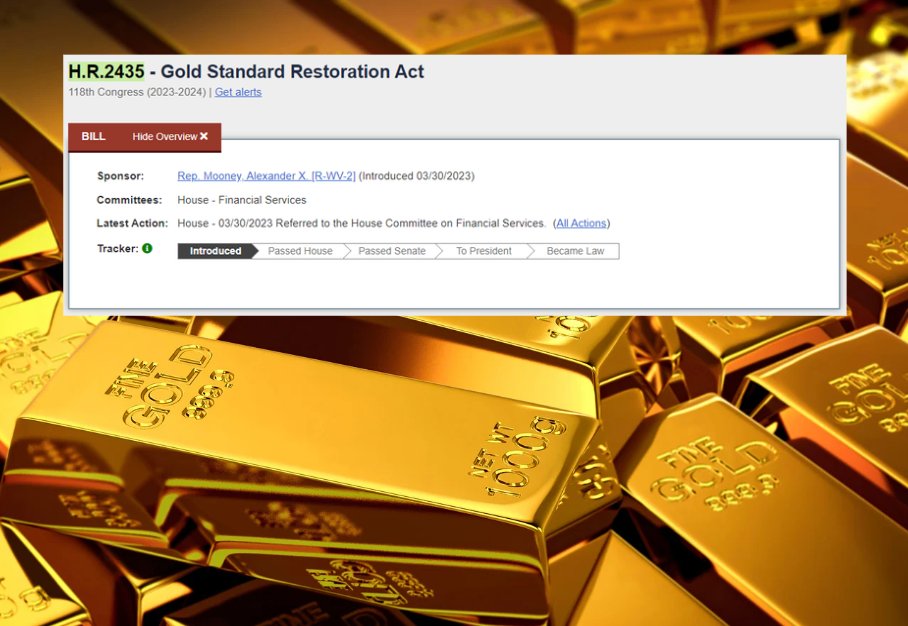

In an era marked by economic uncertainty and inflationary pressures, the introduction of the Gold Standard Restoration Act (H.R. 2435) by Representative Alex Mooney (R-WV) on March 30, 2023, has sparked considerable interest and debate. This bill seeks to redefine the U.S. dollar as a fixed weight of gold, effectively reinstating the gold standard. Let’s delve into the key provisions and rationale behind this significant legislative proposal.

Key Provisions of the Gold Standard Restoration Act

- Redefining the U.S. Dollar:

The bill aims to define the U.S. dollar as a fixed weight of gold, marking a return to a gold-backed currency system. This move is intended to provide a stable monetary base, countering the volatility often seen in fiat currencies. - Transparency in Gold Holdings:

The U.S. Treasury and Federal Reserve would be required to publicly disclose all gold holdings and transactions within 30 months of the bill’s enactment. This transparency is expected to build public trust and accountability in the nation’s monetary system. - Pegging the Dollar to Gold:

After the 30-month disclosure period, the Federal Reserve note (dollar) would be pegged to a fixed weight of gold at the then-market price. This pegging process aims to stabilize the value of the dollar and curb inflationary trends. - Gold Redeemability:

Federal Reserve notes would become fully redeemable for and exchangeable with gold at the new fixed price. The U.S. Treasury’s gold reserves would backstop the Federal Reserve, ensuring that every dollar is supported by tangible assets.

Rationale Behind the Bill

The sponsors of the Gold Standard Restoration Act argue that reinstating the gold standard offers several economic and fiscal benefits:

- Curbing Irresponsible Spending:

By tying the dollar to gold, the bill aims to prevent the government and Federal Reserve from engaging in “irresponsible spending habits” and creating money “out of thin air.” This constraint is expected to foster more disciplined fiscal policies. - Economic-Based Pricing:

The bill advocates for prices to be shaped by economic realities rather than the “instincts of bureaucrats.” A gold-backed dollar would theoretically ensure that market forces, rather than policy decisions, drive price stability. - Long-Term Price Stability:

Proponents highlight the fact that the Federal Reserve note has lost over 30% of its value since 2000 and 97% since 1913. The gold standard is seen as a mechanism to provide long-term price stability by anchoring the dollar to a stable commodity. - Discouraging Deficit Spending:

By enforcing a fixed monetary base, the gold standard could discourage excessive deficit spending and encourage balanced federal budgets. This fiscal discipline is viewed as essential for sustainable economic growth.

Current Status and Future Outlook

As of June 2024, the Gold Standard Restoration Act has been referred to the House Financial Services Committee but has not advanced further in the legislative process. The proposal has generated significant discussion among economists, policymakers, and the public, reflecting a mix of support and skepticism.

Implications for Investors

For global investors, the potential reinstatement of the gold standard presents several implications:

- Currency Stability:

A gold-backed dollar could lead to greater currency stability, reducing the risks associated with currency devaluation and inflation. This stability might enhance investor confidence in U.S. assets. - Gold Investment:

The demand for gold could increase if the bill progresses, making it a more attractive investment. Investors might consider diversifying their portfolios to include more gold and gold-related assets. - Economic Policy Shifts:

A shift to the gold standard would mark a significant change in U.S. economic policy, impacting interest rates, inflation, and government spending. Investors will need to stay informed about these developments to make strategic decisions.

Conclusion

The Gold Standard Restoration Act represents a bold proposal to redefine the U.S. monetary system and restore economic stability. While the bill’s future remains uncertain, its introduction has reignited the debate over the role of gold in modern finance. For investors, understanding the potential impacts of this legislative effort is crucial for navigating the evolving economic landscape.

For more insights and detailed analysis on legislative developments and their implications for global investments, stay tuned to Invest Offshore. Our expert team provides comprehensive coverage on the latest trends and valuable insights for discerning investors.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Leave a Reply