Category: Economics

-

Silver’s Breakout Potential in the Transition to U.S. Treasury Certificates

As the United States moves towards implementing U.S. Treasury Certificates, potentially backed by tangible assets, the spotlight intensifies on precious metals, particularly silver. The current dynamics in the gold-silver ratio, combined with this transition, present a compelling case for a potential breakout in silver prices. Understanding the Gold-Silver Ratio The gold-silver ratio, a critical measure…

-

U.S. Treasury Certificates and the Silver Market Dynamics: Unpacking the Challenges of a Short Squeeze

As the United States navigates the complex transition toward U.S. Treasury Certificates, significant attention has turned to the commodities market, particularly silver, which plays a crucial role in this financial evolution. Amidst this transition, the structure of large short positions in silver, predominantly as hedges against physical holdings rather than naked shorts, presents a unique…

-

2024 Elections: A World in Transition

In 2024, over 60 countries will hold elections, a pivotal year that promises to reshape the global landscape. These elections will not only impact more than four billion people living in these countries but also their neighbors and trade partners. For investors, understanding the implications of these political shifts is crucial as the economic impact…

-

Golden Dreams: The Market’s Illusory BEGS Boom

Speculative Frenzy: Chasing the Golden Goose in Modern Markets CHICAGO, IL — The market today looks like a goose that lays the golden BEGS, a strange and bewildering creature that defies reason and common sense. From the windswept streets of Chicago to the bustling exchanges of New York, investors are chasing dreams, pouring their money…

