Category: Economics

-

A Breakthrough in Financial Engineering: Tier 1 Private Placement Meets Risk-Free BTC Trade

In the world of offshore investing, risk mitigation and upside leverage are often at odds. But what if we told you a breakthrough in financial engineering now makes it possible to combine the unparalleled returns of a Tier 1 Private Placement Program (PPP) with a Bitcoin (BTC) trade offering a guaranteed 10% discount — without…

-

Trump’s Weekend of Miracles: Now Comes the Hard Part in the Middle East

Monday morning broke like the hush after a storm. The headlines rolled in one after another, like shots fired from an old Winchester rifle. Over the weekend, while the world slept, President Trump did what only Trump seems capable of doing in the haze of history’s long shadows: Four miracles before Monday. And now, like…

-

IMF Global Economy Confidence Forecast 2025

The International Monetary Fund’s (IMF) recent blog post, “The Global Economy Enters a New Era,” highlights a significant shift in the global economic landscape, driven by escalating trade tensions and policy uncertainties. This transformation has profound implications for offshore investors seeking to navigate the evolving financial terrain. (IMF Blogs) A New Economic Paradigm The IMF…

-

Golden Rule: He Who Has the Gold Makes the Rules

WASHINGTON — The tweet dropped at 4:20 a.m. on April 20 like a tomahawk over Tokyo. “Fort Knox is full. And then some. God bless America. #GoldenRule” — @realDonaldTrump Just twelve words, and the world buckled. The markets spasmed. Gold ticked up, then down, then off the rails entirely. European Central Bank governors held emergency…

-

Global Recalibration: Trump Tariffs Gain Momentum While Nikkei Signals a Deeper Market Detox

Just weeks after Scott Bessent’s “detox period” began roiling U.S. markets, the global financial order appears to be entering a second stage of recalibration. While the S&P 500 remains volatile after its dramatic February-to-March plunge, a new geopolitical economic trend has emerged in the wake of President Donald Trump’s aggressive trade stance: over 52 countries…

-

Raw Capitalism Returns: The S&P 500 Tumbles Amid Trump-Era ‘Detox Period’

In a market shock that has sent tremors through Wall Street, the S&P 500 plummeted from approximately 6,100 in mid-February to 5,611 by late March 2025—a sharp correction that reflects more than just economic volatility. This decline is tied directly to a deliberate policy shift under newly appointed Treasury Secretary Scott Bessent, who is orchestrating…

-

Why the World Needs Real Asset-Backed Dollars to Mitigate CBDCs and Government Overreach

A recent incident in the UK has gone viral, igniting fierce debate over financial privacy and personal freedom. An English bank customer was denied access to his own funds—£2,500—until he provided proof of what the money would be used for. He simply wanted to buy a second-hand motorbike, yet the bank’s demand for documentation before…

-

Timing is Everything: Canada’s Tariff War is a Smokescreen for Economic Failure

In politics, timing is everything. And when a government is sinking under the weight of its own disastrous economic policies, nothing works better than a good old-fashioned distraction. Enter Canada’s latest move in the tariff war—a carefully orchestrated ploy to shift attention away from the undeniable collapse of the country’s economic fundamentals. From capital flight…

-

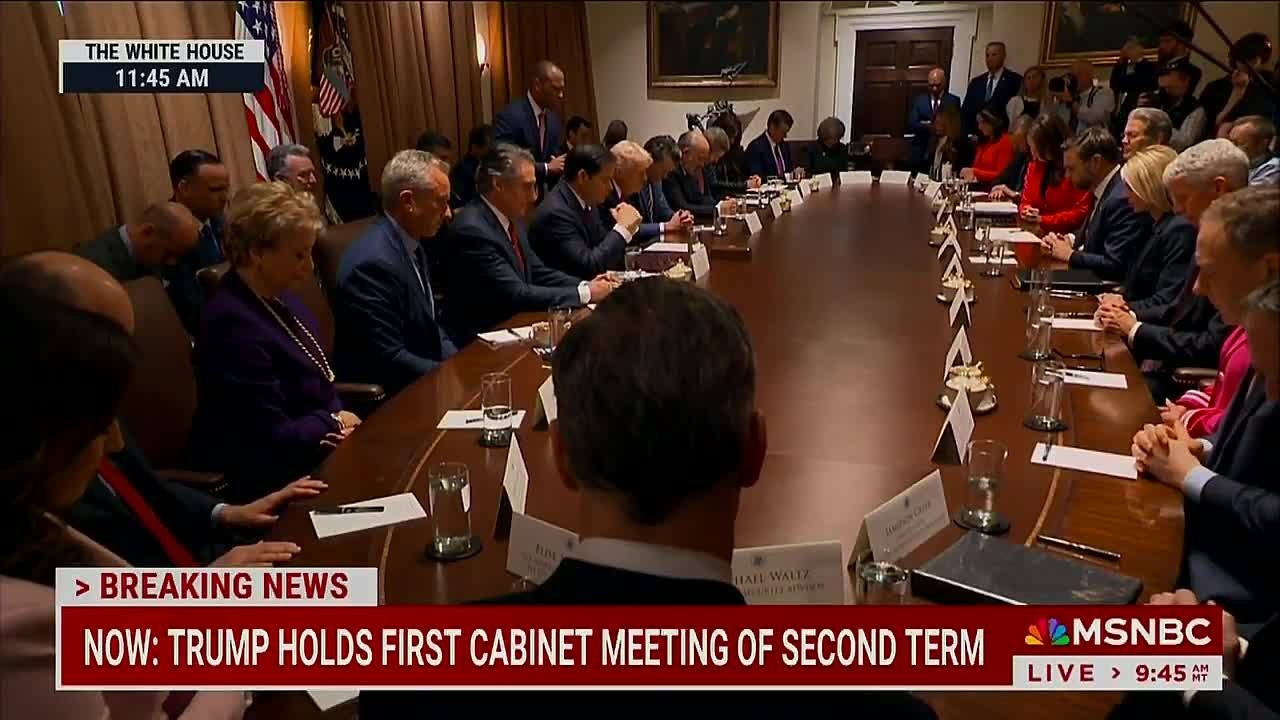

Trump’s New Administration Sparks a New Golden Age of Prosperity

As February comes to a close, the world stands in awe of the unprecedented transformation set into motion by President Donald J. Trump’s second administration. With a cabinet that is widely regarded as the most competent and results-driven in American history, the United States has embarked on a meteoric rise towards economic resurgence, financial transparency,…