In the rapidly evolving landscape of global finance, the mBridge initiative, aimed at fostering cross-border payments between countries with different economic ideologies, stands as a bold experiment. This digital currency bridge, developed by central banks from China, Hong Kong, Thailand, and the United Arab Emirates, seeks to streamline and secure international transactions. However, despite its innovative promise, the mBridge is poised to encounter significant challenges. The most profound of these challenges lies in the fundamental incompatibility between the economic systems of communism and capitalism.

The mBridge Initiative: A Brief Overview

The mBridge project, officially known as the Multiple Central Bank Digital Currency (mCBDC) Bridge, is an ambitious endeavor to create a seamless cross-border payment system using blockchain technology. The primary objective is to enhance efficiency, reduce transaction costs, and improve transparency in international payments. By leveraging the potential of digital currencies issued by central banks, the mBridge aims to address the limitations of current cross-border payment systems.

Divergent Economic Ideologies: A Fundamental Barrier

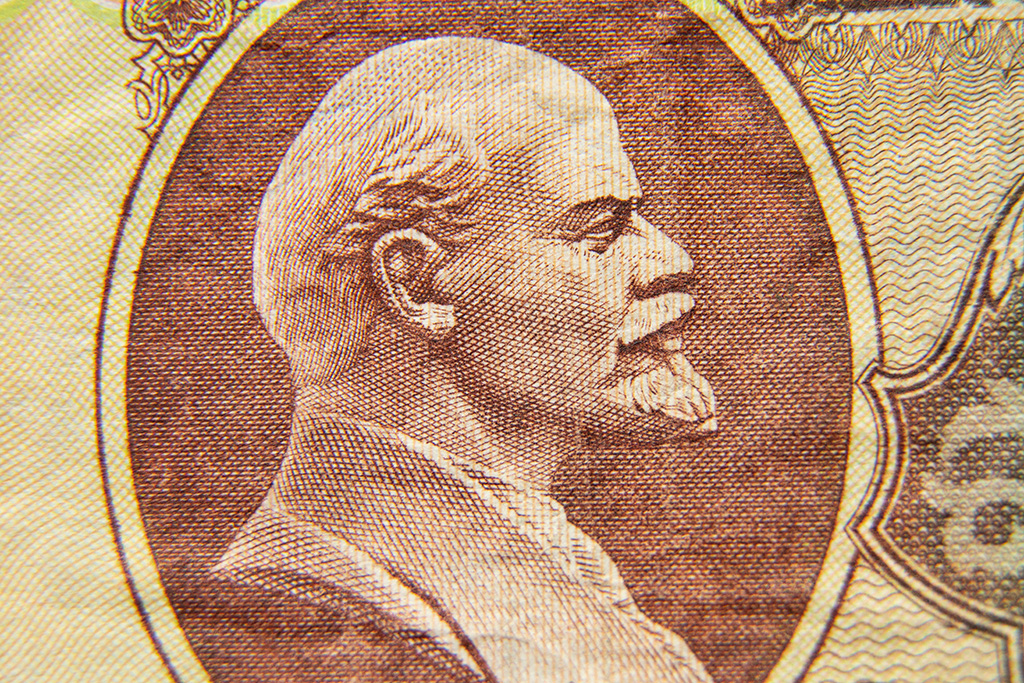

At the heart of the mBridge project are countries with starkly different economic ideologies. China, a key player in the initiative, operates under a communist system where the state exerts significant control over the economy. In contrast, Hong Kong, Thailand, and the United Arab Emirates have economies that lean more towards capitalism, characterized by free markets, private ownership, and minimal government intervention.

This ideological divide presents a significant obstacle to the success of the mBridge. Here’s why:

Regulatory Incompatibility

Communist economies, like China, have stringent regulatory frameworks designed to maintain state control over economic activities. These regulations often involve heavy scrutiny and restrictions on capital flows to prevent capital flight and ensure economic stability. On the other hand, capitalist economies favor deregulation and encourage free movement of capital to promote economic growth and innovation.

The mBridge, designed to facilitate seamless cross-border transactions, must navigate these contrasting regulatory environments. Ensuring compliance with the stringent controls of a communist economy while satisfying the laissez-faire principles of capitalist economies creates a complex and often conflicting regulatory landscape. This incompatibility is likely to hinder the smooth operation of the mBridge, leading to delays, inefficiencies, and increased costs.

Differing Economic Priorities

Communist and capitalist economies prioritize different aspects of economic development. In a communist system, social equity, state ownership, and centralized planning are paramount. Economic policies are often geared towards achieving social goals and maintaining political stability rather than maximizing profits.

In contrast, capitalist economies prioritize market efficiency, competition, and individual enterprise. The focus is on creating an environment conducive to innovation, investment, and economic growth.

These differing priorities can result in conflicting objectives for the mBridge. While capitalist economies may push for rapid implementation and expansion to capitalize on new opportunities, a communist economy like China might prioritize stringent controls and cautious rollouts to safeguard state interests. These divergent approaches can lead to friction and impede the project’s progress.

Trust and Transparency Issues

Trust is a cornerstone of any financial system, and the mBridge is no exception. In a capitalist system, trust is built on transparency, rule of law, and the predictability of market behavior. However, in a communist system, trust is often based on the authority and control of the state.

The mBridge requires participating countries to share sensitive financial data and cooperate closely. The differing levels of transparency and trust between communist and capitalist systems can create significant challenges. Capitalist economies may be wary of the opaque nature of communist regulatory practices, while communist economies may resist sharing data that could undermine state control.

Conclusion: The Inevitable Failure of the mBridge

While the mBridge represents a visionary attempt to revolutionize cross-border payments, the inherent incompatibility between communism and capitalism poses insurmountable challenges. The stark differences in regulatory approaches, economic priorities, and trust mechanisms create a landscape fraught with obstacles. As such, despite its innovative promise, the mBridge is likely to falter under the weight of these ideological contradictions.

For investors and stakeholders, understanding these fundamental issues is crucial. While technological advancements can bridge many gaps, the deep-seated ideological differences between communism and capitalism may ultimately render the mBridge an ambitious yet unviable endeavor.

Invest Offshore remains committed to providing insights and analysis on the evolving global financial landscape. Stay tuned for more updates and expert opinions on the latest developments in international finance.

Leave a Reply