Tag: Private Placement Programs

-

2024 1M TO 5B Private Placement Program: Unlocking Exceptional Opportunities in Direct Trade

High Returns Compounding Program – A Gateway to Prosperity In 2024, the financial world is buzzing with a groundbreaking direct trade opportunity: The 1M TO 5B Private Placement Program. This is not just any investment program; it’s a high-return compounding venture that is set to revolutionize how high-net-worth individuals and corporations grow their wealth. Operated…

-

Unlocking Hidden Wealth: Private Placement Programs for Diamonds

In the world of alternative investments, Private Placement Programs (PPPs) have gained prominence for offering unique opportunities to diversify portfolios and generate substantial returns. While PPPs have traditionally been associated with various asset classes, including stocks, bonds, and real estate, a lesser-known yet highly promising avenue has emerged: Private Placement Programs for Diamonds. These innovative…

-

Private Placement Programs with Tier 1 Trading Platforms

We specialize in connecting investors with lucrative investment opportunities and guiding them through the process of accessing Tier 1 Trading Platforms. With our expertise and network, we help streamline the path to success in the world of PPPs. Explore the Benefits of Offshore Investing on Tier 1 Trading Platforms: Investing offshore opens up a realm…

-

Invest Offshore on a Tier 1 Trading Platform

What is a Tier 1 Trading Platform? A Tier 1 Trading Platform typically refers to a high-quality, highly-regulated electronic trading platform that provides access to a wide range of financial markets and instruments. These platforms are usually used by institutional investors, large banks, and other financial institutions for executing trades quickly and efficiently. Tier 1…

-

Best Bank Instruments for Cross-Border Transactions

Asking Open AI – How many types of bank instruments are there? There are many types of bank instruments, each serving a different purpose. Some of the most common types of bank instruments include: Each type of bank instrument has its own unique features, benefits, and limitations. It is important to understand these characteristics in…

-

Invest Offshore in a Leveraged Investment Structure

A leveraged investment structure, managed buy/sell agreement of a high-yield bond A leveraged investment structure involves borrowing money to invest in a particular asset, such as a high-yield bond. The idea is to use the borrowed funds to increase the potential return on investment, but it also comes with increased risk. A managed buy/sell agreement…

-

Open AI on Private Placement Programs (PPP)

Open AI; Explain how private placement programs work? Private Placement Programs (PPP) are investment opportunities offered by private entities to a limited number of investors who are typically high-net-worth individuals or institutional investors. These programs are often used for alternative investments that are not available through public markets. The basic structure of a PPP involves…

-

Happy New Year 2023

Happy New Year from Invest Offshore! 2022 was a breakthrough year for Invest Offshore in Private Placement Programs. We invite you to join us in 2023 to learn about financial engineering through managed buy-sell, bank trading platforms. SMALL-CAP & PING TRADE PROGRAM – FOR EXAMPLE CASH $5.3M – $100M CURRENCY US DOLLARS OR EUROS London, Decenber…

-

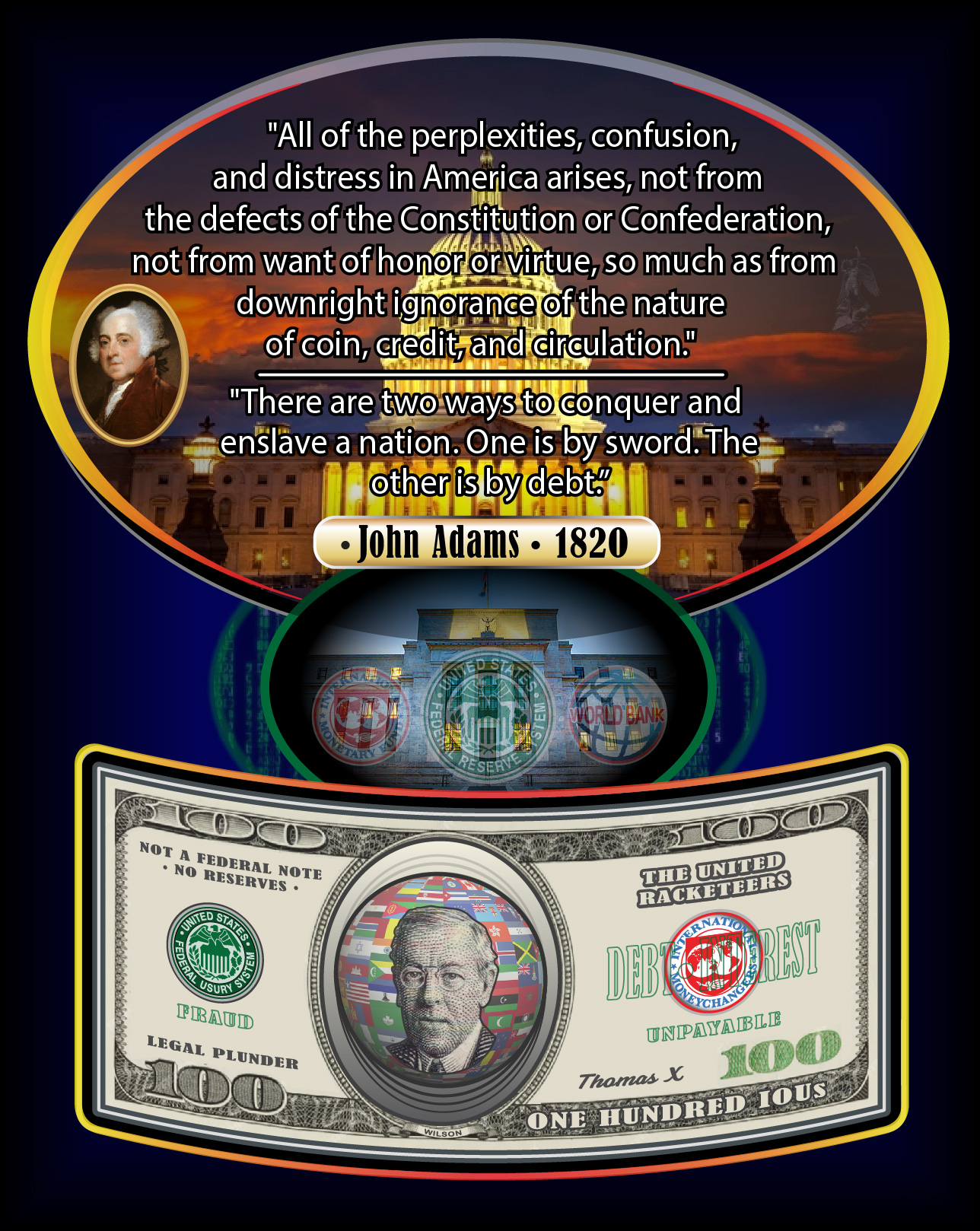

Keynes, Harry White and Bretton Woods, Birth of Offshore Bank Private Placement Platform (PPP)

A Brief History of their Interrelationship and Importance in the International Economic System. To explain how John Maynard Keynes, Bretton Woods and the Prime Bank Instruments Programme, created Offshore Banking for Private Placement Platform trading (PPP). Prime Bank Instruments Programme – Private Placement Platform Picture the world at war in 1944. All of Europe, except…