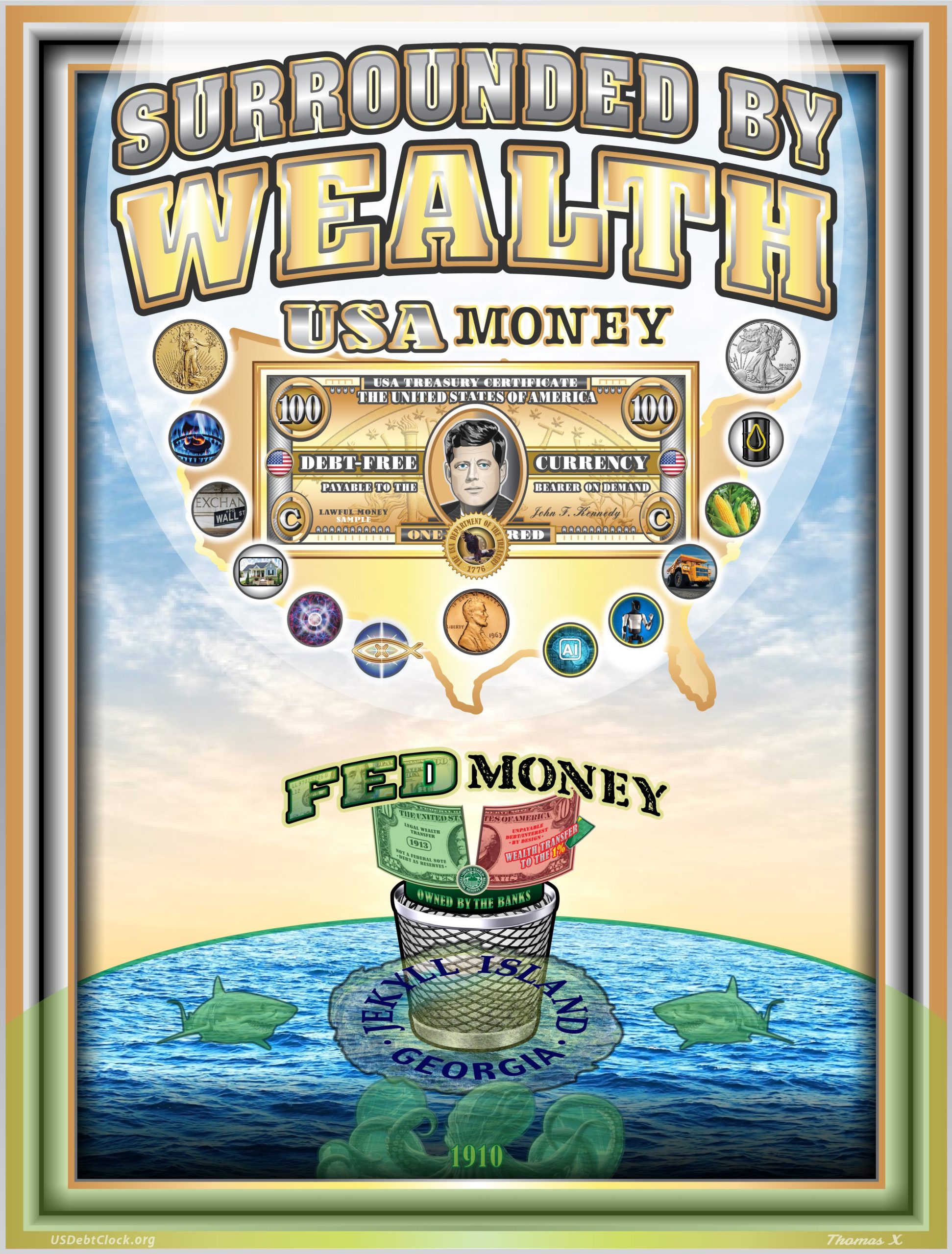

As the United States navigates the complex transition toward U.S. Treasury Certificates, significant attention has turned to the commodities market, particularly silver, which plays a crucial role in this financial evolution. Amidst this transition, the structure of large short positions in silver, predominantly as hedges against physical holdings rather than naked shorts, presents a unique market dynamic. This strategic approach in silver trading makes orchestrating a short squeeze difficult, highlighting the nuanced interplay between physical assets and their paper traded counterparts.

Understanding the Market Structure

In the silver market, large short positions are generally not speculative naked shorts but are instead hedges against physical holdings. Financial institutions and large-scale investors often employ these short positions as a risk management tool, offsetting the potential loss in value of their physical silver holdings by profiting from short positions if the price of silver falls. This hedging strategy is crucial for maintaining balance and limiting exposure to silver’s price volatility.

The Challenge of Orchestrating a Short Squeeze

A short squeeze occurs when a sharp increase in the price of an asset forces traders who had bet against it (short sellers) to buy it back at higher prices to avoid greater losses, further driving up the price. In the case of silver, the prevalence of hedging strategies complicates the possibility of a short squeeze. Since these positions are covered by physical holdings, traders can continually adjust (re-hedge) their positions based on the market movements, thereby blunting the impact of short-term price fluctuations. This continual adjustment makes it exceedingly challenging for a short squeeze to gain the momentum necessary to disrupt the market significantly.

Impact of Rising Silver Prices

However, as the price of silver increases, the dynamics within the market are beginning to shift. Historically, paper traded silver—futures contracts and other financial instruments that represent silver without necessarily entailing physical delivery—has exerted significant influence on the market price of silver. But with rising prices, the hold of paper traded silver is starting to wane. Investors and analysts speculate that as more traders and investors turn to actual physical silver, the paper market might lose some of its ability to dictate prices, thereby potentially increasing market volatility and the impact of physical market demands.

The Role of U.S. Treasury Certificates

The move toward U.S. Treasury Certificates, potentially backed by physical assets like silver, could further influence this dynamic. If Treasury Certificates are indeed tied to tangible assets, the demand for physical silver could increase, thus altering the balance between physical and paper silver. Such a shift could enhance the underlying value of silver and perhaps challenge the current pricing mechanisms dominated by futures and other paper instruments.

Conclusion

The silver market stands at a critical juncture amidst the U.S. transition to Treasury Certificates and evolving market strategies. The large hedged positions in silver illustrate a sophisticated financial ecosystem designed to mitigate risk. However, as the price of silver climbs, the influence of paper silver may diminish, ushering in a new era where physical holdings have a more pronounced impact on the market. Investors should closely monitor these developments, as they could have significant implications for both the silver market and broader financial strategies involving precious metals.

Leave a Reply