Author: Aaron

-

Kraken Financial and the Fed: The Moment Crypto Touched America’s Core Banking Rails

For years, crypto firms have operated like guests inside the traditional financial system—welcome when the banks allowed it, delayed when correspondent relationships tightened, and vulnerable whenever an intermediary decided the risk was no longer worth the trouble. That is why the latest development involving Kraken Financial is so important. Kraken Financial, the Wyoming-chartered banking arm…

-

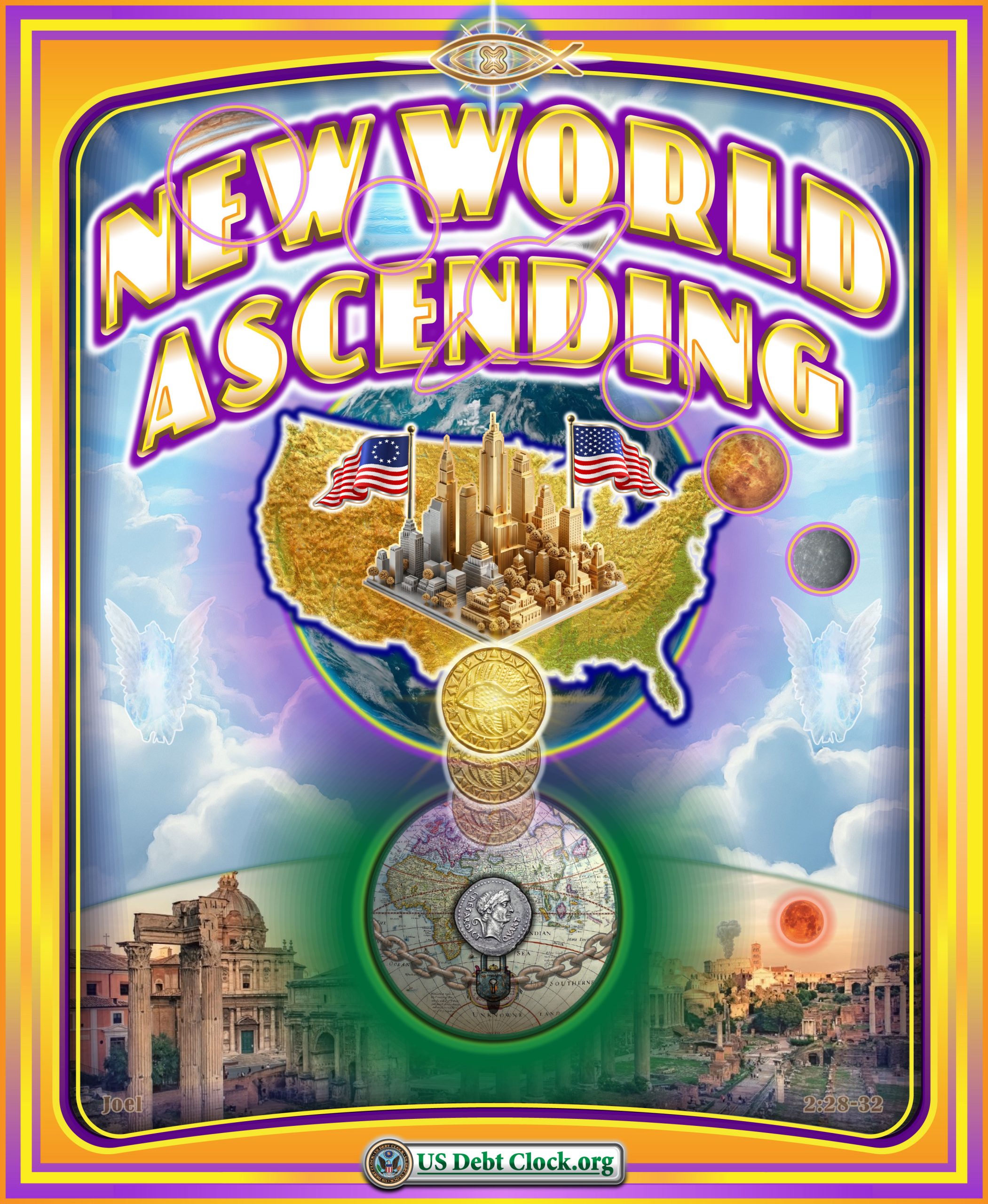

A New World Ascending: Gold, Sovereignty, and the Rise of a New Financial Era

The new March 1 poster from the US Debt Clock is one of the most visually ambitious yet. Titled “NEW WORLD ASCENDING,” it layers monetary symbolism, celestial imagery, biblical reference, and civilizational contrast into a single message: a new era is rising out of the old one. At the center of the image is a…

-

Ripple’s Digital Prime Broker Blueprint Could Bring Wall Street Plumbing to Crypto

