The global race for artificial intelligence (AI) dominance has catapulted semiconductor stocks into the investment spotlight. As NVIDIA, AMD, TSMC, Broadcom, and Marvell Technology dominate headlines and portfolios, savvy investors are looking for efficient ways to gain exposure — not just through individual stock picking, but through carefully chosen ETFs, hedge funds, and mutual funds.

At Invest Offshore, we see a powerful trend: AI and semiconductor-focused funds are not just growth vehicles — they are becoming core portfolio holdings for global investors seeking outsized returns in the next technological supercycle.

Here’s a guide to the best vehicles to ride the semiconductor wave:

1. Best ETFs for Semiconductor Exposure

iShares Semiconductor ETF (SOXX)

- Holdings: Heavyweights like NVIDIA, Broadcom, AMD, Marvell, and TSMC.

- Expense Ratio: 0.35%

- Why It’s a Top Pick: SOXX offers pure, diversified exposure to U.S.-listed semiconductor stocks with a strong bias toward AI beneficiaries.

VanEck Semiconductor ETF (SMH)

- Holdings: Top positions in NVIDIA, TSMC, ASML, Broadcom.

- Expense Ratio: 0.35%

- Why It’s a Top Pick: SMH includes international players like TSMC and ASML alongside U.S. names, giving broader geographic exposure — crucial in a volatile geopolitical environment.

Global X Artificial Intelligence & Technology ETF (AIQ)

- Holdings: A blend of semiconductor companies and AI software leaders.

- Expense Ratio: 0.68%

- Why It’s a Top Pick: For investors who want exposure not just to the chip manufacturers but also to companies deploying AI technologies at scale.

2. Top Hedge Funds Leading the Semiconductor Bet

Coatue Management

- Focus: Heavy concentration in tech and AI, including large holdings in NVIDIA and AMD.

- Strategy: Aggressive growth investing with rapid pivot capabilities — ideal for navigating volatile AI and tech sectors.

Tiger Global Management

- Focus: Long-term tech winners.

- Strategy: After a brutal 2022, Tiger Global repositioned its portfolio toward deep tech, infrastructure, and AI — with strong exposure to chipmakers critical to the AI ecosystem.

Citadel

- Focus: Multi-strategy with strong quantitative trading arms benefiting from semiconductor and AI market volatility.

- Strategy: While not exclusively a tech fund, Citadel’s systematic and fundamental portfolios hold significant semiconductor exposure, capturing both momentum and fundamental growth.

Access to hedge funds typically requires accredited or qualified investor status. At Invest Offshore, we have private introductions available for select investors.

3. Top Mutual Funds for AI and Semiconductor Investors

Fidelity Select Semiconductors Portfolio (FSELX)

- Holdings: NVIDIA, Broadcom, AMD.

- Expense Ratio: 0.69%

- Why It’s a Top Pick: One of the oldest and most focused semiconductor mutual funds, actively managed to adjust to sector shifts, including the explosion in AI demand.

T. Rowe Price Global Technology Fund (PRGTX)

- Holdings: Broad exposure to technology giants including semiconductor manufacturers.

- Expense Ratio: 0.86%

- Why It’s a Top Pick: Offers both semiconductor exposure and investments in the companies driving AI adoption globally.

BlackRock Technology Opportunities Fund (BGSAX)

- Holdings: Mix of high-growth tech, semiconductor, and AI leaders.

- Expense Ratio: 1.11%

- Why It’s a Top Pick: Though pricier, it’s an actively managed portfolio designed to pivot to new tech leadership — including the critical semiconductor enablers of AI.

Offshore Perspective: Thinking Beyond Borders

Global AI infrastructure is not just a U.S. story. Taiwan, South Korea, Japan, Singapore, and soon even Vietnam are becoming semiconductor strongholds. Offshore investment vehicles like Luxembourg UCITS funds, Singapore-domiciled tech funds, and private Luxembourg-based structured notes are increasingly popular for sophisticated investors.

Invest Offshore offers clients the ability to position within specialized offshore vehicles providing exposure to private semiconductor and AI opportunities — while maintaining asset protection and global flexibility.

Conclusion

The AI revolution is fueling a semiconductor boom like no previous tech cycle. By strategically selecting the right ETFs, hedge funds, and mutual funds, investors can harness the explosive potential of the semiconductor sector without taking unnecessary stock-specific risks.

