Over the past decade, U.S. biopharmaceutical imports have surged, crossing $202 billion in 2023 — doubling in just ten years. Despite America’s powerhouse pharmaceutical sector, the country now runs a $101 billion trade deficit in biopharma, as it increasingly relies on imported raw materials, active pharmaceutical ingredients (APIs), and finished drugs, particularly from China, India, and Europe.

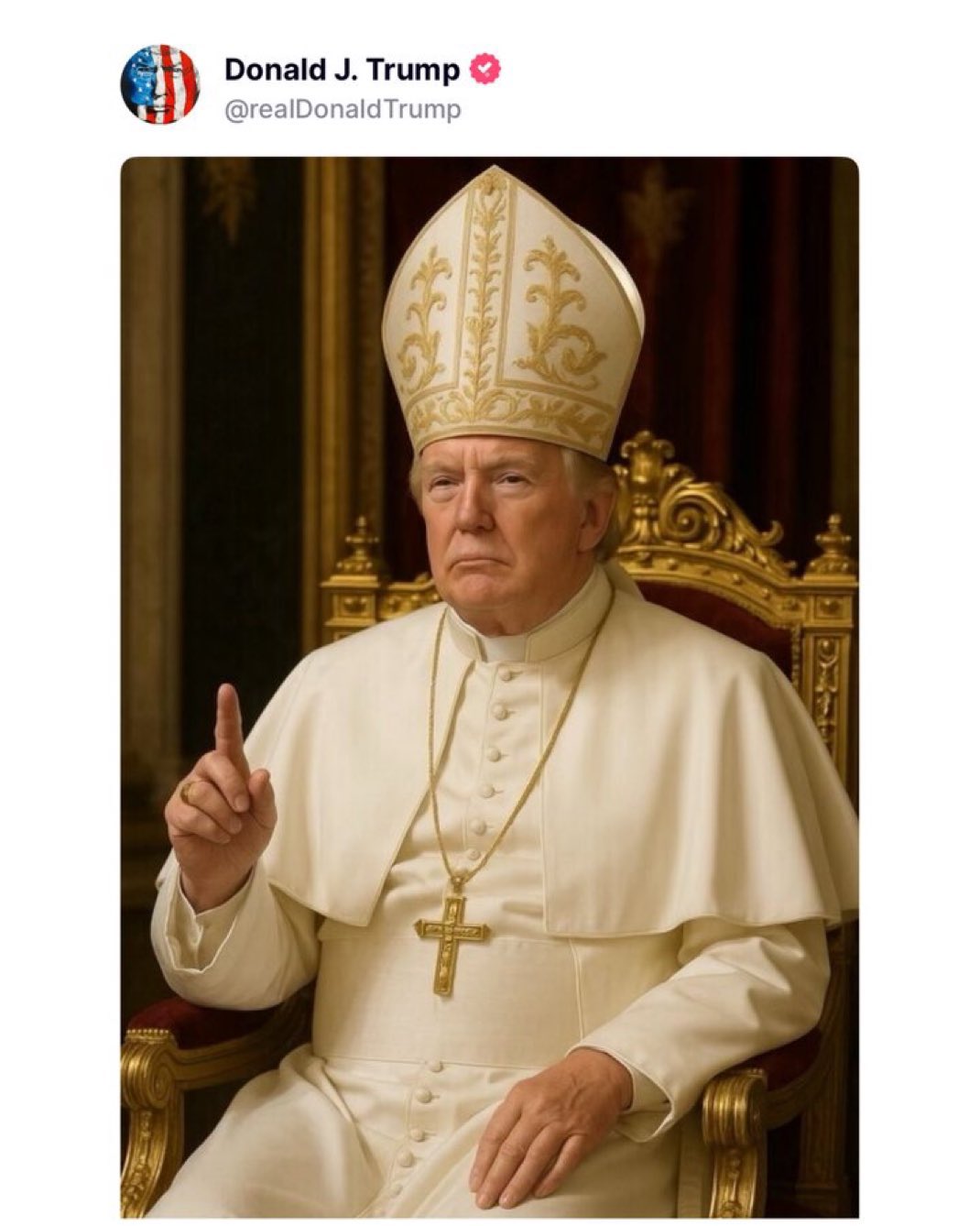

President Donald Trump, in a bid to reshape America’s industrial and trade landscape, has floated the idea of tariffs on U.S. biopharma imports. His campaign message is clear: bring drug manufacturing back home, secure the supply chain, and reduce foreign dependency. But what does this mean for investors?

