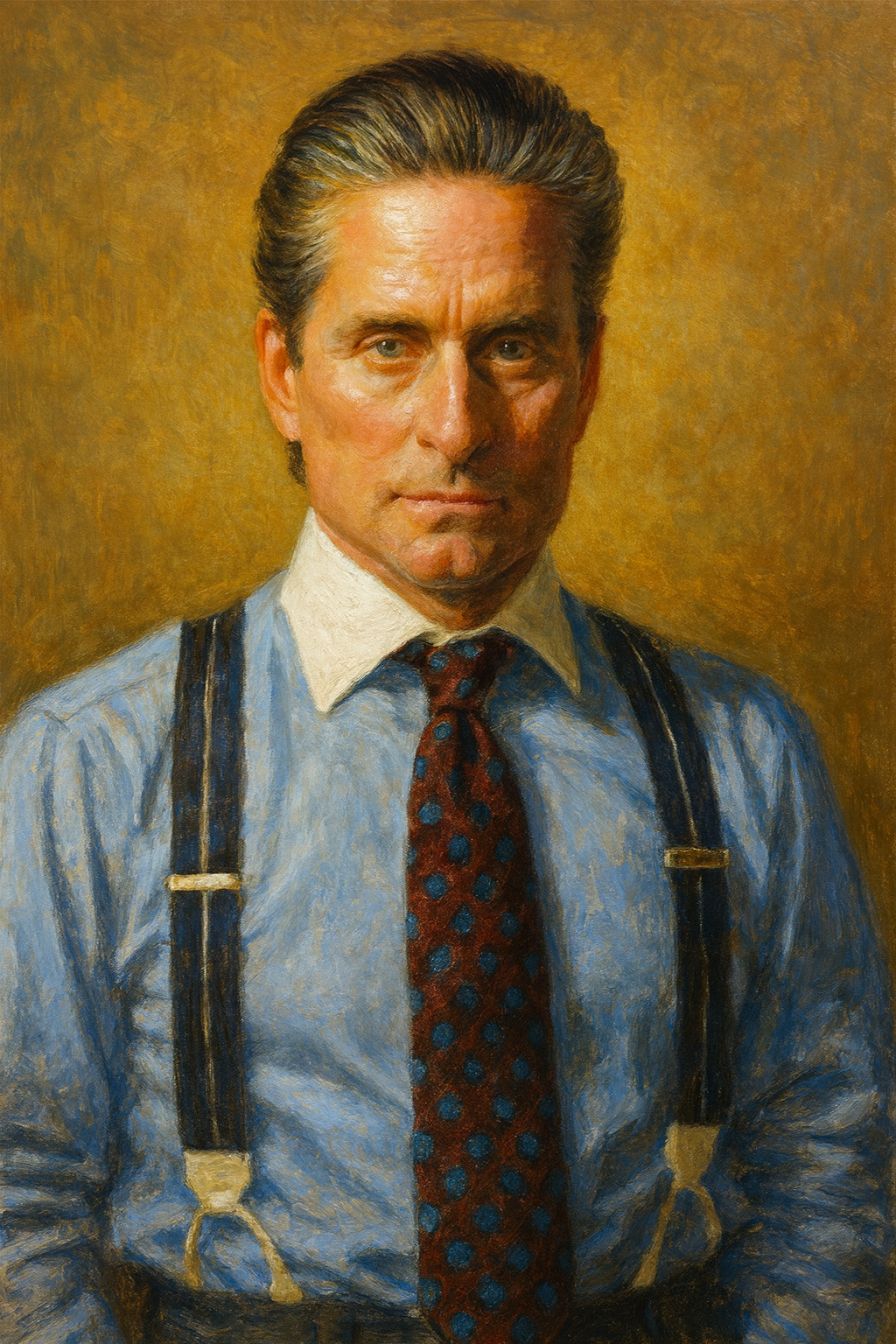

USD Pallet Services: The Gekko Playbook for High-Volume Cash Logistics in a Post-Euro World

You think you’ve seen liquidity? Kid, you haven’t even scratched the surface. We’re entering the most explosive monetary realignment in history—and it’s not happening in a boardroom. It’s happening in bunkers, vaults, and coded storage units filled with USD Pallets. Quiet. Off-ledger. Waiting. And now… they’re coming online. Let me walk you through the real…

-

The BIS’s Role in Controlling and Monitoring Private Placement Trading

The Bank for International Settlements (BIS), established in 1930, is the world’s oldest international financial institution and serves as the central bank for central banks (Private placement). Over the decades, the BIS has become a pivotal regulatory and cooperative hub, guiding global monetary policy and banking standards. One niche but powerful arena under its purview…

-

Review of Goldman Sachs Asset Management Case Study: Focus on Private Placement Trading and Team Overview

Goldman Sachs Asset Management (GSAM) has effectively outlined its innovative approach to trading and portfolio management in a new report, emphasizing the transition towards electronic trading platforms and the strategic use of data analytics. The document provides a clear overview of how GSAM leverages technology to enhance trading execution, reduce costs, and develop more personalized…