Tag: Silver

-

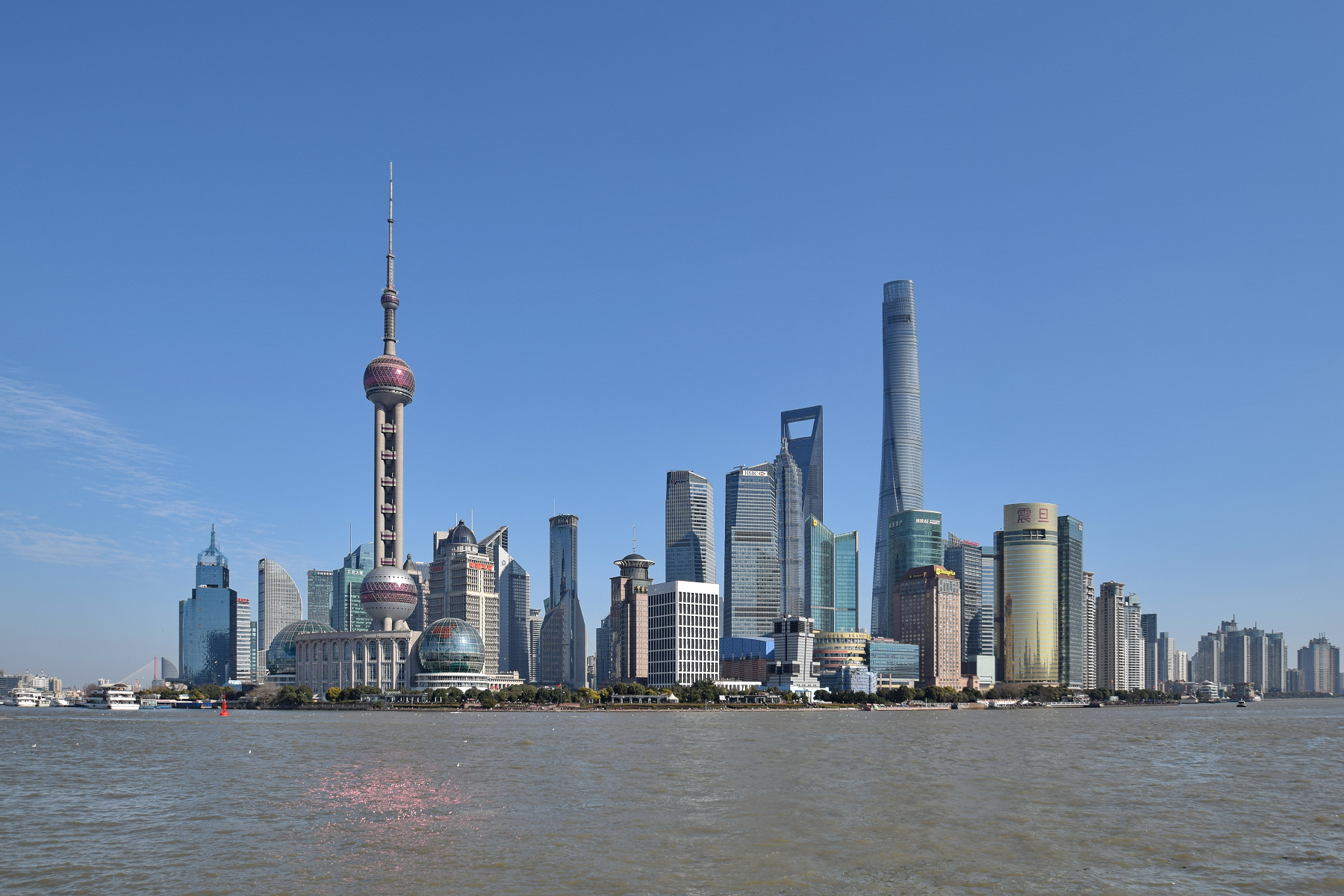

The De-Dollarization Domino Has Fallen: Embrace the Great Reset

You can feel it in the markets. Smell it in the air. The money is moving. But this time, it’s not just a rotation of capital—it’s a regime change. Welcome to the New Money Revolution. For decades, the U.S. dollar sat on the throne of global finance, not because it was flawless—but because it was…

-

Physical Silver vs. Silver ETFs: Cost Structures and Long-Term Value

In 2025, silver remains one of the most compelling assets for investors seeking inflation protection and portfolio diversification. Yet, how you invest in silver — physically or through exchange-traded funds (ETFs) — can dramatically influence returns. The cost structures between silver ETFs and physical bullion differ substantially, impacting both short-term efficiency and long-term sovereignty. Silver…