In the realm of rare and alternative investments, private seed banks are emerging as a distinctive collectible asset for high-net-worth individuals (HNWIs). Often associated with sustainability enthusiasts and farmers, seed banks are now attracting the attention of discerning investors who see them not only as a tangible hedge against food insecurity but also as a highly unique collectible with long-term value potential. These private seed banks offer a combination of rarity, ecological impact, and investment diversification, making them an appealing addition to the portfolios of investors looking beyond traditional asset classes.

What Are Private Seed Banks?

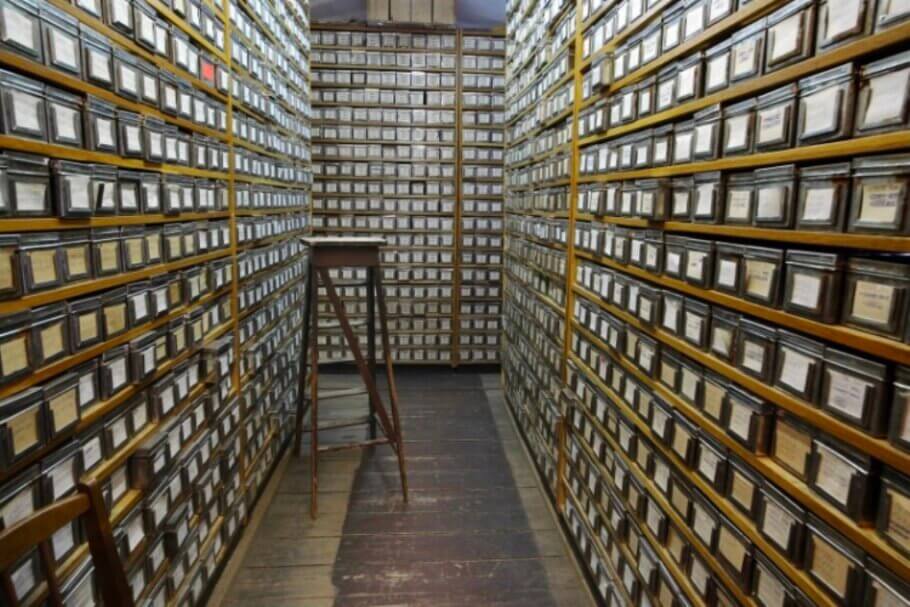

Private seed banks are collections of plant seeds, often encompassing a wide variety of rare, heirloom, or region-specific seeds that are difficult to find elsewhere. Unlike large, government-sponsored seed banks like Norway’s Svalbard Global Seed Vault, private seed banks are typically smaller and may be managed by individual collectors, small companies, or even nonprofit organizations. These seed banks are carefully curated, often featuring seeds from non-GMO, organic, and heirloom varieties that have unique genetic traits and historical significance.

Some collectors focus on certain types of seeds—such as rare vegetables, medicinal herbs, or indigenous plant varieties—while others strive to create a broad, diversified collection that includes seeds from around the world. For HNWIs, the allure lies in the combination of preservation, potential rarity, and the possibility of supporting food diversity and security.

Why Are Seed Banks Becoming Collectibles?

- Preservation of Biodiversity: Many seed banks focus on preserving the genetic diversity of plants, a critical element of global food security. Climate change, industrial farming, and urbanization have led to the decline of many traditional plant varieties. By investing in a seed bank, collectors are actively contributing to the preservation of these endangered genetic resources, which could play a vital role in future agriculture.

- Rarity and Exclusivity: Certain seeds, especially heirloom and indigenous varieties, are becoming exceedingly rare. This rarity, paired with the growing interest in sustainable and regenerative agriculture, has made private seed collections a unique investment opportunity. HNWIs with an interest in environmental impact can own these exclusive collections, adding an element of prestige to their portfolios.

- Long-term Investment Potential: As the global food supply faces increasing challenges due to climate volatility and population growth, seeds that have been curated and preserved may appreciate significantly in value. Heirloom seeds, for instance, can become valuable assets over time as demand for unique, non-hybridized plant varieties grows. Seed banks, in essence, could become a future-facing asset for investors with a vision for sustainability and resilience.

Building a Private Seed Bank Collection

For HNWIs interested in building a seed bank collection, there are a few considerations to keep in mind:

- Research and Source Selection: Some specialized seed banks, eco-focused organizations, and seed exchanges provide heirloom, organic, and region-specific seeds for collectors. Finding credible sources ensures that the seeds are authentic and viable, adding integrity to the collection.

