Category: Economics

-

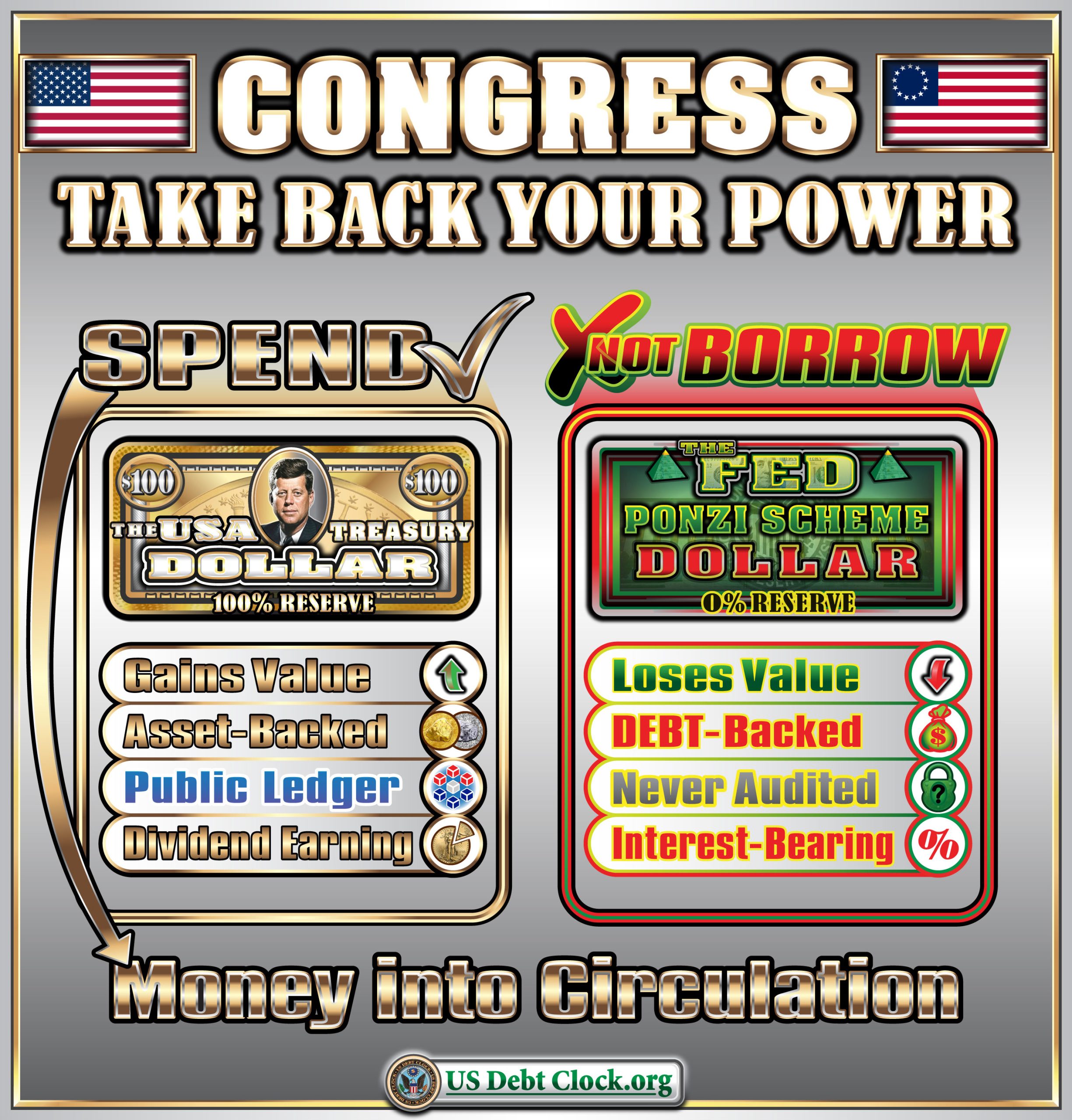

The Great Jubilee Wealth Transfer: What the U.S. Debt Clock Is Really Signaling

A quiet but extraordinary message has appeared on the U.S. Debt Clock. Buried among the familiar counters of federal debt, unfunded liabilities, and interest expense is a far more provocative idea: the Great Jubilee Wealth Transfer — a structural reset of money itself, not merely another market cycle. To many, it looks like fringe commentary.…

-

USMCA at Risk: What a Non-Renewal Would Mean for Canada’s Economy

When the United States–Mexico–Canada Agreement (USMCA) replaced NAFTA in 2020, Ottawa celebrated the deal as a “modernized” framework that would preserve market access and protect Canadian industries in a rapidly changing global economy. For five years, the agreement has quietly underpinned hundreds of billions in annual trade flows, stabilizing supply chains, anchoring manufacturing footprints, and…

-

The Old Money System Just Hit Its Breaking Point — And a New One Is Rising

On December 1, 2025, the financial world quietly crossed a line it can never uncross. No press conference. No presidential address. No Wall Street victory lap. But in one silent moment, the old global monetary regime reached its terminal stage. The Federal Reserve froze its balance sheet at $6.57 trillion—ending Quantitative Tightening forever—and exposed the…

-

China Is Watching… And They’re Nervous: Offshore Investors Brace for the Great US Treasury Certificate Shake-Up

If you ever needed proof that Invest Offshore has a global audience, look no further than the very flattering fact that our readership in China has now grown to over 7,000 active users in a single month — utterly dwarfing everyone else like a sumo wrestler sitting on an office chair.According to the analytics report…

-

The Bond Crisis Comes Home: Why NYC, LA, and America’s Big Blue Cities Will Be Hit Hardest

America’s richest cities—New York and Los Angeles included—are standing directly in the blast radius of the coming U.S. Bond Crisis. For years, municipal leaders borrowed heavily on 20- and 30-year bonds to finance infrastructure, pensions, and politically convenient “renewables,” while enormous slices of the capital quietly disappeared into the hands of consultants, middle-men, and politically…

-

The Great Unwind: Trump’s Return, the Death of the Dollar, and the Wealth Transfer of the Ages

The sky above the Potomac was iron gray and heavy, like a lid clamped over a boiling pot. The people walked slower now, weighed by history. The streets in Washington trembled—not from war, but from something more permanent: a changing of the monetary guard. There will be no parade, no bugles. No ticker tape. Just…

-

Why China Can’t Win a Trade War Against the United States

The global economy has long been defined by the uneasy yet interdependent relationship between the United States and China. But when trade tensions rise — as they have repeatedly over the past decade — it becomes clear that the United States holds strategic advantages that make it virtually impossible for China to “win” a trade…

-

The Moment of Monetary Reckoning Has Arrived

There are times in financial history when the currents shift so violently that only the sharpest players even realize they’re moving. Welcome to Q4 of 2025—the most extraordinary moment in the history of money. We’re talking about a sea of capital in motion. Not theoretical. Not digital vaporware. Real money. Pallets of physical U.S. dollars.…

-

The Gathering of Eagles: A Turning Point for America’s Future and Global Finance

A rare and dramatic scene has unfolded at Quantico, Virginia. Dubbed the “Gathering of Eagles,” President Donald Trump — in his role as Commander in Chief — reportedly summoned all commanders of the U.S. Military to a high-level meeting at “The Farm” in Quantico. This event, held just after the Marine Corps Silent Drill Platoon…