Tag: IRS

-

Crypto’s Tax Haven Era is Over: IRS Launches Major Crackdown Starting with 2025 Filings

For more than a decade, crypto investors enjoyed something close to a digital tax haven—complex, anonymous, and largely unpoliced. That era has officially ended. The IRS has launched one of the most aggressive reporting crackdowns in the history of U.S. taxation, and it begins with the 2025 filing year. The Treasury Department is explicitly targeting…

-

Tax Shelters: Not Just for Billionaires

A recent New York Times article titled “Why Tax Shelters Aren’t Just for Billionaires” sheds light on how tax shelters, often perceived as tools for the ultra-wealthy, are accessible and beneficial for middle-income earners. This revelation is particularly pertinent for Canadians and international investors aiming to optimize their financial strategies. Understanding Tax Shelters Tax shelters…

-

April 2nd: Trump’s “Liberation Day” – A Turning Point for Global Trade and American Sovereignty

President Donald Trump has declared April 2nd a “Liberation Day” for America—a pivotal moment in his vision to reset global trade through the introduction of reciprocal tariffs. Under this policy, if another country imposes a 10% tariff on U.S. goods, the United States will respond with the same 10% tariff on theirs. It’s a straightforward…

-

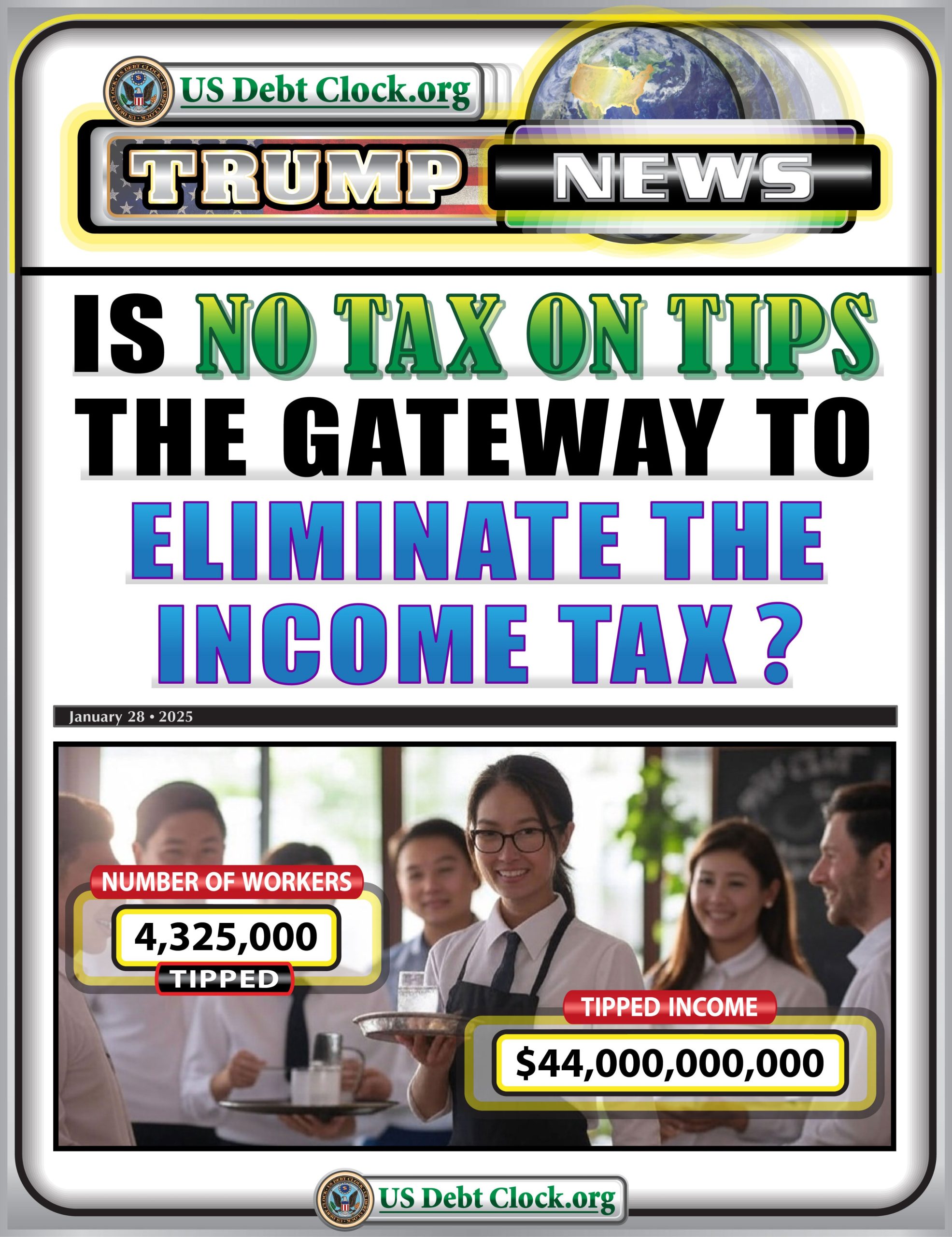

FairTax Act of 2025: Will Trump Unveil a Tax Revolution?