Are you ready to capitalize on the AI semiconductor supercycle while preserving your offshore advantage?

Contact Invest Offshore today to explore custom investment strategies built for global growth.

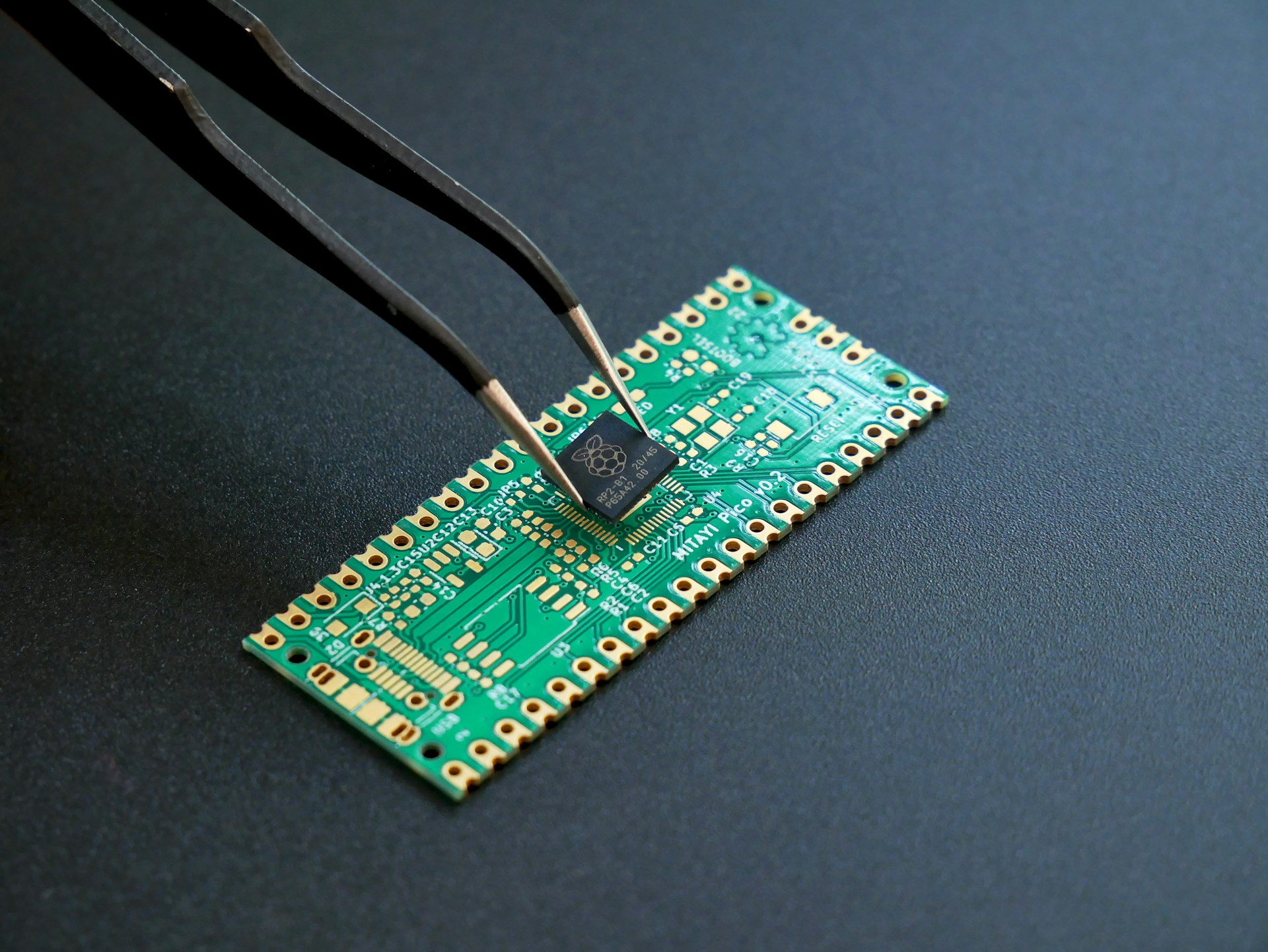

Photo by Vishnu Mohanan on Unsplash

Leave a Reply