Author: Aaron

-

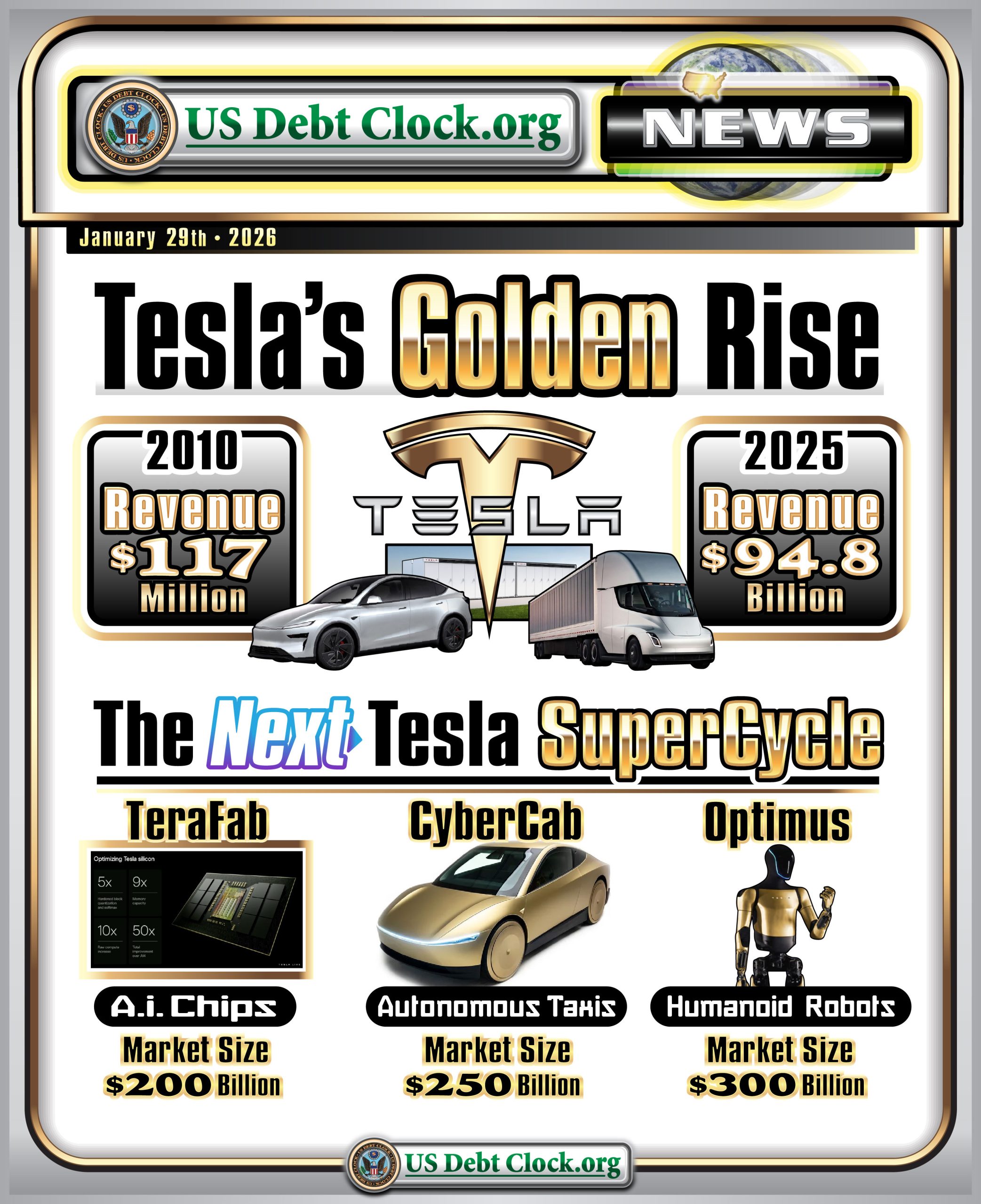

Tesla’s Golden Rise — and the “Next Tesla Super Cycle” the U.S. Debt Clock Is Hinting At

Today’s U.S. Debt Clock graphic is doing what it does best: compressing a decade-plus of disruption into one punchy visual. At the center is Tesla’s revenue arc — from roughly $116.7M in 2010 to $94.8B in 2025 — a reminder that “impossible” often just means “early.” Tesla’s own 2010 results pegged full-year revenue at $116.7M.…

-

Tether Announces the Launch of USA₮, the Federally Regulated, Dollar-Backed Stablecoin, Made in America

27 January 2026 – Tether, the largest company in the digital asset industry, today announces the official launch of USA₮, the federally regulated, dollar-backed stablecoin developed specifically to operate within the United States’ new federal stablecoin framework established under the GENIUS Act. The issuer of USA₮ is Anchorage Digital Bank, N.A., America’s first federally regulated stablecoin issuer. Today’s…

-

The Good, the Bad, and the Ugly of Comoros as an Offshore Tax Haven

In the world of offshore finance, attention usually gravitates toward familiar jurisdictions such as Cayman, BVI, Panama, or Seychelles. Yet quietly sitting in the Indian Ocean, off the coast of East Africa, the Union of the Comoros (UoC) occasionally appears on radar screens as an “emerging” offshore jurisdiction. Comoros is a small, three-island archipelago covering…