-

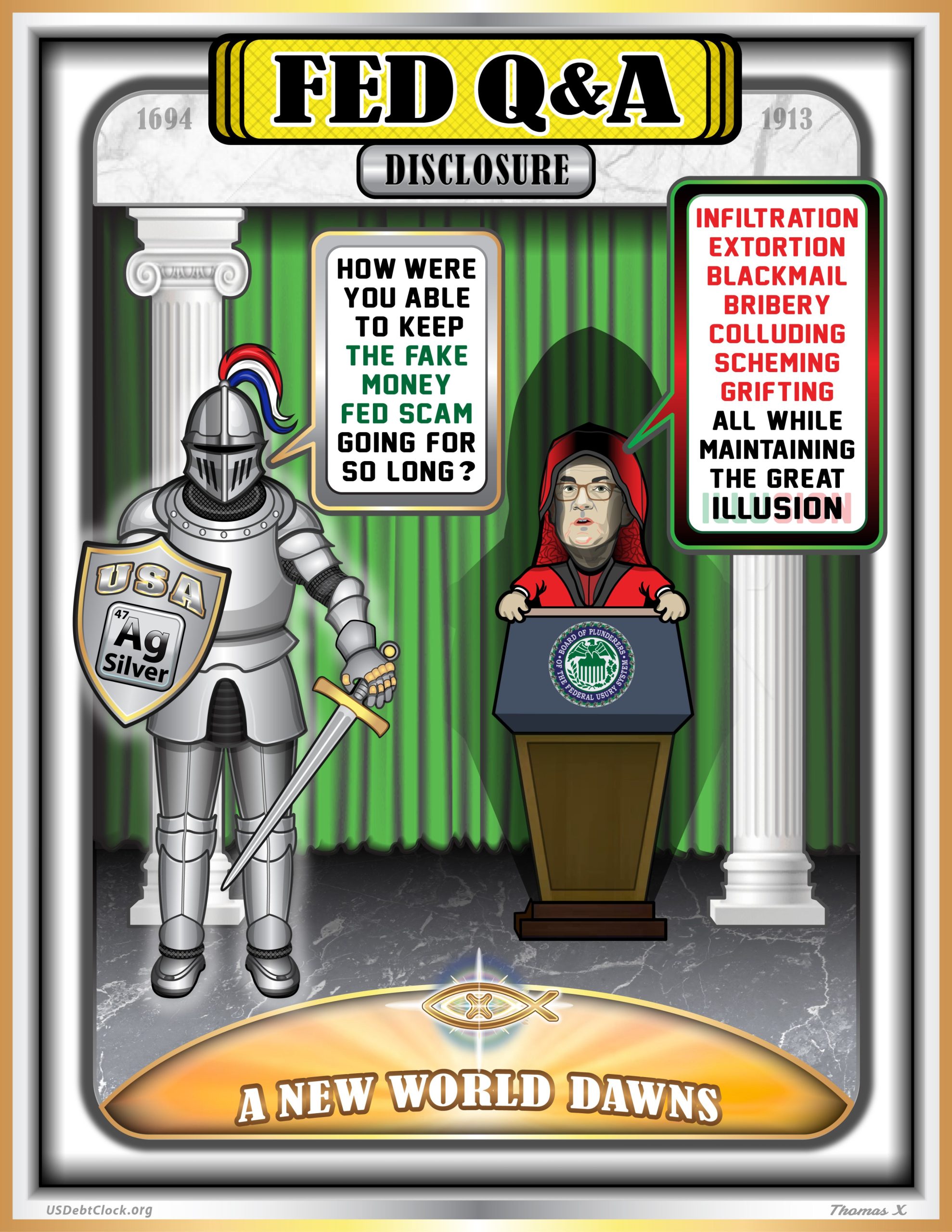

House Passes Bill To Block Fed-Issued Digital Dollar: What It Means for the Transition to Treasury Certificates

In a significant development, the U.S. House of Representatives has passed a bill that would prohibit the Federal Reserve from issuing a digital dollar. This move comes amid growing debate and scrutiny over the future of digital currencies and their potential implications for the financial system. In this blog post, we explore the implications of…

