Author: Aaron

-

The “CRS Survival Guide” (2026 Edition)

A plain-English explanation of automated tax information exchange — and what “legal privacy” actually means today There was a time when “offshore” was shorthand for secrecy. In 2026, it mostly means cross-border compliance. The Common Reporting Standard (CRS) is the plumbing behind that shift: a global system that tells banks what to collect, tells tax…

-

From Hype to Utility – Navigating Crypto’s 2026 Bear Market Blues

The crypto market in February 2026 has been challenging, with a significant downturn marking one of the worst yearly starts in over a decade for major assets. Bitcoin (BTC) and Ethereum (ETH) have led the decline, driven by macro pressures, deleveraging, and policy uncertainties (including earlier tariff-related issues that saw some reversal).Current Market Snapshot (as…

-

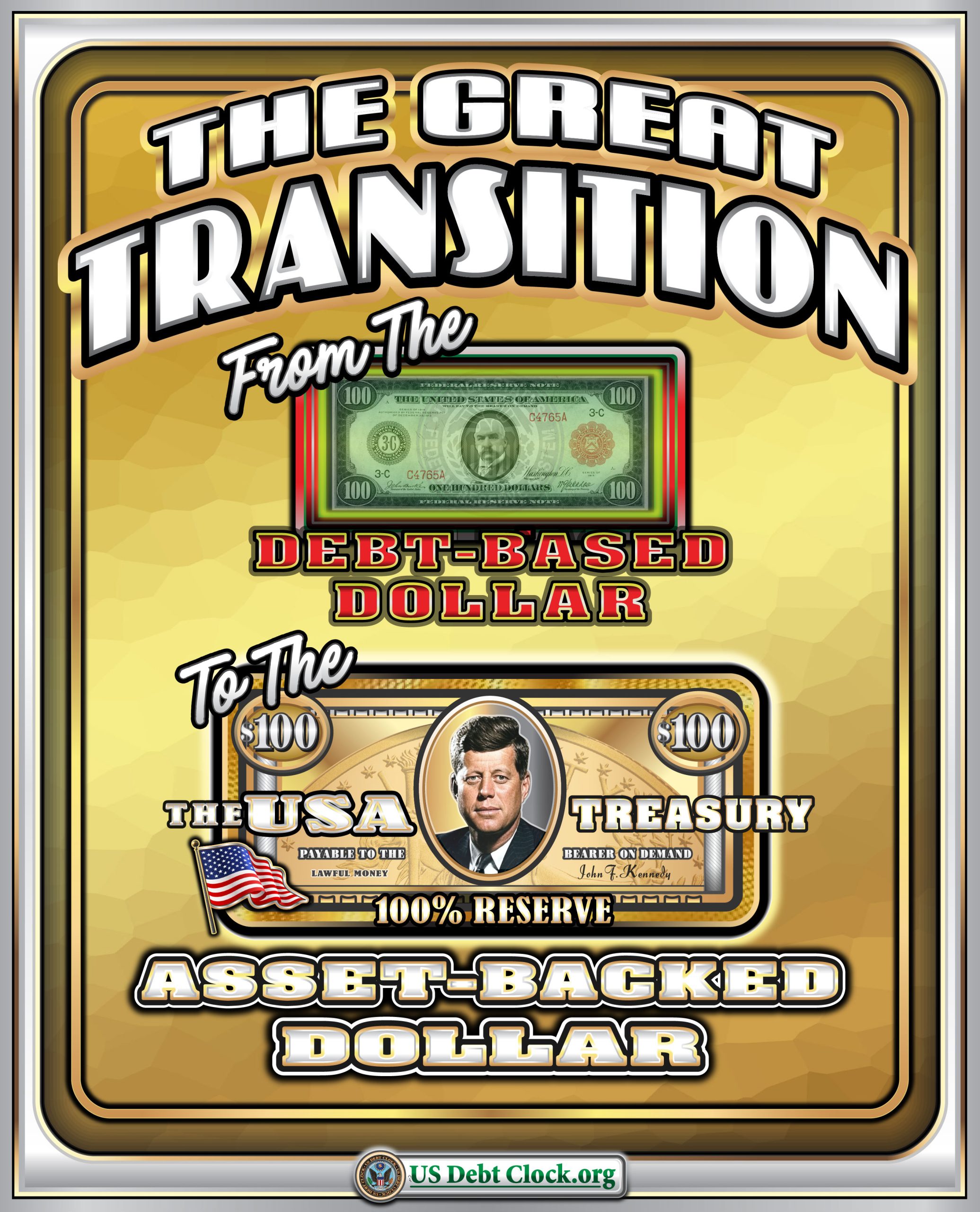

The Great Transition from the Debt-based Dollar to the Asset-backed Dollar

The February 20 graphic from the US Debt Clock is the most obvious depiction yet of what many readers call the New Money Revolution: a stylized “before and after” showing a DEBT-BASED DOLLAR transforming into a U.S. Department of the Treasury 100% RESERVE, ASSET-BACKED DOLLAR. It’s designed like a poster you can’t ignore—big headline (“THE…

-

