Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

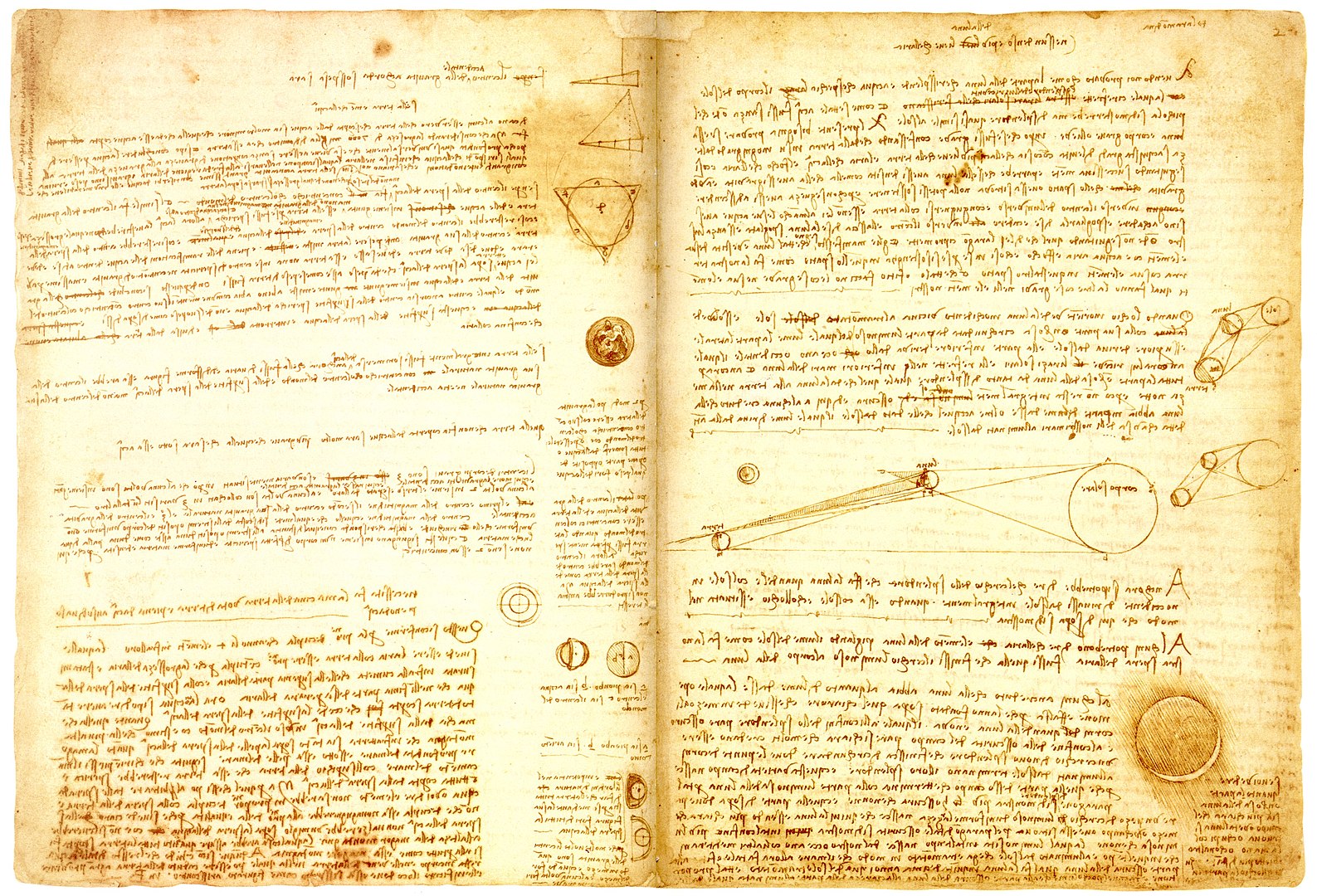

The Timeless Treasure of Collectible Letters and Documents: A Journey Across Borders

The allure of collectible letters and documents lies in their ability to connect us with the past. From handwritten notes by historical figures to rare manuscripts, these pieces of history offer more than just a glimpse into bygone eras; they represent a tangible investment opportunity. This blog post delves into the world of collectible letters…

-

Disrupting Fractional Reserve Banking with Distributed Ledger Technology (DLT)

The financial world is on the brink of a revolution. Distributed Ledger Technology (DLT), the backbone of cryptocurrencies like Bitcoin, is poised to disrupt traditional banking systems, especially the practice of fractional reserve banking. This blog post explores how DLT could reshape our understanding and interaction with financial systems, focusing on its impact on fractional…

-

Safeguarding Offshore Investments

Navigating Counterparty Risks Amidst Commercial Bankers’ Balance Sheet Reductions in the New Interest Rate Landscape Offshore investors are navigating uncharted waters as commercial bankers worldwide face the imperative to ruthlessly reduce their balance sheets in response to the evolving interest rate environment. This shift not only places international banks at a heightened risk of failure…

-

Year-End Investment Review and 2024 Outlook

Reflections on 2023 and Anticipations for the New Year As 2023 draws to a close, investors worldwide are taking a moment to reflect on the year’s events and prepare for what 2024 might bring. This year has been marked by significant volatility, driven by global economic uncertainties, geopolitical tensions, and evolving market dynamics. Here at…

-

The American Edge in Offshore Business: A Guide for Non-U.S. Citizens on Why and Where to Incorporate in the U.S.

Why Non-U.S. Citizens Should Consider the United States for an Offshore Business The concept of offshore business formation is traditionally associated with exotic locations like the Cayman Islands or Bermuda. However, for non-U.S. citizens, the United States of America emerges as an unexpectedly ideal jurisdiction. This may seem counterintuitive given the U.S.’s complex tax laws…

-

The Inflection Point: Velocity of M1 Money in the Era of $33 Trillion U.S. Debt

In a significant financial milestone, the U.S. national debt recently surpassed the $33 trillion mark. This event coincides with a notable inflection point in the velocity of M1 money, an economic indicator that measures the rate at which money circulates through the economy. Understanding the relationship between these two factors, along with the role of…

-

7 Best Performing Asset Classes in Collectibles

A Treasure Trove for Investors Investing in collectibles has long been a fascination for many, blending the allure of owning a piece of history or art with the potential for significant financial return. In recent years, this niche market has seen a surge in interest, driven by unique trends and evolving collector preferences. Here at…

-

Exploring Land Trusts: How They Work, Types, and Real-World Examples

Land trusts are a valuable tool in the world of conservation, real estate, and community development. These organizations play a crucial role in protecting natural landscapes, preserving open spaces, and ensuring affordable housing. In this blog post, we’ll delve into a concept of asset protection, how it works, the different types, and provide some real-world…

Join 900+ subscribers

Stay in the loop with everything you need to know.