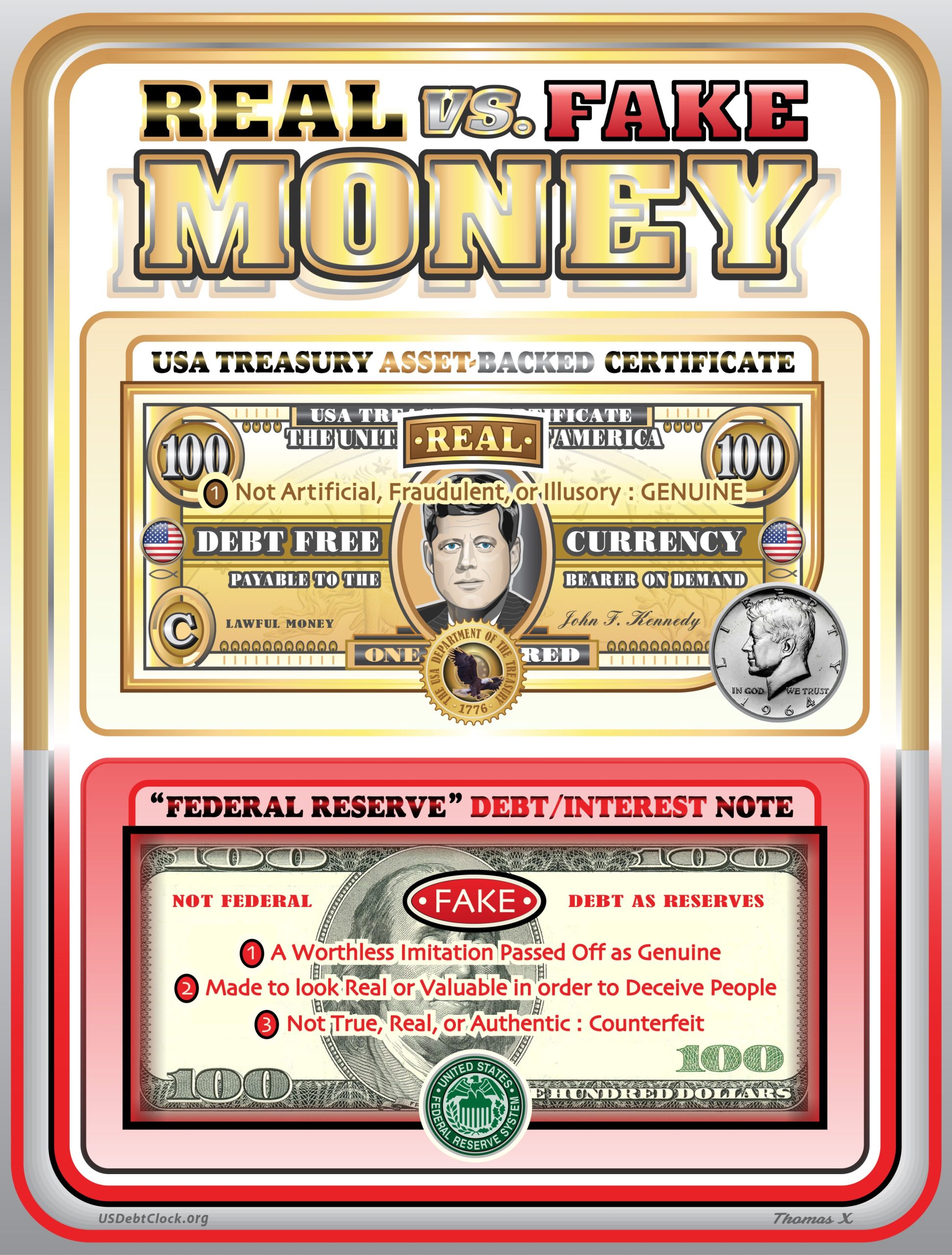

Tag: Treasury Certificate

-

Golden Rule: He Who Has the Gold Makes the Rules

WASHINGTON — The tweet dropped at 4:20 a.m. on April 20 like a tomahawk over Tokyo. “Fort Knox is full. And then some. God bless America. #GoldenRule” — @realDonaldTrump Just twelve words, and the world buckled. The markets spasmed. Gold ticked up, then down, then off the rails entirely. European Central Bank governors held emergency…

-

Why the World Needs Real Asset-Backed Dollars to Mitigate CBDCs and Government Overreach

A recent incident in the UK has gone viral, igniting fierce debate over financial privacy and personal freedom. An English bank customer was denied access to his own funds—£2,500—until he provided proof of what the money would be used for. He simply wanted to buy a second-hand motorbike, yet the bank’s demand for documentation before…