Great Wealth Migration Accelerates With 35% of HNWIs Eyeing Lower-Tax Havens

deVere Group’s data reveals that over a third of wealthy clients are rethinking their residency for tax relief and stability—part of a deliberate ‘Great Wealth Migration’ from the UK, Europe, and beyond. High-net-worth individuals (HNWIs) are voting with their feet—and fortunes—as global fiscal landscapes shift. New deVere Group findings show that 35% of its 80,000…

-

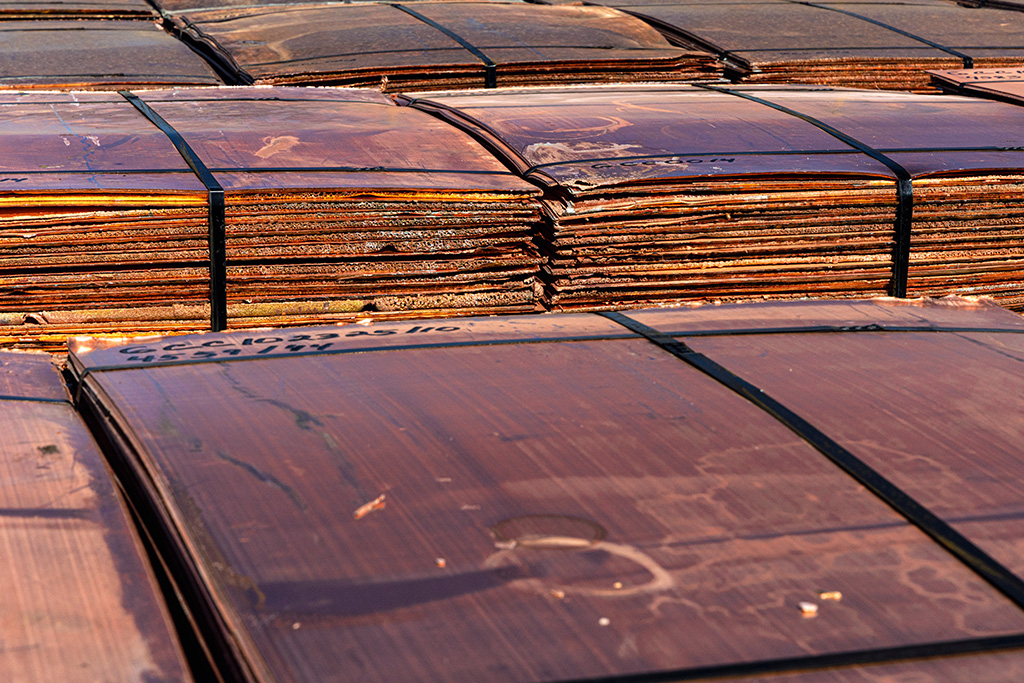

Why Investors Like Junior Producers: Small Caps, Big Torque

When investors talk about mining “sweet spots,” junior producers often sit right in the middle of the risk–reward spectrum. They’re no longer pure speculation (like early exploration juniors), but they’re not yet “slow-moving ships” (like major miners). They produce metal today—and they still have meaningful runway to grow. That combination is exactly why junior producers…

-

Fire Horse, Steel Nerves: China’s Robot Kung Fu Moment Signals a New Era of “Physical Intelligence”

The Chinese New Year has always been about momentum—families moving, markets moving, fortunes moving. And in 2026, the Year of the Fire Horse arrives with the exact kind of symbolism you’d expect: speed, power, audacity, and an almost stubborn refusal to stand still. This year, that Fire Horse energy didn’t just show up in lanterns…