In the ever-changing landscape of global finance, understanding key economic indicators such as the Consumer Price Index (CPI) is essential for investors seeking to navigate inflationary pressures and safeguard their wealth. In this blog post, we delve into the significance of the CPI, its historical trends, and the implications of the transition to Treasury Certificates in the context of rising consumer prices.

Decoding the Consumer Price Index (CPI)

What is the CPI?

- The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a basket of goods and services.

- It serves as a crucial indicator of inflationary pressures, reflecting changes in the cost of living and purchasing power of consumers.

Historical Trends:

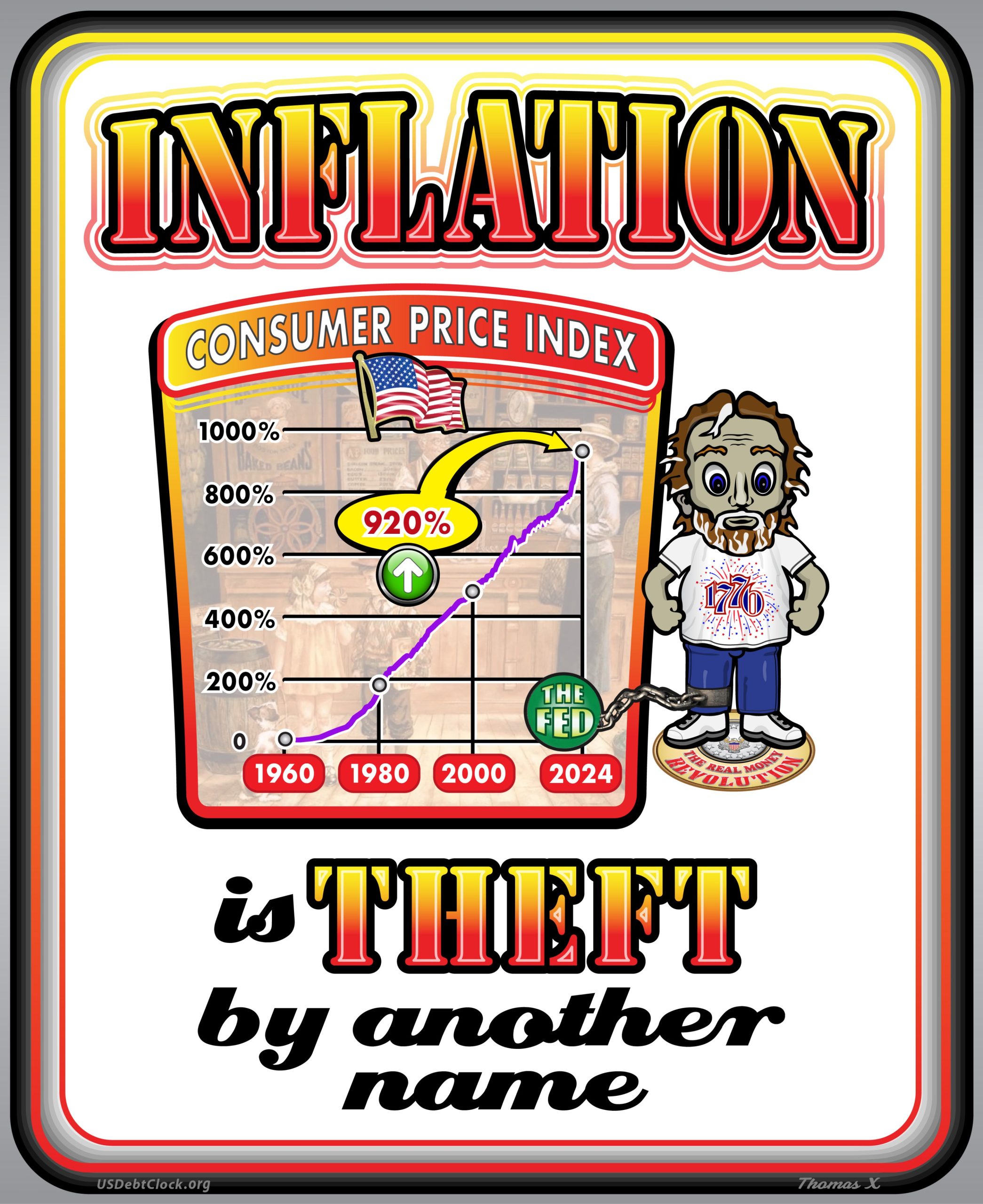

- Since its inception, the CPI has undergone significant fluctuations, reflecting the ebb and flow of economic cycles and external factors influencing consumer prices.

- For instance, in 1960, the CPI value stood at 29.4. Fast forward to March 2024, the latest available data point, and the CPI value soared to 312.332—an increase of around 962% since 1960.

The Transition to Treasury Certificates: Addressing Inflationary Pressures

Inflation Hedge:

- Amidst rising inflationary pressures, investors are increasingly turning to alternative stores of value to preserve their wealth and hedge against currency depreciation.

- Treasury Certificates, backed by tangible assets and issued directly by the US Treasury, offer a compelling solution to mitigate the erosive effects of inflation on investment returns.

Stability and Transparency:

- Unlike traditional fiat currencies subject to central bank manipulation and inflationary pressures, Treasury Certificates provide investors with greater stability, transparency, and confidence in the purchasing power of their investments.

- By anchoring the value of Treasury Certificates to tangible assets and adopting sound money principles, policymakers can promote price stability and foster long-term economic prosperity.

Implications for Investors

Portfolio Diversification:

- As inflationary pressures intensify, investors should consider diversifying their portfolios to include alternative assets such as Treasury Certificates, precious metals, and real estate to hedge against currency depreciation and mitigate risks associated with rising consumer prices.

- By adopting a balanced investment strategy that encompasses both traditional and alternative assets, investors can optimize risk-adjusted returns and preserve wealth in inflationary environments.

Risk Management:

- Inflation poses a significant risk to fixed-income investments and cash holdings, eroding the real value of returns over time.

- Investors should proactively manage inflation risk by allocating capital to assets that have historically outperformed during periods of rising inflation, such as equities, commodities, and inflation-protected securities.

Conclusion

As the Consumer Price Index (CPI) continues to climb, reflecting persistent inflationary pressures, investors must adapt their investment strategies to navigate changing market dynamics and safeguard their wealth. By understanding the significance of the CPI, embracing the transition to Treasury Certificates, and adopting proactive risk management strategies, investors can position themselves to thrive amidst evolving economic conditions and seize opportunities for long-term growth and prosperity.

In the next installment of our series, we will explore innovative investment strategies and asset allocation techniques to help investors navigate inflationary environments and capitalize on emerging opportunities in the evolving financial landscape.

Disclaimer: This blog post is for informational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

Leave a Reply