-

The Debt To Wealth Revolution

The dawn of a new financial era is upon us, marked by a rare and awe-inspiring cosmic event. On January 27 2025, a rare planetary alignment will see Venus, Mars, Jupiter, Saturn, Neptune, and Uranus line up in the night sky, signaling what many are calling the “New Money Revolution.” This revolution, dubbed the “Debt…

-

The Year of the Snake: How Canada Becomes the Most Powerful 51st State of the USA and Sparks a Global Supercycle

As we enter the metaphorical “Year of the Snake,” a time traditionally associated with transformation, strategy, and renewal, an unexpected geopolitical shift could redefine global markets and wealth dynamics. Imagine Canada, often seen as the polite northern neighbor, embracing deeper integration with the United States to become its most powerful “51st State.” While this concept…

-

Connecting the New Money Revolution to Executive Order 13818 and the SDN List

The concept of a “New Money Revolution” often evokes discussions around decentralized finance (DeFi), blockchain technology, and the democratization of financial systems. However, an underexplored yet critical angle of this revolution lies in its intersection with regulatory frameworks and the enforcement of global financial sanctions, particularly those connected to Executive Order 13818 and the Alphabetical…

-

The New Money Revolution: Treasury Certificates to Redefine American Independence

On July 4, 2025, as America celebrates its 249th anniversary, a bold new financial era is set to unfold. Donald J. Trump, known for his flair for the audacious, is reportedly poised to roll out Treasury Certificates, an innovative monetary initiative aimed at disrupting the global financial system. This announcement is more than a headline-grabber—it’s…

-

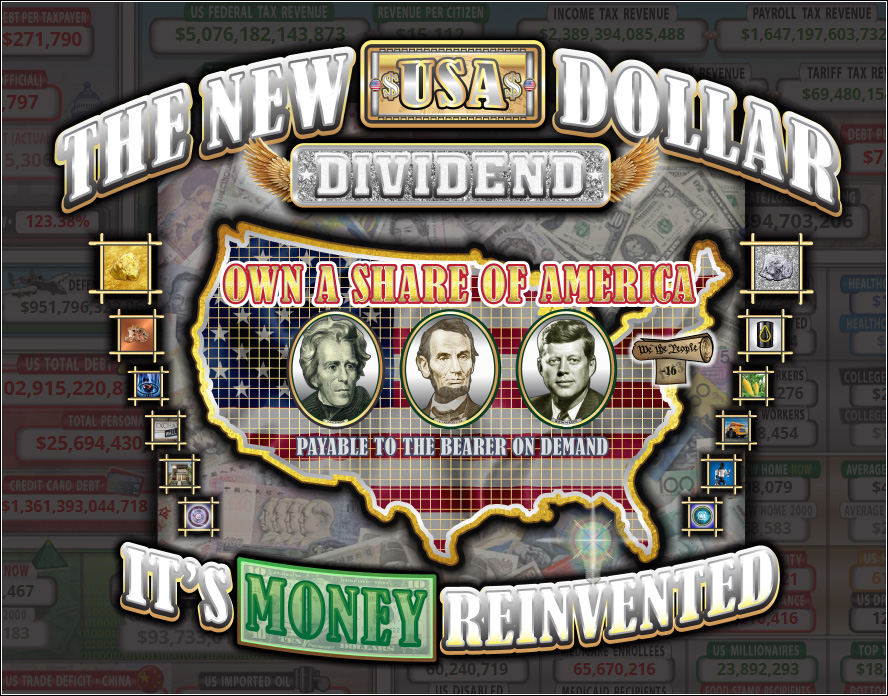

The USA Treasury Dividend Dollar – Wealth Preservation for the Next Millennium

The introduction of the USA Treasury Dividend Dollar marks a historic turning point in global finance, ushering in a new era of economic stability and wealth preservation. Designed to appreciate at a steady 3% annually, this innovative currency is not only a solution to decades of monetary policy challenges but also a forward-looking strategy for…

-

The New Money Revolution: Could 2025, Mark the Launch of a New Monetary Era?

As the financial world braces for seismic changes 2025 is emerging as a potential watershed moment in global monetary history. The date aligns with mounting speculation about the U.S. introducing a new monetary system based on Treasury Certificates and the appreciating Dividend Dollar. Adding to the intrigue is a bold statement from President-elect Donald Trump…

-

The New Money Revolution: New Money for a New Era—The 3% Dividend Dollar

The dawn of 2025 marks a pivotal moment in the U.S. monetary system as the Treasury introduces a groundbreaking financial innovation: the Dividend Dollar. Designed to address the limitations of the Federal Reserve’s debt-based currency system, the Dividend Dollar is a bold leap forward, aligning economic growth with stability and fairness. Issued directly by the…