Tomorrow, President Donald Trump will address a joint session of Congress in Washington, marking a pivotal moment in his second term. While not officially designated as a State of the Union, this speech will serve as a blueprint for his administration’s legislative priorities and economic vision for the year ahead. Key Topics to Expect Trump’s…

-

End of Green New Deal, Paris Agreement and Welcome New Era of Economic Freedom

Marking a pivotal shift in America’s approach to economic policy and energy independence, the end of the Green New Deal, the United States’ exit from the Paris Agreement, and the introduction of H.R.25 herald a bold new era for innovation and growth. These seismic shifts signal a renewed focus on liberty, economic opportunity, and the…

-

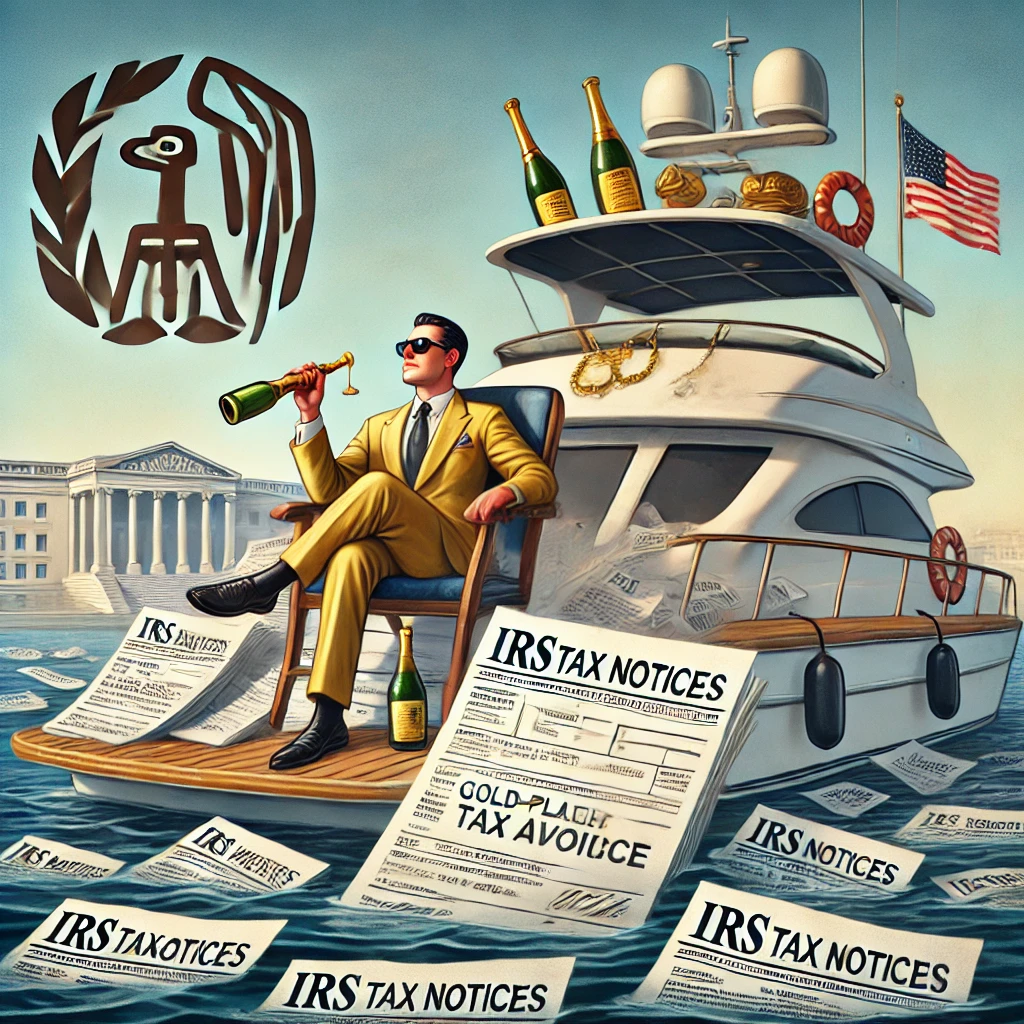

Oh, You Forgot to File? The IRS Is Here to Remind You – With Love, of Course

Well, well, well, the IRS is rolling out its red carpet again, but not for the usual suspects. This time, the guest list is exclusive: 125,000 high-earning Americans who apparently decided taxes were optional sometime between 2017 and 2022. Bravo, folks. If you’re pulling in over $400,000 a year (or over $1 million for the…

-

IRS Unveils New Federal Income Tax Brackets For 2025

by Tyler Durden The IRS on Oct. 22 unveiled the new federal income tax brackets for 2025. As The Epoch Times’ Zachary Stieber reports, each bracket was changed, including the top one. Single taxpayers making more than $636,350, or couples making more than $751,600, will be subject to a 37 percent tax rate. That’s up from $609,350, and $731,200, respectively.…

-

Unlocking the Potential of Real Estate Mortgage Investment Conduits (REMICs)

The landscape of real estate investment has continually evolved, offering a variety of opportunities for investors to grow their wealth. Among these opportunities, the Real Estate Mortgage Investment Conduit (REMIC) stands out as a powerful vehicle for those looking to invest in mortgage-backed securities. Created by the Tax Reform Act of 1986, REMICs have transformed…

-

IRS Cracks Down on High-Income Non-Filers: What Global Investors Need to Know

The Internal Revenue Service (IRS) has announced a major new initiative targeting high-income individuals who have failed to file tax returns. This effort, which focuses on approximately 125,000 cases involving high earners, including millionaires, aims to address financial activity exceeding $100 billion. For global investors and high-net-worth individuals, understanding the implications of this crackdown is…