As the financial world braces for seismic changes 2025 is emerging as a potential watershed moment in global monetary history. The date aligns with mounting speculation about the U.S. introducing a new monetary system based on Treasury Certificates and the appreciating Dividend Dollar. Adding to the intrigue is a bold statement from President-elect Donald Trump on November 30 via X, where he outlined a firm stance against the BRICS nations’ attempts to move away from the U.S. dollar.

Trump’s Warning to the BRICS: Defending the Dollar

Here’s what Trump declared:

This fiery rhetoric leaves little doubt about the incoming administration’s commitment to preserving the U.S. dollar’s dominance. Trump’s statement signals an aggressive policy pivot aimed at neutralizing the perceived threat from the BRICS bloc (Brazil, Russia, India, China, and South Africa), which has been exploring alternatives to the dollar in international trade, including the possibility of a BRICS-backed currency.

Why December, 2024, Matters

Several factors suggest that December could mark the launch of a bold new monetary system designed to reinforce the dollar’s global primacy:

- Fiscal Year Alignment

December falls at a critical juncture in the U.S. fiscal calendar, providing an opportune moment to announce sweeping economic reforms ahead of the new administration’s January inauguration. This timing could allow the Treasury to set the stage for a smooth transition. - The End of the Federal Reserve Era

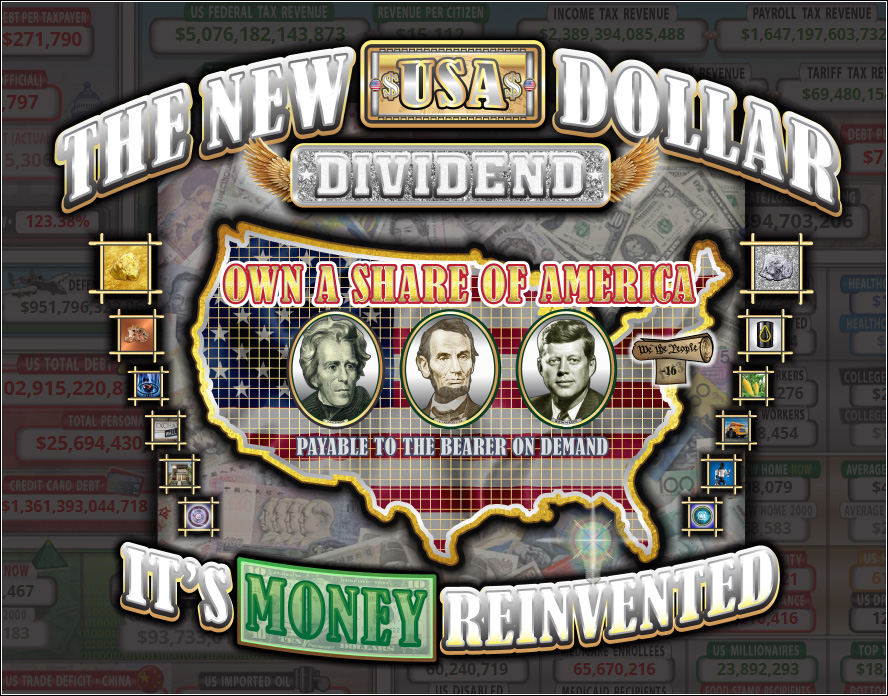

Speculation is rife that the Federal Reserve’s role in the U.S. monetary system may be fundamentally altered or even abolished. Representative Thomas Massie’s Federal Reserve Board Abolition Act, introduced in May 2024, underscores growing momentum for this shift. The timing of a potential new currency launch aligns with broader efforts to redefine the U.S. monetary framework. - Treasury Certificates and the Dividend Dollar

The new monetary system could feature Treasury-issued Dividend Dollars, which appreciate at 3% annually, marking a radical departure from debt-based Federal Reserve Notes. This model promises to stabilize the dollar, reduce reliance on borrowing, and stimulate economic growth, all while reinforcing the currency’s role as the cornerstone of international trade. - The BRICS Challenge

Trump’s comments underscore the urgency of countering the BRICS nations’ de-dollarization efforts. Launching a stronger, more stable U.S. currency could serve as a preemptive strike, reasserting the dollar’s dominance while forcing other nations to reconsider their reliance on alternative systems.

What a New Monetary Era Could Look Like

- Debt-Free Currency

Treasury Certificates would replace Federal Reserve Notes, eliminating the need for debt-based money creation. This shift would reduce the national debt while providing a more stable and transparent monetary system. - Appreciating Value

The Dividend Dollar’s 3% annual appreciation would serve as an inflation hedge, preserving purchasing power and incentivizing savings and investment. This model could strengthen the domestic economy while enhancing global confidence in the dollar. - Tariff-Backed Enforcement

Trump’s promise of 100% tariffs on BRICS nations underscores a no-nonsense approach to preserving the dollar’s status. By leveraging the U.S.’s economic power, the administration aims to dissuade other nations from pursuing alternative currencies. - Global Trade Realignment

A revamped dollar could reshape international trade dynamics, compelling nations to continue using the dollar while disincentivizing de-dollarization. This move would reestablish the U.S. as the dominant player in global commerce.

Implications for Offshore Investors

The introduction of a new monetary system could have profound implications for global markets and offshore investment strategies:

- Currency Stability: The Dividend Dollar’s appreciation could attract international capital, making U.S.-backed investments more appealing to offshore investors.

- Hard Assets: A stronger dollar may initially dampen demand for gold and silver, but these assets remain essential hedges against geopolitical uncertainty and systemic risk.

- Emerging Markets: Nations reliant on the BRICS bloc may face economic headwinds, creating opportunities for strategic investments in regions less affected by de-dollarization.

Preparing for 2025 and Beyond

As the countdown to 2025 continues, the financial world watches closely. The potential launch of a new monetary system, coupled with Trump’s firm stance against BRICS de-dollarization efforts, signals a transformative moment for the global economy.

For offshore investors, staying ahead of these developments is crucial. Diversifying portfolios, exploring hard assets, and closely monitoring Treasury Certificate initiatives will be key to navigating this new era. As always, Invest Offshore will keep you informed, offering insights to help you adapt and thrive in the face of historic financial changes.

Stay tuned as we continue to follow the New Money Revolution and its profound implications for global markets. 2025 may very well mark the dawn of a bold new era for the U.S. dollar—and for offshore investors around the world.

Leave a Reply