-

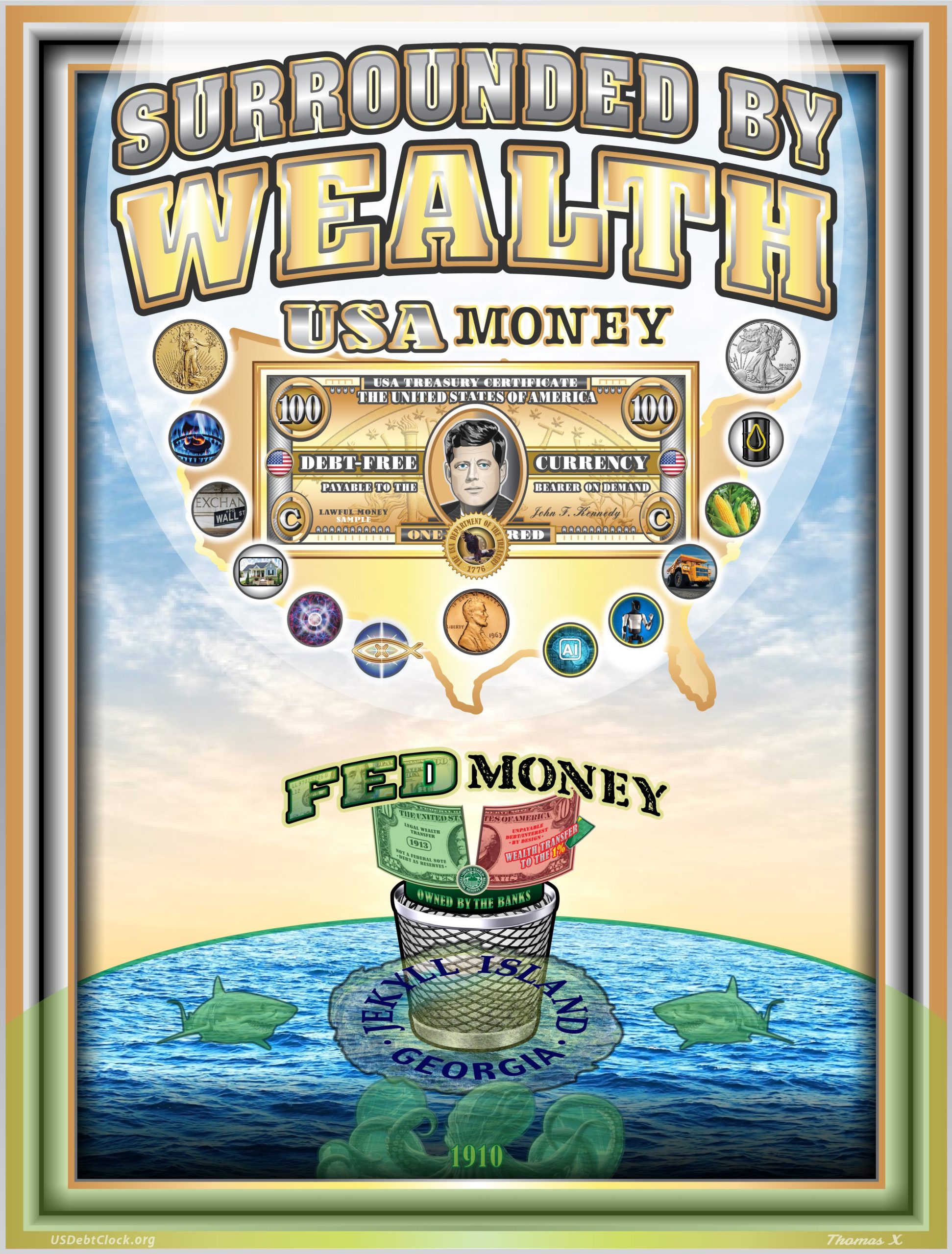

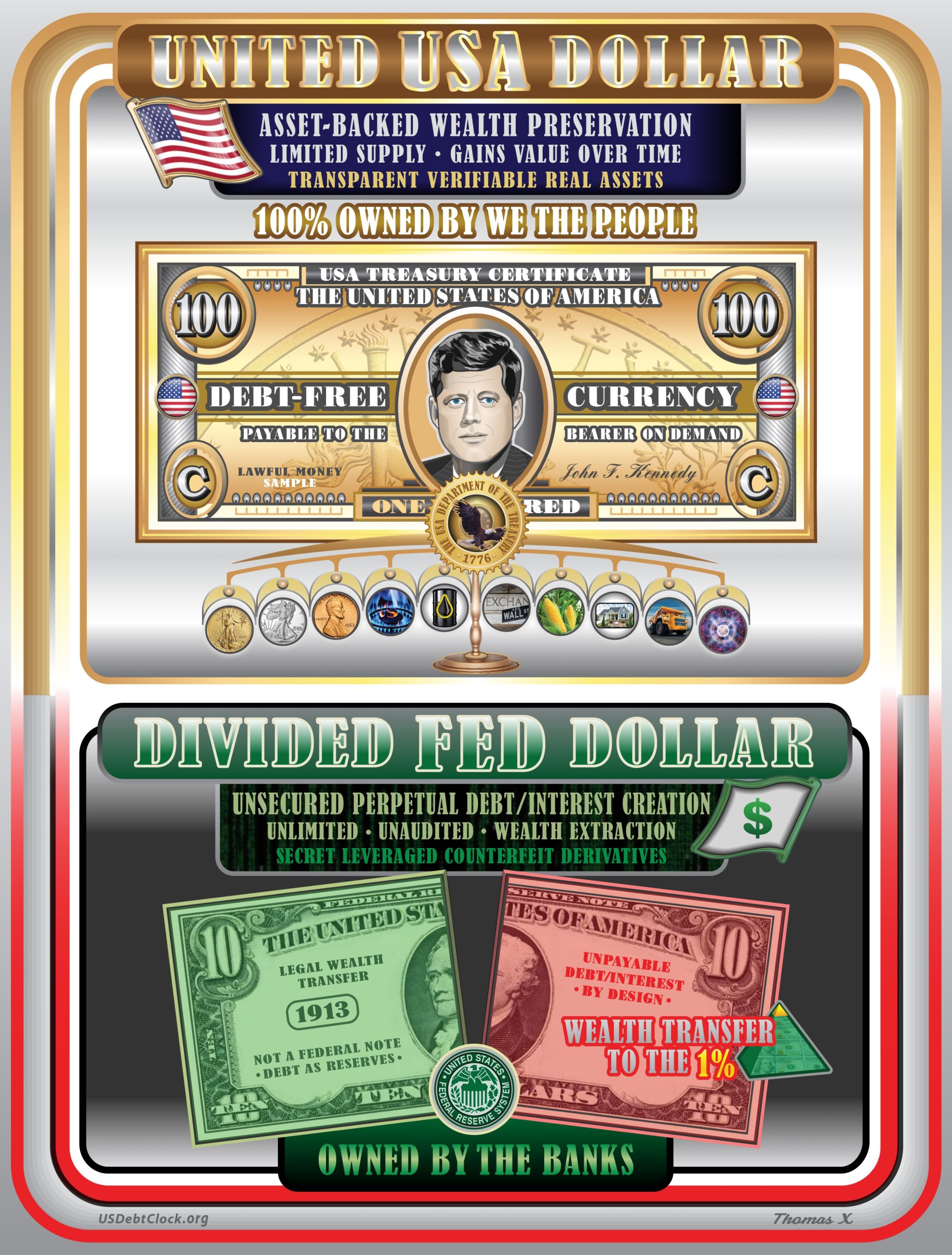

Transition to U.S. Treasury Certificates: Deciphering the Path Toward “Ending the Fed”

The financial landscape of the United States is on the brink of a monumental shift with the proposed transition to U.S. Treasury Certificates, a move furthered by historical and recent executive orders aimed at restructuring the nation’s financial system. Understanding this transition involves revisiting Executive Order 11110 and examining the implications of Executive Order 13772.…