- Storage and Maintenance: Proper storage conditions are critical to maintain the viability of seeds. Seeds should be stored in cool, dry, and dark conditions to preserve their germination potential. Climate-controlled seed vaults or high-quality storage equipment can add to the overall investment but are worthwhile for serious collectors.

- Sustainability and Conservation Partnerships: Some collectors choose to partner with organizations focused on biodiversity preservation or regenerative agriculture. These partnerships may offer unique access to rare seeds and align with philanthropic goals, allowing investors to support food security and environmental conservation directly.

The Appeal of Seed Banks as a Tangible Asset Class

Purpose and Function

For high-net-worth individuals, private seed banks offer more than just an intriguing collectible—they represent a commitment to sustainability, biodiversity, and long-term food security. As an investment, seed banks provide diversification, potential appreciation, and a tangible, historical value that aligns with both financial and philanthropic goals. With the right curation and care, a private seed bank can become a cherished legacy, connecting wealth preservation with the preservation of the world’s natural heritage.

Private seed banks play a significant role in the conservation and commercialization of plant genetic resources. Here’s an overview of private seed banks and their implications:

Private seed banks are primarily established by commercial entities, often large agricultural or biotechnology companies, to collect, store, and utilize plant genetic material. Their main objectives include:

- Preserving genetic diversity

- Developing new plant varieties

- Supporting research and development efforts

- Generating profits through patented seeds and plant varieties

Advantages

Technological Advancements: Private seed banks often have access to advanced technologies for seed preservation and genetic research[2]. This can lead to the development of crops that are better adapted to changing climatic conditions.

Efficiency: The resources available to private companies can make plant breeding faster, more efficient, and potentially cheaper[2].

Economic Impact: The biodiversity stored in these gene banks can fuel advances in plant breeding and generate significant profits[2].

Concerns and Criticisms

Farmer Dependence: Critics argue that private seed banks can lead to farmers becoming dependent on patented high-yield hybrid varieties that cannot be reproduced locally[2]. This may result in farmers having to purchase seeds year after year.

Corporate Control: There are concerns about the concentration of genetic resources in the hands of a few large corporations, potentially giving them significant control over global food security[2].

Biopiracy: Some worry that private seed banks may engage in biopiracy by patenting genetic information collected from traditional varieties without proper compensation to the original communities[2].

Comparison with Community-Based Seed Banks

Community-based seed banks, in contrast to private ones, often focus on:

- Preserving local varieties

- Promoting seed and food sovereignty

- Sharing knowledge about seeds and their specificities

- Supporting small-scale, sustainable agriculture[2]

These community-based initiatives aim to strengthen access to traditional seed varieties and support local farmers’ livelihoods and resilience[2].

Global Perspective

While private seed banks play a significant role, there are also large public and international seed banks working to preserve plant genetic diversity. For example:

- The Svalbard Global Seed Vault in Norway serves as a backup storage facility for seed banks worldwide[5].

- The National Tree Seed Centre in Canada preserves the genetic diversity of Canada’s forests[3].

- The Millennium Seed Bank Partnership in England is active in over 80 countries, focusing on wild plant species conservation[4].

In conclusion, while private seed banks contribute to agricultural innovation and genetic preservation, their role remains controversial due to concerns about corporate control over genetic resources and the potential impact on small-scale farmers and traditional agricultural practices.

Conclusion

In a world where many investments are digitized, private seed banks provide a tangible asset that investors can literally hold in their hands. Seed banks offer the rarity and historical significance often found in art or fine wine but carry an added layer of value: the potential to impact future generations by preserving food sources and agricultural biodiversity. As such, private seed banks are becoming collectibles that bridge the gap between investment and impact, making them especially attractive to HNWIs who seek unique, purpose-driven assets.

At Invest Offshore, we see private seed banks as an emerging opportunity for HNWIs looking to add purpose-driven investments to their portfolios. For those interested in the unique and resilient, seed banks are an asset worth sowing.

Citations:

[1] https://silvaseed.com

[2] https://aseed.net/seed-banks-community-based-or-private/

[3] https://natural-resources.canada.ca/science-and-data/research-centres-and-labs/forestry-research-centres/atlantic-forestry-centre/national-tree-seed-centre/ntsc-seed-collection-and-conservation/23984

[4] https://foodtank.com/news/2020/07/26-organizations-working-to-conserve-seed-biodiversity/

[5] https://time.com/doomsday-vault/

[6] https://www.rbg.ca/plants-conservation/science/library-archives/seed-library/

[7] https://theseedbank.net

[8] https://ecoseedbank.com

Leave a Reply