Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

Sovereign Mint Coins: Government-Backed Silver with Global Recognition

For investors seeking physical silver that combines trust, liquidity, and global acceptance, sovereign mint coins remain the gold standard of the silver market. Backed by national governments, these coins offer guaranteed purity, consistent specifications, and strong resale demand—qualities that matter even more as silver prices hover around $78–$80 per ounce and investor interest accelerates. Why…

-

OTC Big-Block Crypto Buyers: Inside the Compliance-First World of Cash-to-USDT Trades in the UAE

In today’s institutional crypto market, the largest transactions don’t happen on public exchanges. They happen quietly, over-the-counter (OTC), in tightly controlled environments where compliance matters as much as liquidity. One of the most common structures involves big-block crypto buyers exchanging large volumes of physical USD or EUR cash for freshly minted USDT (Tether)—often in the…

-

XDNA and the Rise of Self-Sovereign Biology: Why DNA-Backed Identity Is the Next Frontier

The world is rapidly moving beyond passwords, plastic cards, and centralized identity databases. The next phase of the digital economy will be built on verifiable, self-sovereign identity (SSI)—and increasingly, that identity will extend beyond documents and devices to the most fundamental layer of all: biology itself. This is where XDNA, developed by DNA Protocol, enters…

-

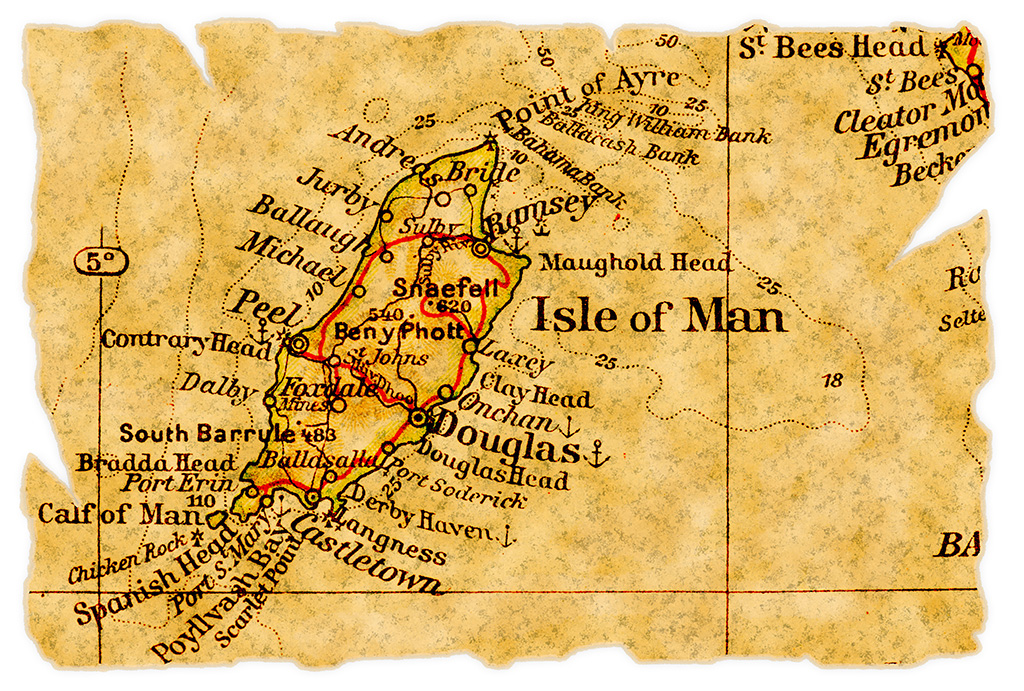

Isle of Man’s 3% Growth Ambition: £1B Investment, 5,000 New Jobs — and the Quiet HNWI Tailwind

The Isle of Man is making a deliberate bet: invest roughly £1 billion to lift trend growth toward ~3%, create 5,000 new jobs, and expand the working population enough to keep the Island’s public finances, services, and living standards moving in the right direction. That’s not just “economic development speak.” It’s a survival plan for…

-

A Forgotten U.S. Defense Paper Accidentally Revealed Ripple’s Blueprint

Buried in plain sight is a 2018–2019 U.S. Space & Defense research paper presented at the Space Symposium by The Aerospace Corporation—a federally funded research body that advises the Pentagon, NASA, and U.S. intelligence agencies. The paper was not written for speculators, retail traders, or meme culture. It was written for national infrastructure planners. And…

-

U.S. Pitches ‘Project Sunrise’ Plan to Turn Gaza Into a High-Tech Metropolis — A Bold Reconstruction Vision With Deep Investment Implications

In a striking geopolitical and economic blueprint released this week, a team led by Jared Kushner and U.S. Middle East envoy Steve Witkoff has pitched a sweeping plan — called “Project Sunrise” — to transform war-torn Gaza into a futuristic high-tech metropolis and economic hub. The proposal, shared with foreign governments and potential investors, outlines…

-

Energy, Power and Suppression by Laura Aboli

Every civilization, without exception, is built on energy. Not ideology, nor money, it’s actually ENERGY that marks the difference between thriving or merely surviving. Who controls it, who distributes it, who decides its price, and who is allowed access to it, determines everything else that follows. We are now moving into a world that will…

-

The Great Jubilee Wealth Transfer: What the U.S. Debt Clock Is Really Signaling

A quiet but extraordinary message has appeared on the U.S. Debt Clock. Buried among the familiar counters of federal debt, unfunded liabilities, and interest expense is a far more provocative idea: the Great Jubilee Wealth Transfer — a structural reset of money itself, not merely another market cycle. To many, it looks like fringe commentary.…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.