On November 21, Cody Harris, a Republican member of the Texas State House of Representatives, took the stage at the North American Blockchain Summit to address the development of a state-issued gold-backed digital token. In a fireside chat with David Duong, Coinbase’s Head of Institutional Research, Harris outlined the potential of this initiative to serve as a bridge for Texans exploring digital assets like Bitcoin while simultaneously pushing back against the concept of a central bank digital currency (CBDC).

The Vision for a Gold-Backed Token

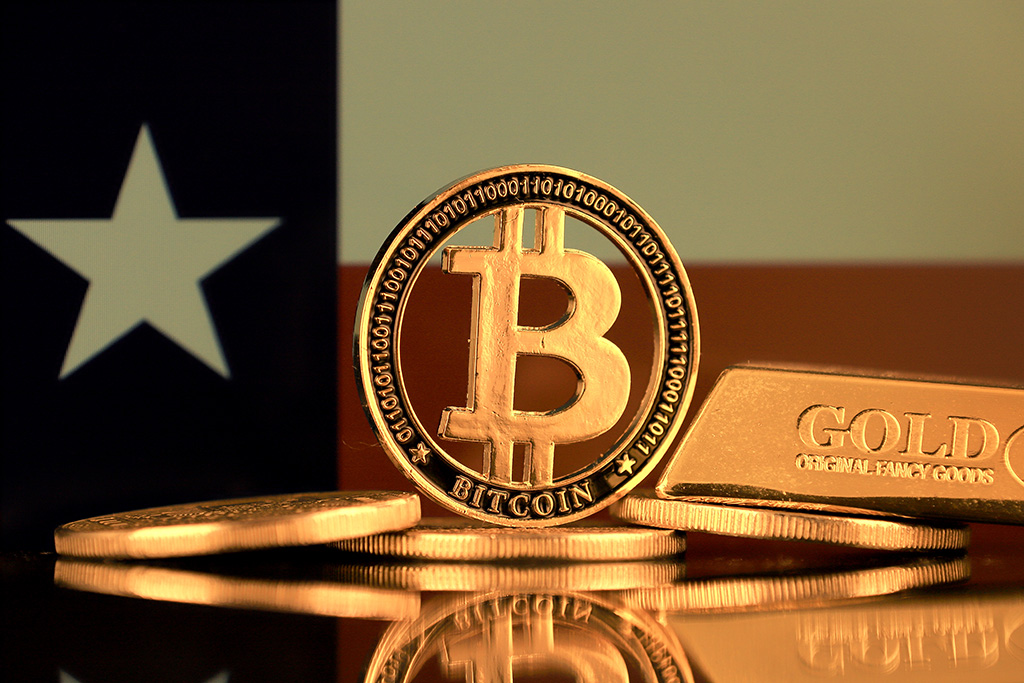

Harris proposed that a Texas-issued gold-backed token could offer a secure and tangible entry point into the world of digital assets. Unlike cryptocurrencies solely based on market speculation, this token would be pegged to the value of physical gold, a trusted store of value for millennia.

“This [state-issued digital currency backed by gold] is something safe that people can get their feet wet with,” Harris explained. “It’s more of a stepping stone to owning Bitcoin than competing with it or taking the place or something like that.”

This innovative proposal underscores the Lone Star State’s efforts to position itself at the forefront of digital asset adoption while preserving its historical affinity for hard money.

A Stepping Stone to Bitcoin

Harris emphasized that the gold-backed token wouldn’t compete with Bitcoin but rather complement it, offering Texans a way to familiarize themselves with blockchain technology and digital assets. He argued that by anchoring the token to a tangible asset like gold, users could gain confidence in digital currencies, potentially paving the way for greater Bitcoin adoption.

This approach could resonate with skeptics who are wary of cryptocurrencies’ volatility, providing a “safer” entry point into the digital finance ecosystem. It also aligns with Texas’s broader vision of embracing financial innovation while maintaining a firm stance on individual freedoms.

The Threat of CBDCs

Harris also used the platform to voice his concerns about central bank digital currencies (CBDCs), describing them as “detrimental to the nation.” He warned that CBDCs could centralize power, erode financial privacy, and enable unprecedented levels of government surveillance over personal finances.

His comments reflect growing skepticism among U.S. lawmakers about the implications of CBDCs, with Texas positioning itself as a stronghold for decentralized and state-led alternatives.

Texas: A Pioneer in Blockchain Innovation

Texas has been making waves in the blockchain and cryptocurrency sectors, from becoming a hub for Bitcoin mining to exploring legislation for a gold-backed digital currency. Harris’s proposal adds another layer to the state’s ambition to lead the charge in financial innovation.

If successful, the gold-backed token could strengthen the state’s financial sovereignty, offer residents an innovative way to preserve wealth, and further solidify Texas’s reputation as a blockchain-friendly jurisdiction.

Conclusion

Cody Harris’s proposal for a state-issued gold-backed token represents an intriguing fusion of traditional assets and digital innovation. By providing a gateway to Bitcoin and other digital assets, this initiative could help Texans embrace the future of finance while addressing concerns over the risks posed by CBDCs.

As the world of digital currencies evolves, Texas appears committed to charting its own course—one that values innovation, freedom, and financial stability.

Invest Offshore continues to monitor global and local developments in digital and traditional asset markets. Stay tuned for more insights on innovative financial solutions.

Leave a Reply