The next phase of institutional crypto adoption may not be driven by hype, token launches, or retail momentum. It may be driven by something far less glamorous—and far more important: market structure. In its 2026 whitepaper, The Blueprint for Institutional Digital Assets Trading, Ripple argues that institutional participation in crypto is still being held back…

-

RBC and the New Standard for Canadian Offshore Wealth

In cross-border finance, the real question is not whether a bank can wire money abroad or open a foreign-currency account. The real question is whether it has built a genuinely integrated wealth platform—one that can coordinate private banking, investments, trust structures, lending, and client service across multiple jurisdictions under one recognizable umbrella. On that test,…

-

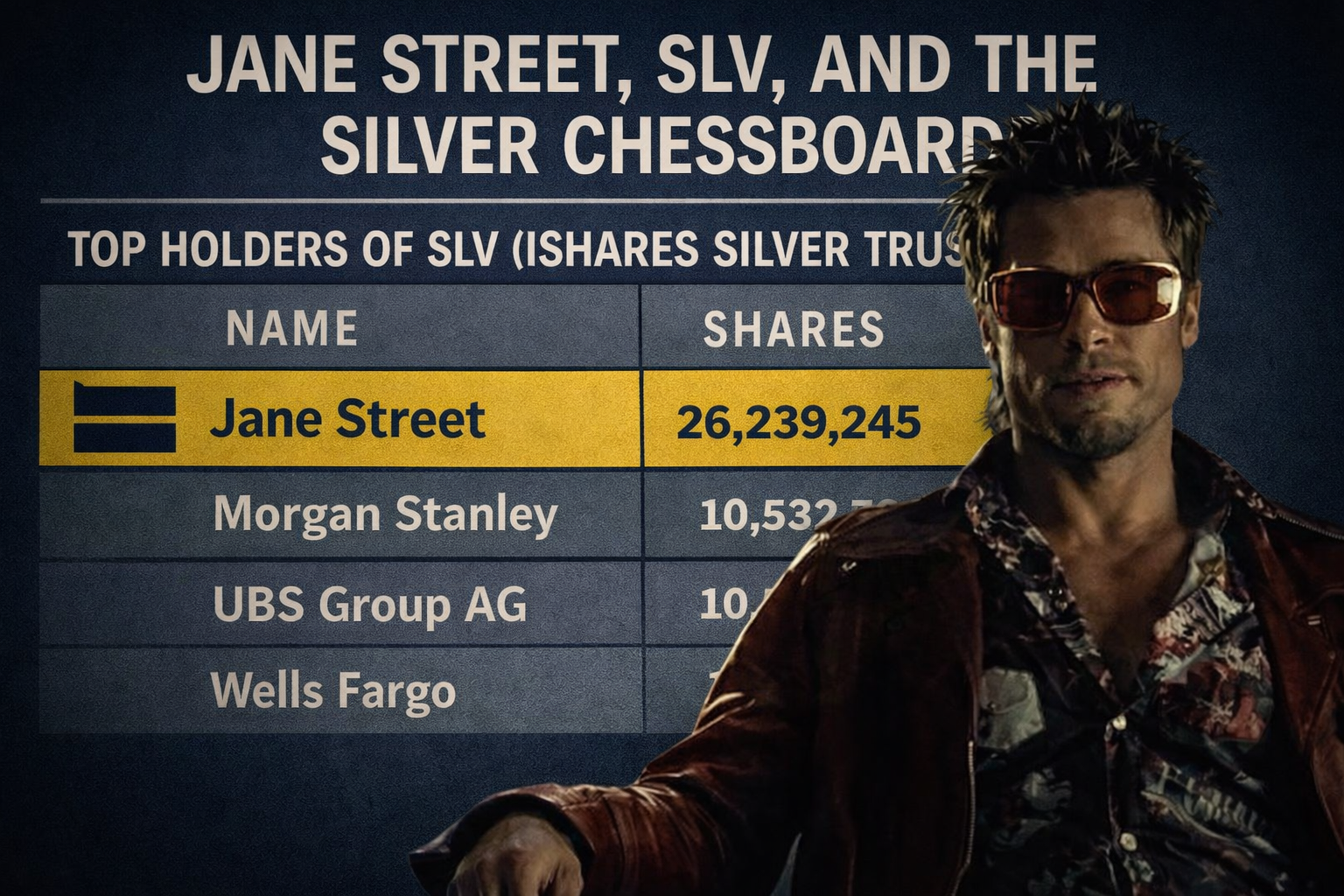

Jane Street, SLV, and the Silver Chessboard

I love silver.I’ve loved silver since 2009—when nobody cared, when it was cheap, hated, and misunderstood. But loving silver and trusting the silver market are two very different things. On February 25, 2026, @zerohedge dropped a little grenade on X: “We have been huge silver bulls since 2009, but be very careful here: lots of…