-

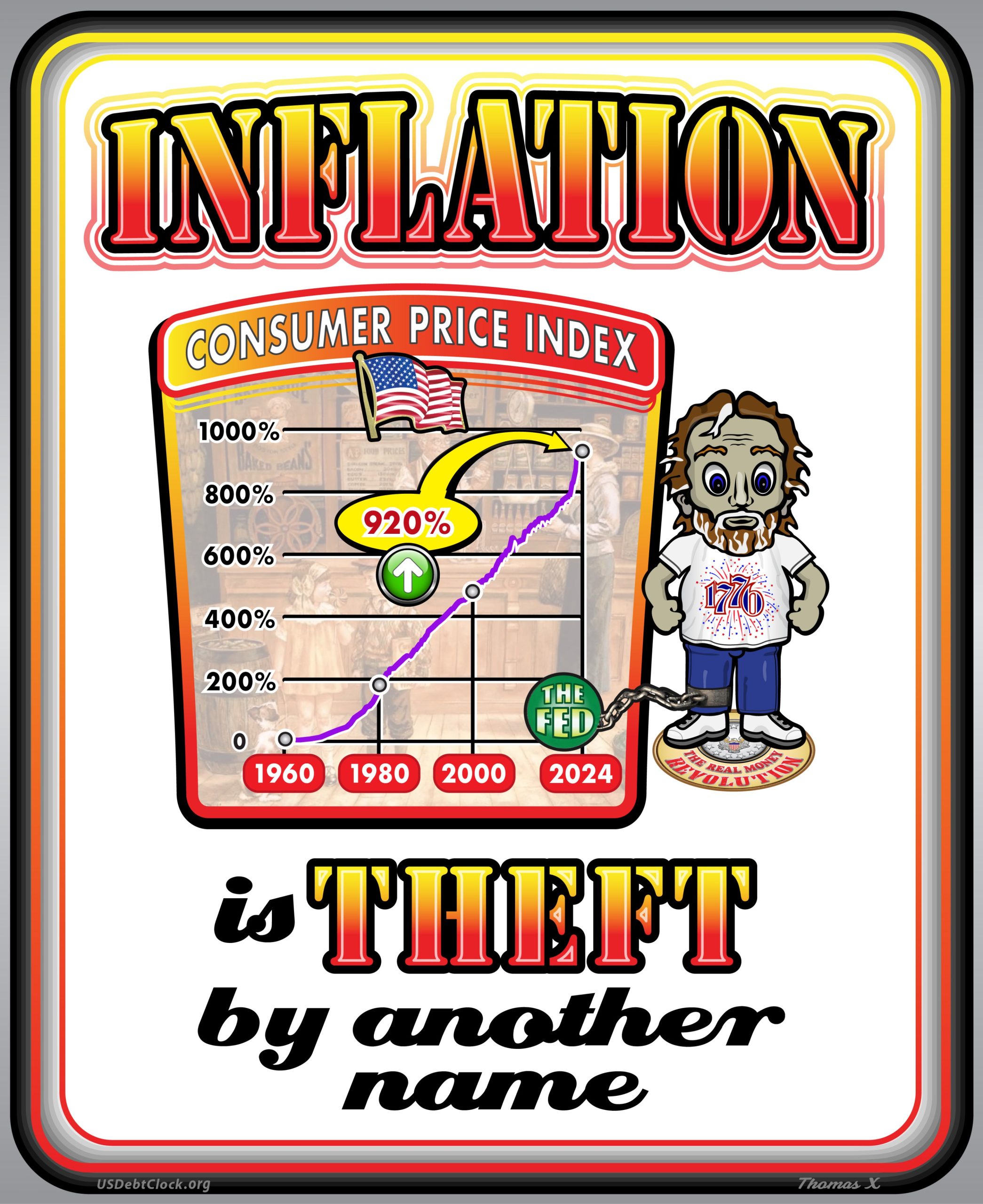

Understanding the Consumer Price Index (CPI) and the Transition to U.S. Treasury Certificates

In the ever-changing landscape of global finance, understanding key economic indicators such as the Consumer Price Index (CPI) is essential for investors seeking to navigate inflationary pressures and safeguard their wealth. In this blog post, we delve into the significance of the CPI, its historical trends, and the implications of the transition to Treasury Certificates…

