Where to Invest Offshore?

Deciding where to invest offshore can be a challenging decision, particularly when it comes to the choice between emerging and developed. Each offers unique opportunities and risks, which can have significant implications for investment outcomes. This article aims to compare the investment prospects in emerging and developed markets, providing insights to guide offshore investment decisions.

Understanding Emerging and Developed

Developed is typically characterized by a high level of industrialization, high per capita income, and well-developed financial markets. Examples include the United States, Japan, and countries in Western Europe.

Emerging markets, on the other hand, are in the process of rapid growth and industrialization. They often have lower per capita income but offer high growth potential. Examples include China, India, Brazil, and many countries in Africa.

Investment Prospects in Emerging Markets

Pros:

High Growth Potential: Emerging markets often exhibit higher economic growth rates than developed countries, which can translate into higher returns for investors.

Diversification: Investing in emerging markets can provide diversification benefits, particularly because these markets may not move in sync with developed markets.

Cons:

Political and Economic Risk: Emerging markets can be subject to political instability, economic volatility, and regulatory changes, which can increase investment risk.

Liquidity Risk: Some emerging markets have less liquid financial markets, which can make it difficult to buy or sell investments quickly.

Investment Prospects in Developed Areas

Pros:

Stability: Developed generally offer more political and economic stability than emerging markets, which can reduce investment risk.

Mature Financial Markets: Developed have well-regulated, liquid financial markets, making it easier for investors to buy and sell investments.

Cons:

Lower Growth Potential: While stable, developed areas typically have slower economic growth rates compared to emerging markets, which might lead to lower potential returns.

Market Saturation: Many sectors in developed markets are saturated, meaning there may be less room for companies to grow compared to those in emerging markets.

Making the Decision

The choice between investing in emerging or developed depends on an investor’s risk tolerance, investment goals, and time horizon. Investors willing to accept higher risk for potentially higher returns might lean towards emerging markets. On the other hand, those seeking stability and lower risk might favor developed.

Moreover, it’s worth considering a diversified approach that includes investments in both types of markets. This can help balance the potential for high returns with a level of stability.

Conclusion

Investing offshore presents a host of opportunities, whether in the high-growth economies of new markets or the stable, mature economies of developed countries. By understanding the unique characteristics, opportunities, and risks of each, investors can make informed decisions that align with their financial goals.

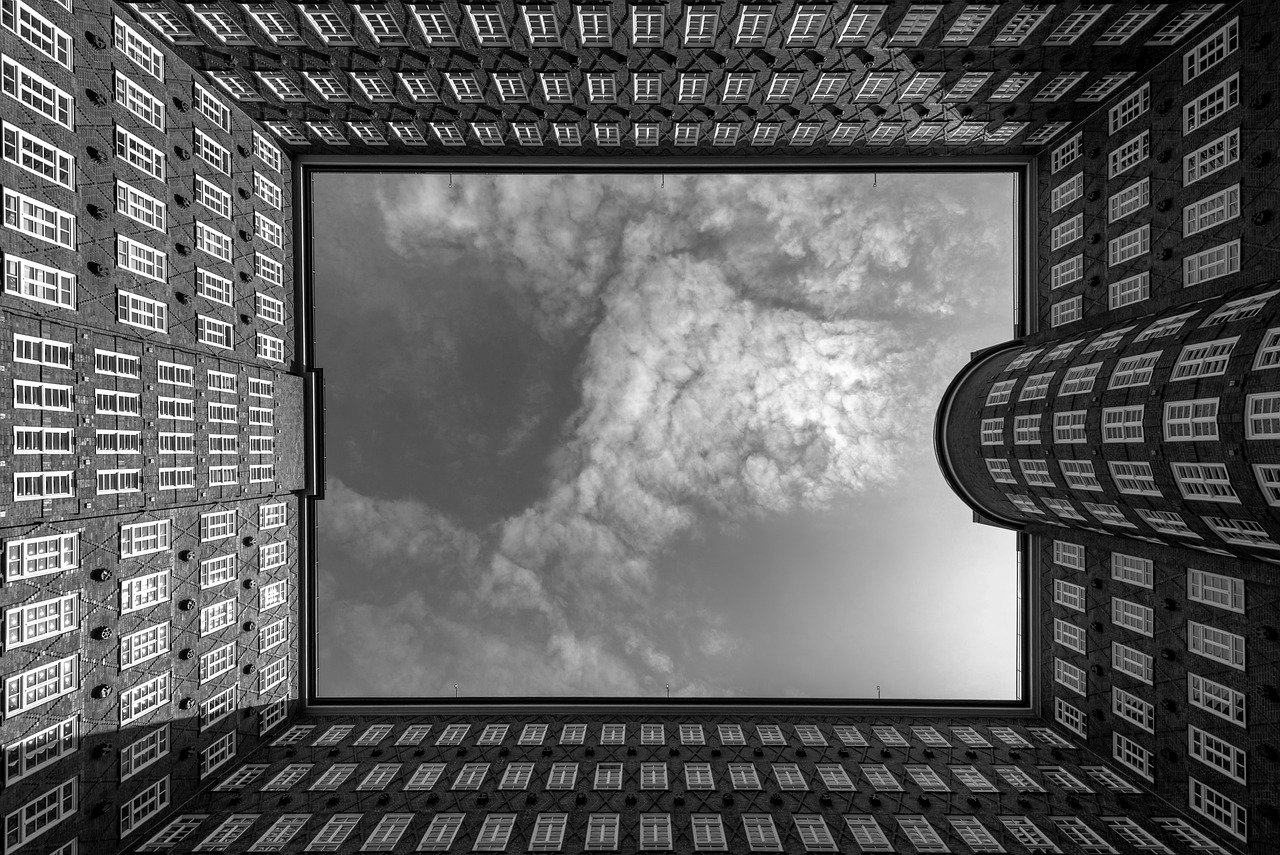

Image by Wolfgang Weiser from Pixabay

Leave a Reply