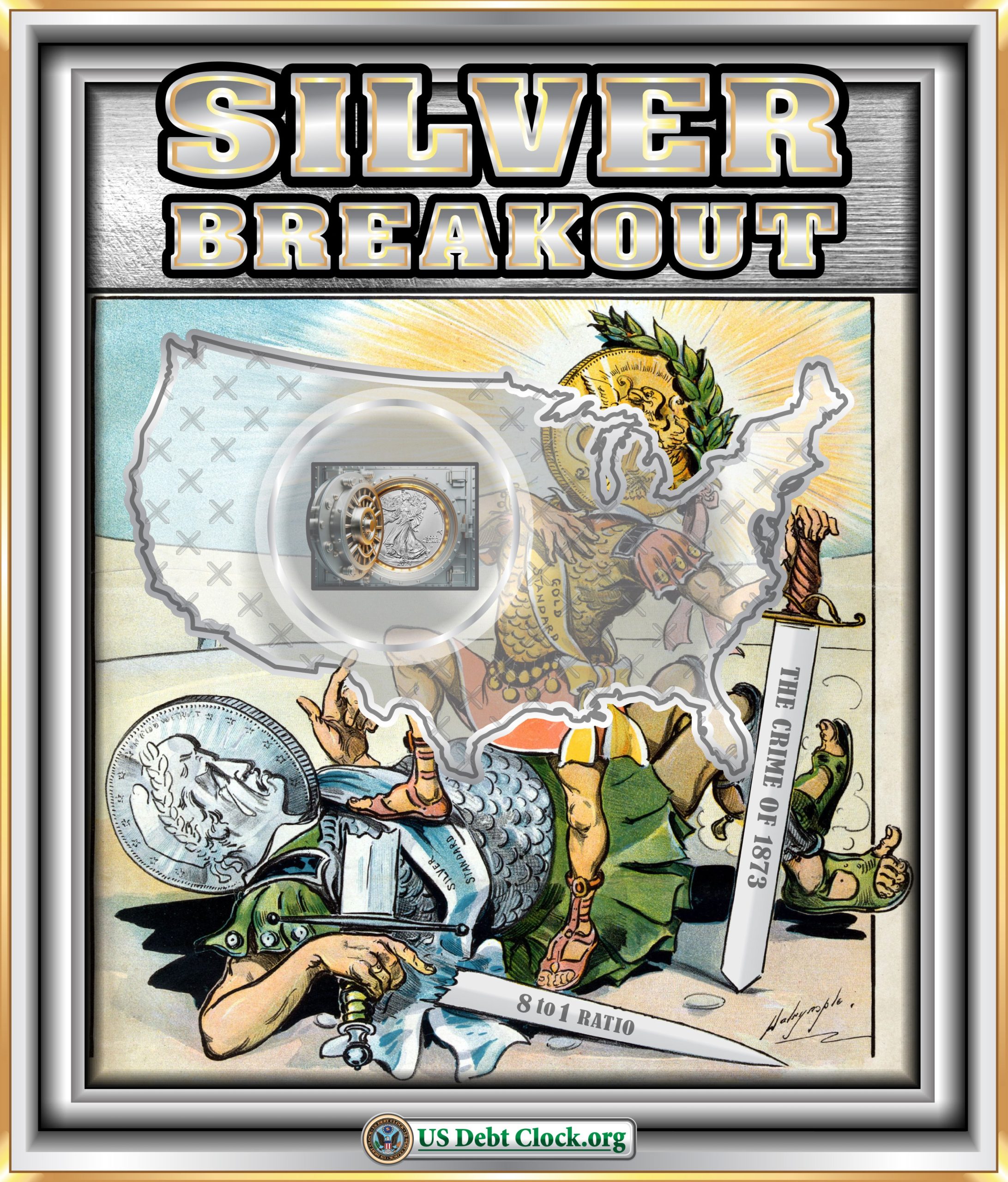

Silver, long overshadowed by gold, is breaking out from the confines of its status as the “poor man’s gold.” Its recent rally has reinvigorated interest in this once-vital metal, spurring a renewed focus on its potential. Investors, both large and small, are taking note, and with good reason: silver’s value is experiencing a significant shift as it edges toward an 8-to-1 ratio with gold. This development has led many to reconsider silver’s historical significance and its potential to restore a balance in the precious metals market that has been missing for over a century.

The echoes of the “Crime of 1873” still resonate. This term, coined by silver advocates, refers to a legislative decision by the United States that effectively demonetized silver. In a single stroke, silver lost its place alongside gold as a primary monetary metal, with profound effects on the economy. While the rationale was presented as an effort to streamline currency, many saw it as a betrayal—one that favored the elite and left average Americans in the lurch. The move away from silver led to its undervaluation and scarcity in official use, an effect that still lingers in today’s financial landscape.

The shift toward an 8-to-1 silver-to-gold ratio is not without historical precedent. In fact, this was the approximate ratio in the bimetallic standards of the 19th century, before silver’s removal from the currency system. Historically, an 8-to-1 ratio reflects a more equitable valuation, one that recognizes silver’s intrinsic worth and its role in bolstering economies. In the current market, the return to such a ratio suggests that investors are beginning to see silver not as a lesser commodity, but as a powerful store of value in its own right.

This renewed interest in silver could prove beneficial for offshore investors looking to diversify their holdings. Silver’s utility extends beyond investment portfolios; it has significant industrial applications in electronics, solar energy, and other green technologies. As demand in these sectors grows, silver’s value proposition becomes even stronger, and its breakout from low valuations appears sustainable.

For Invest Offshore, silver’s resurgence presents unique opportunities for investors. Those who understand silver’s historical context—its forced suppression, and now its potential resurgence—can appreciate its long-term value. Investing in silver offers a hedge against currency fluctuations and market volatility, providing both stability and growth potential.

In these times, silver’s rally is more than just a market trend. It’s a return to a time-tested value standard, an assertion of its rightful place in the world of precious metals. Silver’s breakout is a reminder of its worth, both in the past and in the future. As the market shifts, silver stands as a reminder that sometimes, history not only repeats itself but reveals new possibilities.

Leave a Reply