-

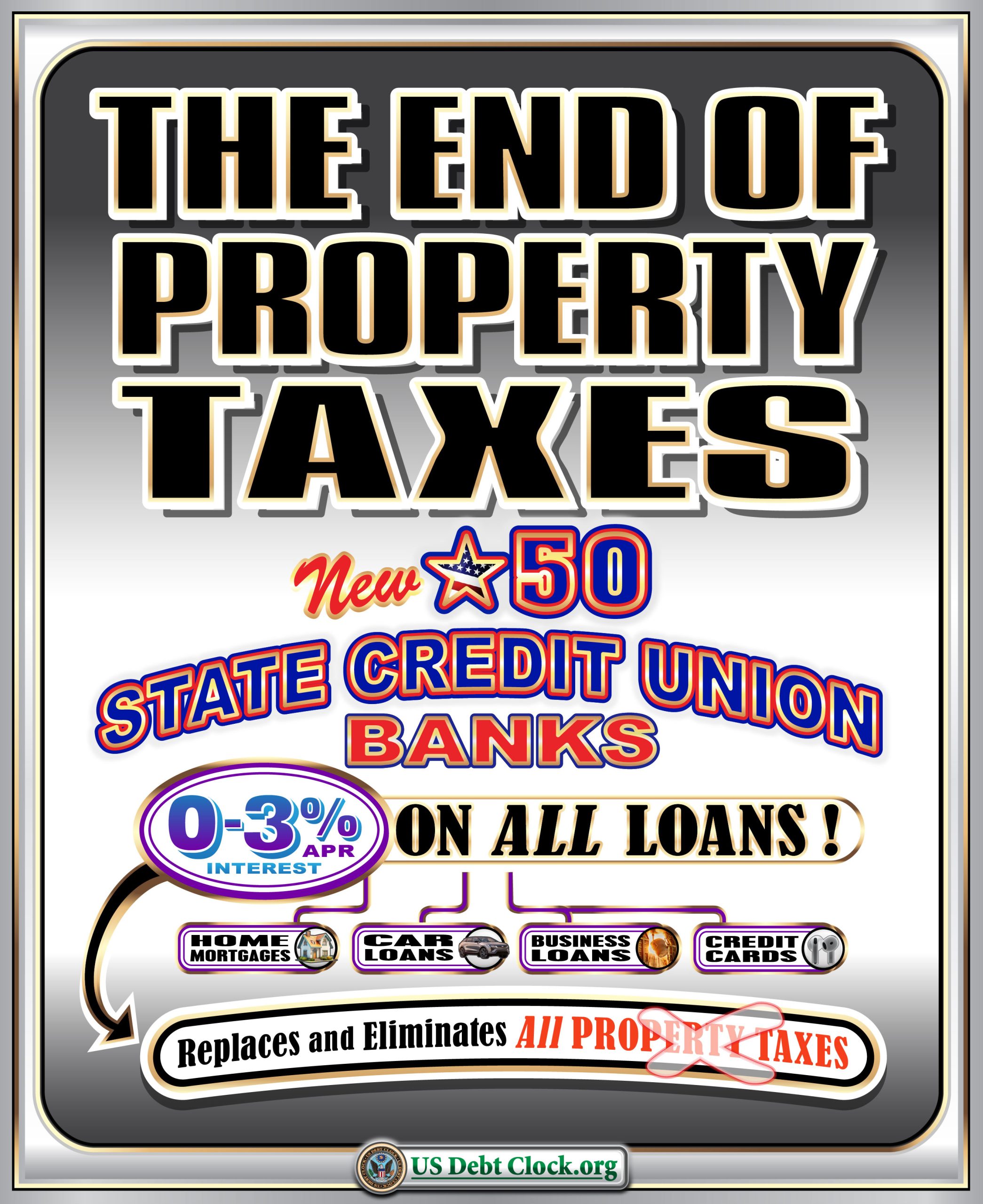

Peace, Prosperity, and Radical Reform: Signals of a Potential Golden Era

📊 Invest Offshore News Brief — January 2026 US Debt Clock Sparks Talk of Radical Economic Reform A controversial posting circulating on USDebtClock.org and shared widely on social platforms has ignited heated debate about what some are calling “The End of Property Tax” in the United States and a proposed overhaul of the financial system.…

-

Canada Just Broke the Golden Passport Market — Without Selling a Single Passport

For decades, wealthy individuals and globally mobile families have paid hundreds of thousands — sometimes millions — of dollars to secure a second passport through so-called Citizenship by Investment (CBI) programs in places like Malta, Türkiye, and the Caribbean. But in late 2025, Canada quietly changed the game. With the implementation of Bill C-3 (An…

-

The World’s Most Reluctant Tourists: A Venezuelan Expat’s Guide to Everywhere (Except Home)

The Venezuelan expat didn’t leave home because they wanted to. They left because the universe gently—but persistently—pushed them out the door with a suitcase, a WhatsApp group, and a recipe for arepas memorized like scripture. Make no mistake: Venezuela is still home. The kind of home you dream about at 3 a.m., where the coffee…

-

Trending Crypto: Institutions Accumulate as Retail Chases the Next Move

Crypto markets are entering 2026 with a familiar but important split personality: institutions are accumulating quietly, while retail attention is drifting toward fast-moving altcoins and social tokens. Prices are firm, sentiment is constructive, but the tone is notably measured rather than euphoric. That combination often marks the middle phase of a cycle — not the…

-

Shorting the Wind: Why Inverse Plays on Wind ETFs Are Back on the Table

At the World Economic Forum 2026 in Davos, Donald Trump delivered a blunt message that sent a chill through the renewables narrative. Calling green energy policies the “greatest hoax in history” and deriding the Green New Deal as a “Green New Scam,” Trump singled out wind energy as emblematic of policy-driven misallocation of capital. Whether…