Offshore Investing Guide

We understand that preserving and growing your wealth on a global scale presents both unique opportunities and complexities.

Invest Offshore Blog Posts

-

How to Investigate an Off-Grid Community in Paraguay—Effectively and Without Bias

Paraguay has quietly become one of Latin America’s most attractive relocation hubs for investors, expats, and off-grid pioneers. Low taxes, affordable land, abundant water, a pro-investor legal environment, and a calm geopolitical profile make it a preferred destination for those seeking greater autonomy or a Plan B lifestyle. So when a reader asks: “My wife…

-

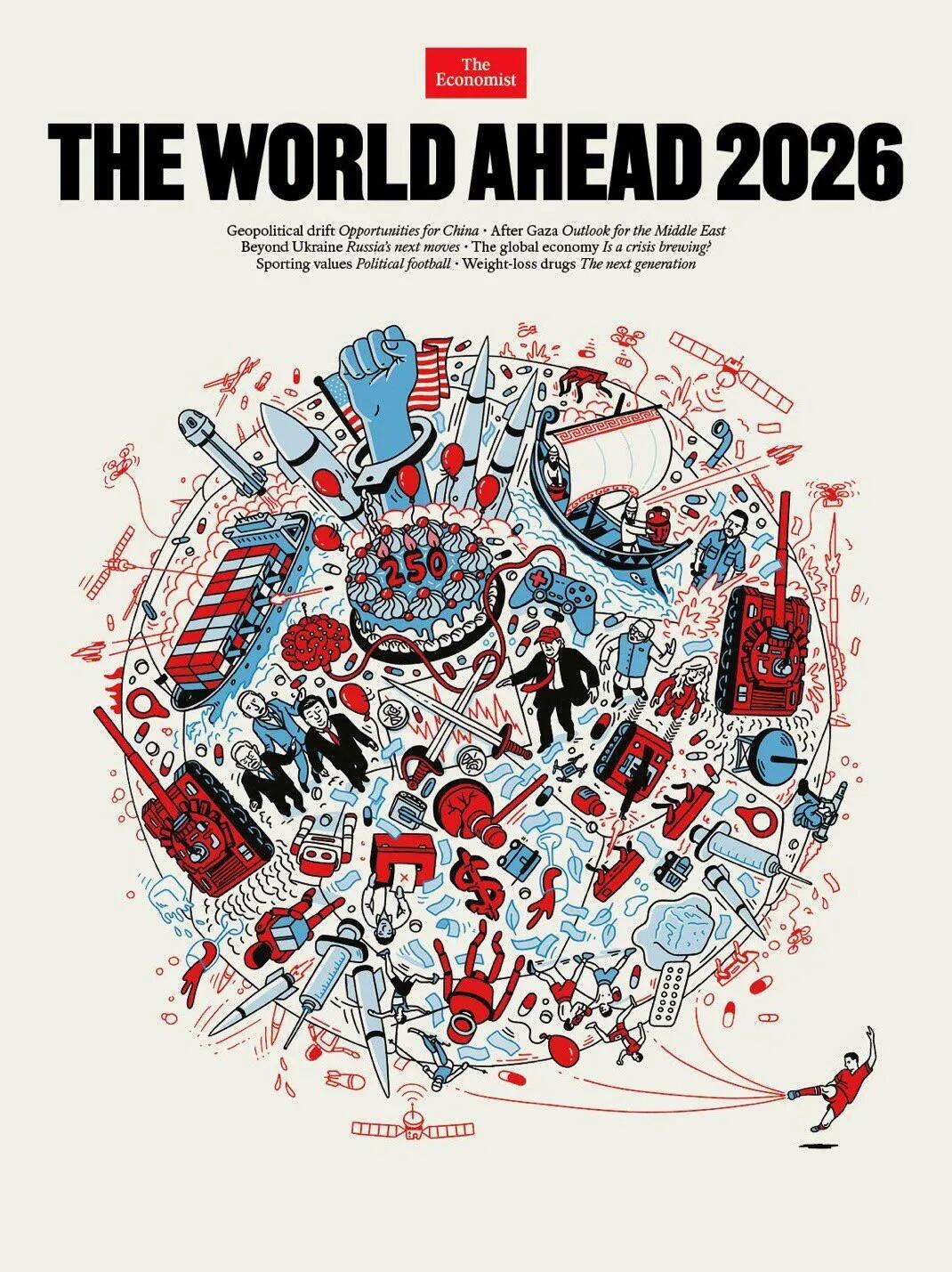

Super Creepy ‘The World Ahead 2026’ Economist Magazine Cover Signals War, Pestilence, & Financial Collapse Next Year

Authored by Michael Snyder via The End of The American Dream blog, There is one magazine that represents the interests of the global elite more than any other. It is known as “The Economist”, and each year it puts out an issue that is dedicated to what is coming in the year ahead. As we have…

-

Japan Just Killed the Global Money Printer — and Nobody Noticed

Invest Offshore — Global Macro Intelligence for Serious Capital The most dangerous number in global finance right now is 1.71%. That’s the yield on Japan’s 10-year government bond—the highest since 2008.On November 10th, 2025, that single number quietly signaled the end of the world’s largest, longest, and most distortionary monetary experiment. And almost nobody understands…

-

British Columbia, Unceded Lands & the Coming Legal Storm

The rain fell straight and cold across the coast, the way it always does when the Pacific has something heavy to say. Out on the unceded lands of British Columbia, a courtroom ruling has stirred up an old question that Canada once believed it had settled with order, patience, and civility. But the decision cuts…

-

ISO 20022, XRP, and the Future of Global Payments: Efficiency, Transparency, and a Massive Upside Story

The global financial system is undergoing a once-in-a-generation transformation — and it’s happening quietly in the background of banks, central banks, and payment networks worldwide. The shift to ISO 20022, the universal financial messaging standard for international transactions, is creating a new era of efficiency, transparency, interoperability, and regulatory compliance across the world’s payment rails.…

-

The Bond Crisis Comes Home: Why NYC, LA, and America’s Big Blue Cities Will Be Hit Hardest

America’s richest cities—New York and Los Angeles included—are standing directly in the blast radius of the coming U.S. Bond Crisis. For years, municipal leaders borrowed heavily on 20- and 30-year bonds to finance infrastructure, pensions, and politically convenient “renewables,” while enormous slices of the capital quietly disappeared into the hands of consultants, middle-men, and politically…

Join 900+ subscribers

We adhere to the highest privacy standards, ensuring that your personal information is treated with the utmost respect and confidentiality.