Understanding the Scope of the Biopharma Trade Gap

The U.S. pharmaceutical industry remains a global leader in R&D, but it has outsourced much of its production. Over 80% of APIs come from abroad — mainly China and India — and even many “Made in America” drugs rely on foreign-sourced components. The result? A ballooning trade deficit:

- 2023 imports: $202 billion

- 2023 exports: $101 billion

- Net trade deficit: $101 billion

Tariffs, if imposed, could dramatically increase input costs for U.S. drugmakers, spark retaliatory moves, and disrupt global supply chains. But they might also unlock new investment themes.

Investment Opportunities Amid Tariff Disruption

Here’s where sharp-eyed investors can look for potential gains:

✅ Domestic API Manufacturers

If tariffs make imports more expensive, U.S.-based ingredient producers could see rising demand. Companies like Lannett Company (LCI) and AMRI could benefit as big pharma looks to “reshore” key production lines.

✅ Generic Drug Makers

Generics are price-sensitive, and tariffs on cheap imports from India or China could squeeze U.S. margins. But they also open opportunities for companies that can scale domestic production efficiently — think Teva USA and Perrigo.

✅ Biotech and R&D-Focused Firms

The tariffs likely won’t directly hit biotech firms focused on cutting-edge therapies (gene therapy, mRNA, cell therapy) because these depend more on intellectual property than raw material imports. Amgen, Biogen, Vertex Pharmaceuticals, and similar firms could continue to thrive, especially if they innovate faster than tariff disruptions.

✅ U.S. Equipment and Automation Providers

If companies move manufacturing back onshore, they’ll need equipment upgrades and automation solutions. Investors might look at companies like Danaher Corporation and Thermo Fisher Scientific, which provide laboratory and manufacturing equipment, as major beneficiaries.

✅ Pharmaceutical ETFs and Healthcare Funds

For those wanting broader exposure, healthcare ETFs like XLV (Health Care Select Sector SPDR Fund), PJP (Invesco Dynamic Pharmaceuticals ETF), or IBB (iShares Biotechnology ETF) offer diversified stakes across pharma and biotech sectors — helping hedge against specific tariff winners or losers.

Risks to Watch

While tariffs can stimulate domestic production, they also carry serious risks:

⚠ Higher Drug Prices: Tariffs could increase costs for consumers, pressuring companies to absorb expenses or pass them on — possibly triggering political backlash.

⚠ Global Retaliation: China and India could impose countermeasures, hurting U.S. pharma exports.

⚠ Supply Chain Disruption: Sudden policy shifts could destabilize sensitive production networks, delaying drug development and manufacturing timelines.

Conclusion: A Sector Ripe for Strategic Plays

Trump’s proposed biopharma tariffs highlight America’s deep dependence on foreign pharmaceutical supply chains — but they also open up targeted opportunities for investors. Domestic manufacturers, equipment providers, and innovative biotech firms could benefit from a shift toward U.S.-based production, while broad healthcare ETFs offer ways to ride sector-wide momentum.

As always, savvy investors should balance optimism with caution: tariffs could spark both winners and losers, and careful selection is key. But one thing is clear — America’s $202 billion biopharma import surge has set the stage for a major reshuffling, and the markets are watching closely.

Invest Offshore actively tracks global trade, investment opportunities, and sector disruptions. For tailored insights into offshore strategies and sector-focused plays, including healthcare and biopharma, contact us today. We have investment opportunities across West Africa’s Copperbelt and beyond, seeking visionary partners.

Leave a Reply