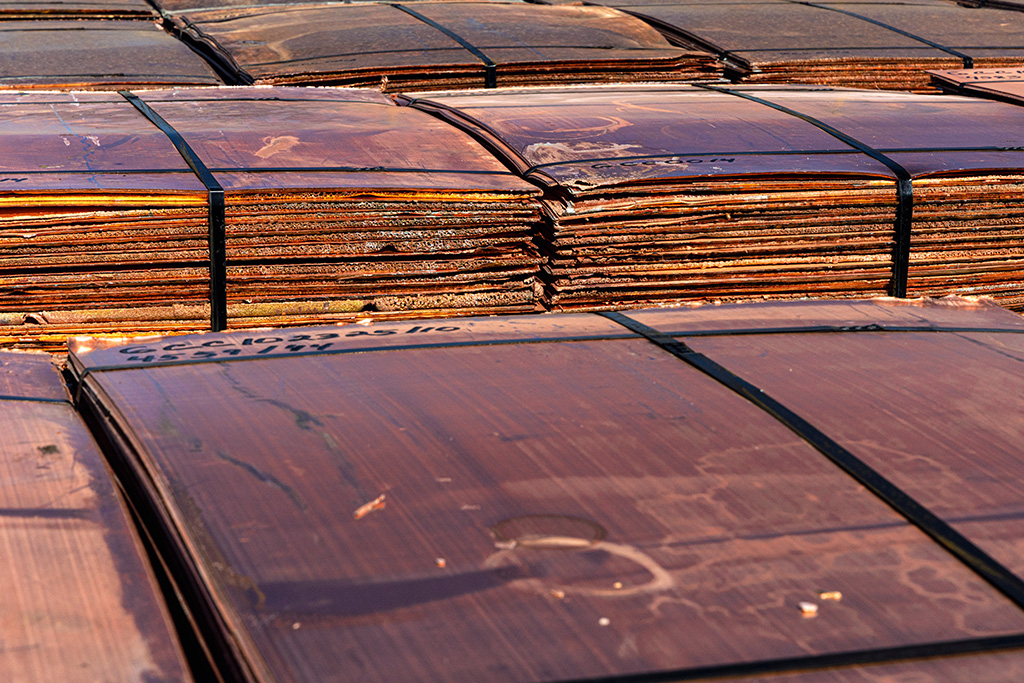

Tag: Copper

-

Why Investors Like Junior Producers: Small Caps, Big Torque

When investors talk about mining “sweet spots,” junior producers often sit right in the middle of the risk–reward spectrum. They’re no longer pure speculation (like early exploration juniors), but they’re not yet “slow-moving ships” (like major miners). They produce metal today—and they still have meaningful runway to grow. That combination is exactly why junior producers…

-

All the Ways to Invest in Copper: ETFs, Miners, Crypto, and Stocks

Copper has become one of the most compelling investment stories of our time. Often called “the new oil”, this industrial metal powers the backbone of electrification — from EV batteries and renewable energy to data centers and smart grids. With demand expected to double by 2035, investors are asking: what’s the best way to gain…