-

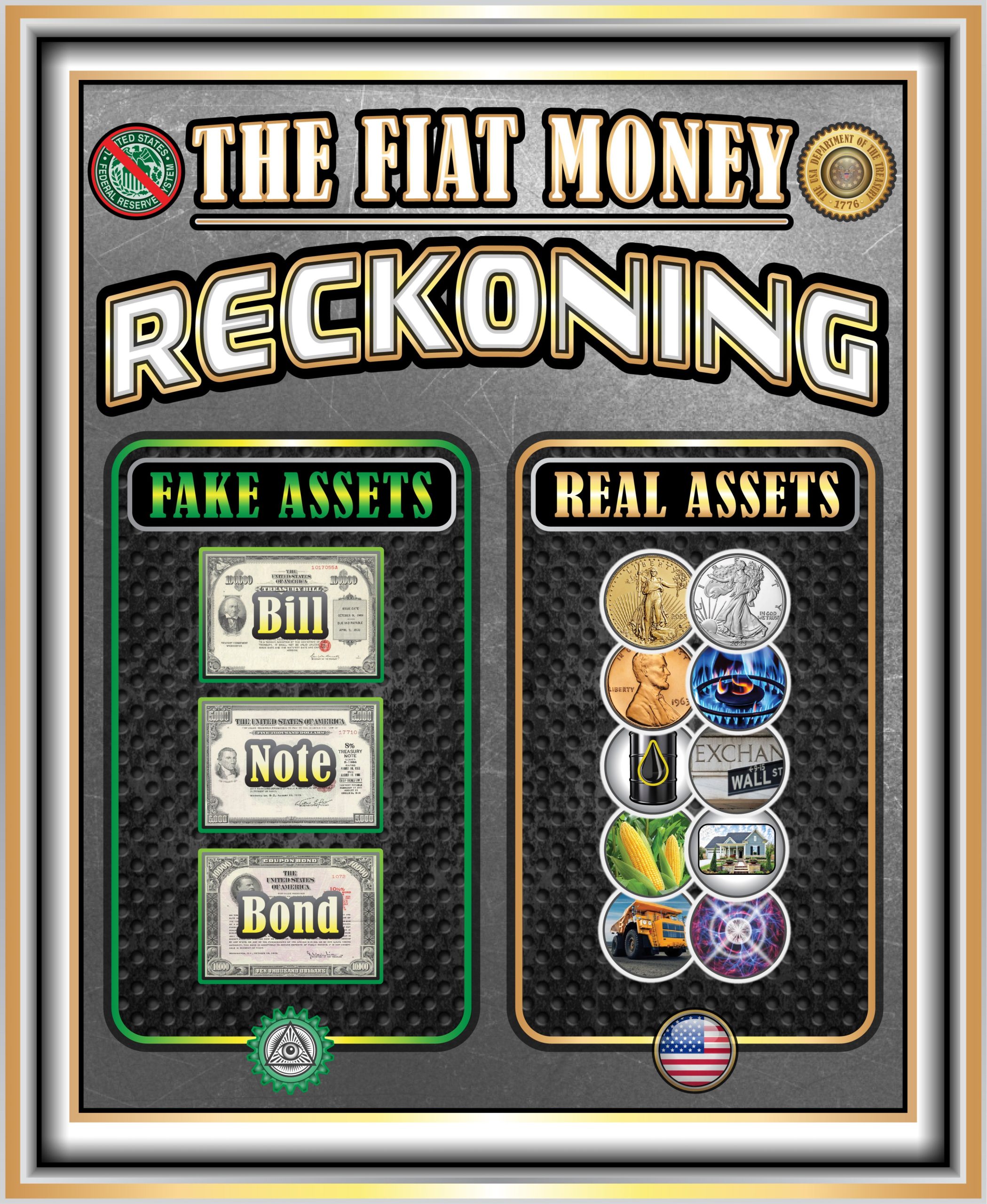

The End of an Era: US Treasury Bonds Collapse Signals Transition to Treasury Certificates

In a seismic shift that reverberates through financial markets, US Treasury bond prices are collapsing, while yields soar to multi-year highs. This development marks a significant inflection point in the trajectory of the global financial system, signaling the imminent end of the Federal Reserve system as we know it. In this blog post, we delve…

-

Manifest Greatness: The Jesse Livermore Guide to Investing Offshore

In the annals of financial history, few names resonate like Jesse Livermore’s, a man whose trading strategies and life story continue to inspire and instruct investors around the world. Dubbed the “Great Bear of Wall Street,” Livermore’s philosophy and approach offer timeless insights, particularly when applied to the modern context of offshore investing. The Legend…